Profit and loss account of credit institutions as at 30 September 2016

Press release 16/40

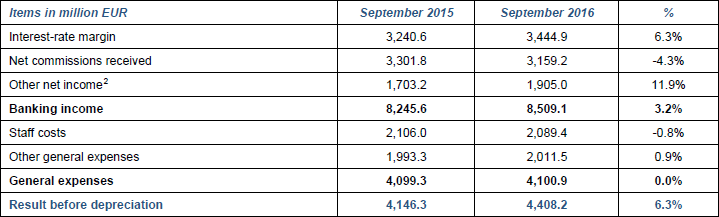

The CSSF estimates profit before provisions of the Luxembourg banking sector at EUR 4,408 million for the nine first months of 2016. Compared to the same period in 2015, profit before provisions thus increased by 6.3%.1

The development of the profit and loss accounts of credit institutions in Luxembourg results from the increase in banking income (+3.2%) which is mainly due to the interest-rate margin and other net income.

The growth in banking income results from a positive development of the interest-rate margin (+6.3%) and of other net income (+11.9%), whereas the net commissions received declined by 4.3% as compared to the same period in 2015. Despite the context of low, or even negative, interest rates, the interest-rate margin of slightly more than half of the banks of the financial centre rose. The sharp rise year-on-year is, inter alia, attributable to two major phenomena: (i) an increase in the business volume of most banks some of which have business models based on short-term loans with greater profitability, and (ii) the impact of negative interest rates by certain banks towards their institutional customers.

The fall of net commissions received concerned over half of the banks in Luxembourg. The drop of these net commissions received, which is mainly derived from asset management activities on behalf of private and institutional customers, is associated with a less favourable stock market environment as compared to the previous year, in particular, during the first half of the year. Thanks to the positive development of the financial markets in the third quarter of this year, the decline in net commissions received has slowed year-on-year. Other net income recorded a strong increase (+11.9%) as compared to the same period last year. This item is very volatile due to its composition. The rise recorded at the end of September 2016 as against the same period in 2015 is largely attributable to non-recurring factors specific to a limited number of banks of the financial centre.

General expenses remained stable over a year. While staff costs decreased by 0.8%, the other general expenses increased by 0.9% compared to last year. This increase in other general expenses concerned most of the banks of the financial centre and reflects not only the investments in new technical infrastructures but also expenses to be borne by banks in order to comply with a more complex regulatory framework.

As a result of the above-mentioned developments, profit before provisions increased by 6.3% year-on-year.

Profit and loss accounts as at 30 September 2016

1 Due to major changes in the banking prudential reporting in 2016, the scope of consolidation has been adapted to better reflect the evolution of the profit and loss accounts of Luxembourg banks. Consequently, figures for September 2015 have been adjusted to reflect a broader scope of consolidation comparable to that of the new reporting of September 2016.

2 Including dividends received.