Global situation of undertakings for collective investment at the end of September 2016

Press release 16/41

I. Overall situation

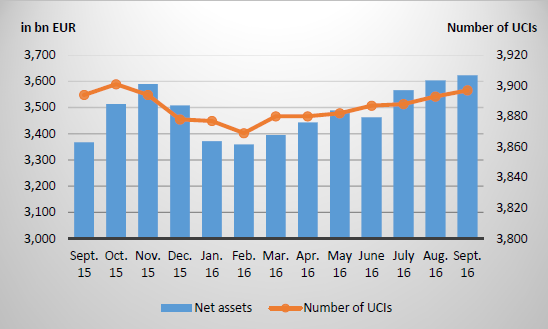

As at 30 September 2016, total net assets of undertakings for collective investment and specialised investment funds amounted to EUR 3,621.929 billion compared to EUR 3,602.162 billion as at 31 August 2016, i.e. a 0.55% increase over one month. Over the last twelve months, the volume of net assets rose by 7.58%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 19.767 billion in September. This increase represents the balance of positive net issues of EUR 25.868 billion (0.72%) and of the negative development in the financial markets amounting to EUR 6.101 billion (-0.17%).

The number of undertakings for collective investment (UCIs) and specialised investment funds (SIFs) taken into consideration totalled 3,897 as against 3,893 in the previous month. 2,590 entities have adopted an umbrella structure, which represents 12,976 sub-funds. When adding the 1,307 entities with a traditional structure to that figure, a total of 14,283 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on Luxembourg UCIs and SIFs (hereafter “UCIs”) and, on the other hand, the net capital investment in these UCIs, the following can be said about September 2016.

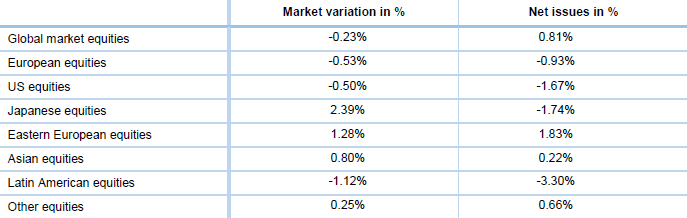

The categories of equity UCIs developed differently during the month under review.

As far as developed countries are concerned, the European equity UCI category registered a slight decrease due, in particular, to the absence of new accommodating monetary policy measures announced by the European Central Bank. US economic indicators below expectations as well as the Fed maintaining its key interest rates at the current level provide an explanation for the mild decline in the prices of US equity UCIs. Japanese equity UCIs improved while the decline of stock exchange prices as a result of the appreciation of the YEN and the new monetary policy guidelines taken by the Bank of Japan was largely offset by the appreciation of the YEN vs. EUR.

Concerning emerging countries, Asian equity UCIs recorded an overall positive performance, in particular, due to China’s economic data which continue to show a stabilisation of the Chinese economy. Eastern European equity UCIs ended the month positively mainly under the effect of stabilising oil prices entailing a slowing recession in Russia despite the lingering geopolitical issues in the region. The losses registered by the Latin American equity UCIs can be mainly explained by the depreciation of the main currencies of the region in a context of stagnating stock exchange prices.

In September, equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of September 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

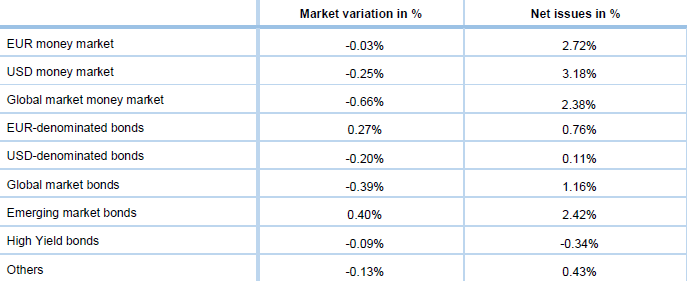

In Europe, government and private sector bond yields remained more or less stable in the context, in particular, of maintained monetary policy measures by the European Central Bank. Consequently, EUR-denominated bond UCIs varied only slightly in the month under review.

The Fed’s decision to maintain the level of its key interest rates entailed only a slight change in the USD-denominated government bond yields over the month under review. The low USD vs. EUR depreciation saw the USD-denominated bond UCIs end the month with a small decrease.

The maintenance of the key interest rates in the United States and the agreement signed between the OPEC countries on the oil production curb resulted in small gains for the emerging countries bond UCI category.

In September, fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of September 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

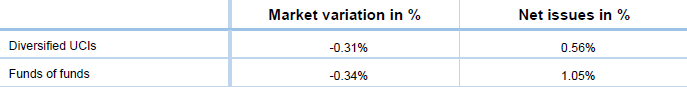

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Diversified income UCIs and funds of funds during the month of September 2016*

* Variation in % of Net Assets in EUR as compared to the previous month

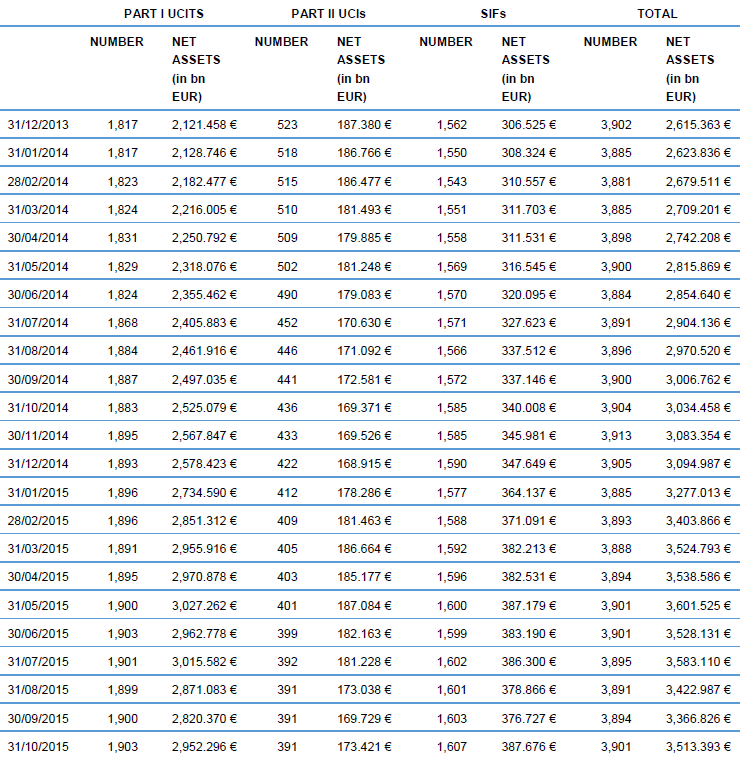

II. Breakdown of the number and the net assets of UCIs according to Parts I and II of the 2010 Law and of SIFs, respectively, according to the 2007 Law

During the month under review, the following 19 undertakings for collective investment and specialised investment funds have been registered on the official list:

1) UCITS Part I 2010 Law:

- DEUTSCHER STIFTUNGSFONDS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- DOUBLELINE FUNDS (LUXEMBOURG), 16, boulevard d’Avranches, L-1160 Luxembourg

- KAMINIORA, 106, route d’Arlon, L-8210 Mamer

- TELL SICAV-UCITS, 33A, avenue J-F Kennedy, L-1855 Luxembourg

2) SIFs:

- A&G GLOBAL II SICAV – SIF, 34A, boulevard Grande-Duchesse Charlotte, L-1330 Luxembourg

- AB COMMERCIAL REAL ESTATE DEBT FUND III, SICAV-SIF S.C.SP., 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- AGRICULTURE INVESTMENT URUGUAY SICAV-SIF, 26, avenue de la Liberté, L-1930 Luxembourg

- AM ALPHA APAC FONDS SCS SICAV-SIF, 20, Rue Philippe II, L-2340 Luxembourg

- AM ALPHA GLOBALE IMMOBILIEN SCS SICAV-SIF, 20, Rue Philippe II, L-2340 Luxembourg

- AM-RE S.A. SICAV-SIF, 20, Rue Philippe II, L-2340 Luxembourg

- B SETTLEMENT SICAV-SIF, 5, rue Jean Monnet, L-2180 Luxembourg

- FG WOHNINVEST DEUTSCHLAND S.C.S SICAV-SIF, 5, rue Jean Monnet, L-2180 Luxembourg

- GREEN RETURN FEEDER FUND SCA, SICAV-FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- IBC LENDING SCSP SICAV-SIF, 121, avenue de la Faïencerie, L-1511 Luxembourg

- JAPAN ASEAN WOMEN EMPOWERMENT FUND, 28-32, place de la Gare, L-1616 Luxembourg

- MULTI ASSET PROTECT 1780, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- NEW CAPITAL ALTERNATIVE SIF, 16, boulevard d’Avranches, L-1160 Luxembourg

- SIGFRIDO S.C.A. SICAV-SIF, 34A, boulevard Grande-Duchesse Charlotte, L-1330 Luxembourg

- VELOCITY FUNDS, SICAV S.A., 37A, avenue J-F Kennedy, L-1855 Luxembourg

The following 15 undertakings for collective investment and specialised investment funds have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- AC OPP, 5, Heienhaff, L-1736 Senningerberg

- BETHMANN ABSOLUTE FLEX INTERNATIONAL, 1B, Heienhaff, L-1736 Senningerberg

- CCMG NAVIGATOR, 5, Heienhaff, L-1736 Senningerberg

- DEKA-EUROGARANT 10, 5, rue des Labours, L-1912 Luxembourg

- DWS DIVIDENDE GARANT 2016, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- LUX TAURUS, 2, place François-Joseph Dargent, L-1413 Luxembourg

- MARTIN CURRIE GLOBAL FUNDS, 49, avenue J-F Kennedy, L-1855 Luxembourg

- MEAG OPTIERTRAG, 15, rue Notre-Dame, L-2240 Luxembourg

2) UCIs Part II 2010 Law:

- DWS EMERGING CORPORATE BOND MASTER FUND, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

3) SIFs:

- ANGOLA GROWTH S.C.A., SICAV-FIS, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- ATLANTICO INVESTMENT STRATEGIES S.C.A., SICAV-SIF, 34A, boulevard Grande-Duchesse Charlotte, L-1330 Luxembourg

- BRANDENBURG FUND SICAV-FIS, 69, route d’Esch, L-1470 Luxembourg

- DWS CHINA A-FUND, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- GERMAN RETAIL PROPERTY FUND FCP-SIF, 5, allée Scheffer, L-2520 Luxembourg

- MGE REAL ESTATE FUND S.A R.L., 19, rue Eugène Ruppert, L-2453 Luxembourg