Profit and loss account of credit institutions as at 31 December 2015

Press release 16/13

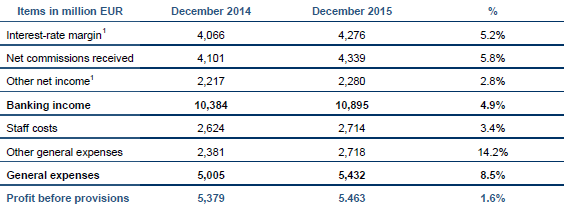

The CSSF estimates profit before provisions of the Luxembourg banking sector for the year 2015 at EUR 5,463 million. Compared to the same period in 2014, profit before provisions thus increased by 1.6%.

The development of the profit and loss account of credit institutions in Luxembourg is due to a rise in banking income of 4.9% partially compensated by an increase in general expenses.

The upward trend of banking income is supported by all categories of income, in particular net commissions received and interest-rate margin. Net commissions received which mainly result from asset management activities on behalf of private and institutional clients, rose by 5.8% compared to 2014. Year-on-year, these net commissions received benefited from a rather favourable stock market environment despite the increased volatility. The interest-rate margin is up for half of the banks but its scale is mainly due to specific factors relating to a limited number of credit institutions. The low or negative interest rate situation continues to represent a real challenge for the profitability of banks in Luxembourg and, more generally, in the euro area. It is clear that, despite the increase over a year, the interest-rate margin remains below the levels reached in 2010-2012.

General expenses increased by 8.5% compared to 2014. This rise is mainly related to the other general expenses which increased by 14.2% compared to 2014. This rise in general expenses affects most of the banks in the financial centre, reflecting, besides the investments in technical infrastructures, additional expenses to be borne by banks in order to comply with a new and more complex regulatory framework.

As a result of the above-mentioned developments, profit before provisions increased by 1.6% year-on-year.

Profit and loss account as at 31 December 2015

1 In order to better reflect the trends of the different income sources of the banks, the dividends received have been reclassified from interest-rate margin to other net income. This reclassification appropriately reflects the existing relation between the assets valued at fair value and the distribution of relating dividends.