Global situation of undertakings for collective investment at the end of March 2016

Press release 16/20

I. Overall situation

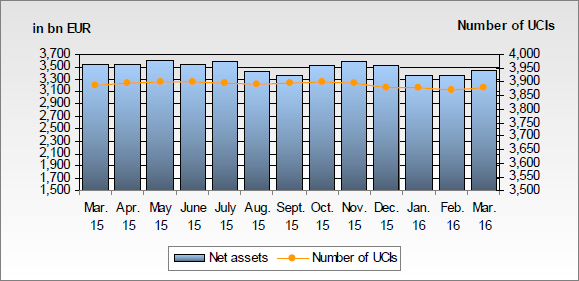

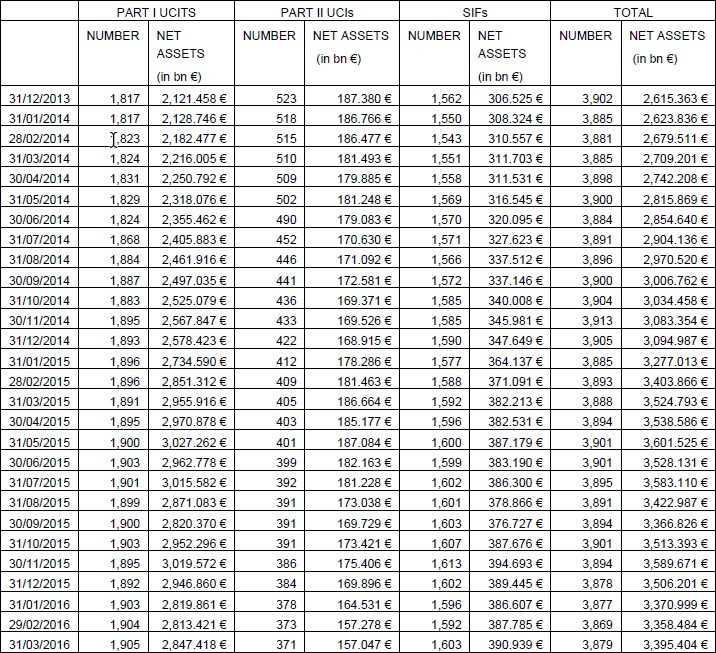

As at 31 March 2016, total net assets of undertakings for collective investment and specialised investment funds reached EUR 3,395.404 billion compared to EUR 3,358.484 billion as at 29 February 2016, i.e. a 1.10% growth over one month. Over the last twelve months, the volume of net assets decreased by 3.67%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 36.920 billion in March. This increase represents the balance of positive net issues of EUR 6.852 billion (0.20%) and a positive development in financial markets amounting to EUR 30.068 billion (0.90%).

The number of undertakings for collective investment (UCIs) and specialised investment funds (SIFs) taken into consideration totalled 3,879 as against 3,869 in the previous month. A total of 2,559 entities have adopted an umbrella structure, which represents 12,859 sub-funds. When adding the 1,320 entities with a traditional structure to that figure, a total of 14,179 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on Luxembourg UCIs and SIFs (hereafter “UCIs”) and, on the other hand, the net capital investment in these UCIs, the following can be said about March 2016.

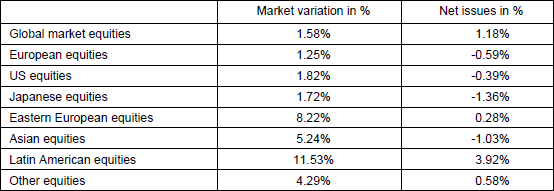

All equity UCI categories registered a positive development.

As far as developed countries are concerned, EU and US equity UCIs benefited from the new measures of monetary easing decided by the European Central Bank and from the more moderate perspective of an increase of key interest rates by the Fed, respectively, as well as from an encouraging economic environment on both sides of the Atlantic. Despite less favourable economic perspectives, the Japanese equity UCIs followed the upward trend of the markets.

As regards emerging countries, the publication of reassuring economic figures for China and the lower uncertainty in relation to the strategy of the Chinese Central Bank concerning the exchange rate supported the Asian equity UCIs. Despite economic, political and geopolitical problems some countries encountered, the Eastern European and Latin American equity UCIs appreciated with the sharp rise of oil prices and the strong appreciation of currencies of some big countries like Russia and Brazil.

In March, the equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of March 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

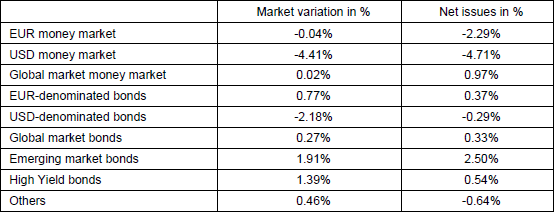

The new measures in monetary policy announced by the European Central Bank, together with an increase of the investors’ risk appetite, lead to a decrease of government bond yields and risk premiums of private sector bonds.

Consequently, EUR-denominated bond UCIs recorded price increases.

The communication of the Fed that the global economic environment justifies extreme caution of its policy of raising key interest rates positively influenced USD-denominated bond UCIs which recorded, in this context, price increases that were, however, compensated by the depreciation of the USD against the EUR by over 4%.

Due to the impact of the Fed’s decision not to raise the key interest rates and the increase in oil prices, the category of emerging countries bond UCIs developed positively considering the decline in risk premiums of these bonds.

In March, while bond UCIs recorded an overall positive net capital investment, monetary UCIs registered net capital outflows.

Development of fixed-income UCIs during the month of March 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

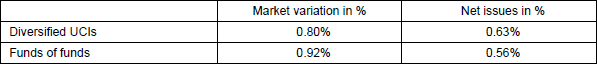

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Diversified UCIs and funds of funds during the month of March 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and the net assets of UCIs according to Parts I and II, respectively, of the 2010 Law and of SIFs according to the 2007 Law

During March, the following 27 undertakings for collective investment and specialised investment funds have been registered on the official list:

1) UCITS Part I 2010 Law:

- AIM LUX, 5, allée Scheffer, L-2520 Luxembourg

- BELFUND SICAV, 15A, avenue J-F Kennedy, L-1855 Luxembourg

- CAIXABANK WEALTH SICAV, 60, avenue J-F Kennedy, L-1855 Luxembourg

- CONSTANCE SICAV, 2, rue d’Arlon, L-8399 Windhof

- D&R AMWAL GCC SICAV, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- DASYM SICAV, 6B, route de Trèves, L-2633 Senningerberg

- RENTA 4, 15, avenue J-F Kennedy, L-1855 Luxembourg

- THESAN SICAV, 5, allée Scheffer, L-2520 Luxembourg

2) SIFs:

- AZ FUND K, 35, avenue Monterey, L-2163 Luxembourg

- BLACK FOREST SICAV-SIF, 18, rue de l’Eau, L-1449 Luxembourg

- DUSKA S.A. SICAV – FIS, 12, rue Eugène Ruppert, L-2453 Luxembourg

- EURO ASIA CONSUMER FUND II, 11, rue Aldringen, L-1118 Luxembourg

- GMF INVESTMENT FUND SICAF – SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- GOLDING INFRASTRUCTURE 2016 SCS SICAV-FIS, 6, avenue Marie-Thérèse, L-2132 Luxembourg

- HOLOS SICAV-SIF, 6, route de Trèves, L-2633 Senningerberg

- IRE-RE SA SICAV-SIF, 37A, avenue J-F Kennedy, L-1855 Luxembourg

- KBC LIFE INVEST PLATFORM, 11, rue Aldringen, L-1118 Luxembourg

- KGAL ESPF 4 SICAV-SIF S.C.S., 1C, rue Gabriel Lippmann, L-5365 Munsbach

- M GLOBAL SOLUTIONS, 5, rue Jean Monnet, L-2180 Luxembourg

- PALESSIA MULTI ASSET FUND SICAV-SIF, 5, rue Jean Monnet, L-2180 Luxembourg

- PERE-UI-FONDS FCP-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- PERPETUUM SICAV-FIS, S.A., 5, rue des Labours, L-1912 Luxembourg

- SAN MAURIZIO SCA SICAV-SIF, 30, boulevard Royal, L-2449 Luxembourg

- UBS GLOBAL PRIVATE EQUITY GROWTH III FEEDER SCA, SICAV-SIF, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- VINTAGE 2016 PRIVATE INVESTMENTS NON-US SICAV-SIF S.C.SP., 31, Z.A. Bourmicht, L-8070 Bertrange

- VTWM SPECIAL FUNDS S.A. SICAV-FIS, 2, place François-Joseph Dargent, L-1413 Luxembourg

- WARBURG INFRASTRUKTUR FONDS S.C.S. SICAV-SIF, 2, place Dargent, L-1413 Luxembourg

The following 17 undertakings for collective investment and specialised investment funds have been deregistered from the official list during March:

1) UCITS Part I 2010 Law:

- ACQ, 5, Heienhaff, L-1736 Senningerberg

- AQUANTUM, 15, rue de Flaxweiler, L-6776 Grevenmacher

- CAPITAL INTERNATIONAL PORTFOLIOS 2, 6C, route de Trèves, L-2633 Senningerberg

- CIG FUNDS, 2-8, avenue Charles de Gaulle, L-1653 Luxembourg

- DWS STRATEGY EUROPE 80, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- DWS STRATEGY US 80, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- FRUCTILUX, 12, rue Eugène Ruppert, L-2453 Luxembourg

- PUILAETCO DEWAAY FUND (L), 11, rue Aldringen, L-1118 Luxembourg

- UBS (LUX) KEY SELECTION SICAV 2, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- W&P EUROPEAN EQUITY, 15, rue de Flaxweiler, L-6776 Grevenmacher

2) UCIs Part II 2010 Law:

- ALTERNATIVE STRATEGY, 5, allée Scheffer, L-2520 Luxembourg

3) SIFs:

- 1798 US SPECIAL SITUATIONS MASTER FUND, 5, allée Scheffer, L-2520 Luxembourg

- HFS DISCOVER FUND SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- MONALUX S.C.A., SICAV SIF, 2, avenue Charles de Gaulle, L-1653 Luxembourg

- OROX CAPITAL INVESTMENT, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- PMG SPECIAL FUNDS, 5, Heienhaff, L-1736 Senningerberg

- VENDAVEL SICAV-SIF, 370, route de Longwy, L-1940 Luxembourg