Global situation of undertakings for collective investment at the end of June 2017

Press release 17/30

I. Overall situation

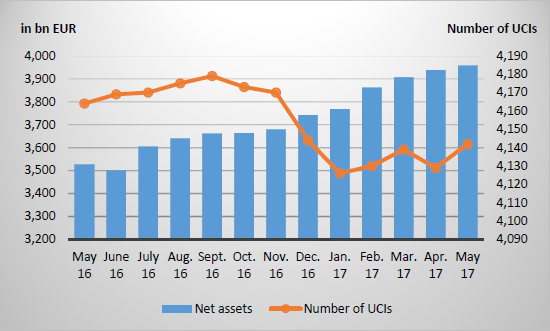

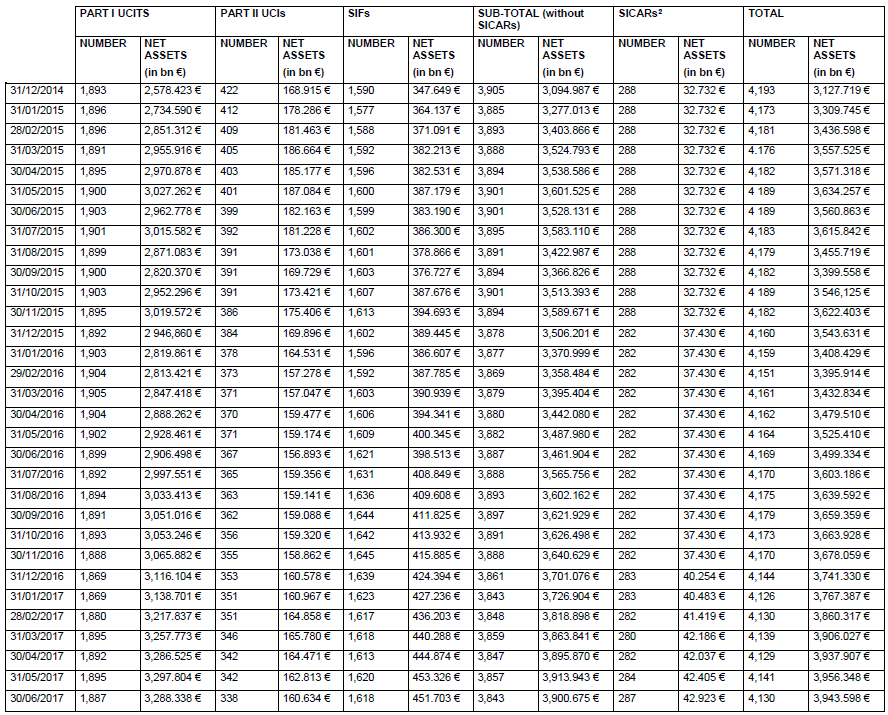

As at 30 June 2017, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 3,943.598 billion compared to EUR 3,956.366 billion as at 31 May 2017, i.e. a 0.32% decrease over one month. Over the last twelve months, the volume of net assets rose by 12.70%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 12.768 billion during the month of June. This decrease results from the balance of positive net issues amounting to EUR 20.751 billion (0.53%) combined with a negative development in financial markets of EUR 33.519 billion (0.85%).

The development of undertakings for collective investment is as follows1:

The number of undertakings for collective investment (UCIs) taken into consideration totals 4,130 as against 4,142 in the previous month. A total of 2,646 entities have adopted an umbrella structure, which represents 13,190 sub-funds. When adding the 1,484 entities with a traditional structure to that figure, a total of 14,674 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about June:

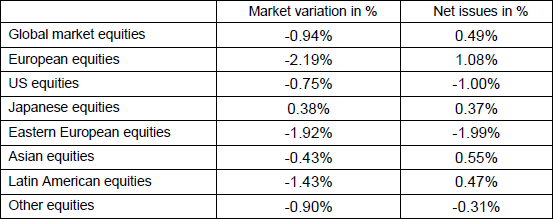

Most categories of equity UCIs developed negatively during the month under review.

As far as developed countries are concerned, European equity UCIs recorded price losses within the context of anticipations of a less accommodating monetary policy in the future and the EUR appreciation. While equity markets in the United States slightly increased due, in particular, to the good results of certain undertakings, the USD vs. EUR depreciation made US equity UCIs finish the month in negative territory. The sound foreign trade figures in Japan and the depreciation of the YEN against the USD resulted in a positive performance of Japanese equity UCIs, which was largely offset by the YEN vs. EUR depreciation.

As regards emerging countries, the Asian equity UCI category developed negatively following the depreciation of the main Asian currencies, despite a positive performance of the Asian equity markets within the context of stable economic data in China and an overall favourable environment. Losses of Eastern European equity UCIs are mainly owed to the drop in oil prices as well as persisting geopolitical problems in the region. As a result mainly of the persisting political issues in the different countries of the region and the depreciation of the main South American currencies, the Latin American equity UCIs ended the month down.

In June, the equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of June 2017*

*Variation in % of Net Assets in EUR as compared to the previous month.

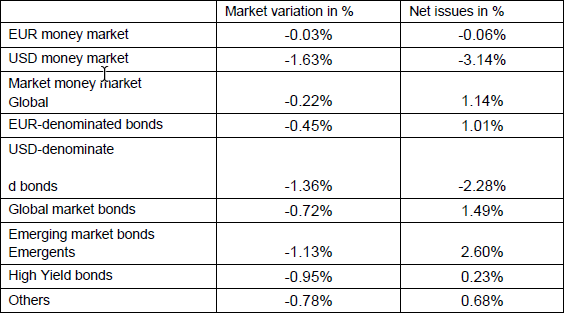

In Europe, the stable economic situation as well as the anticipations of a reduced asset buyback programme by the European Central Bank entailed an increase of the long-term interest rates of government and corporate bonds so that EUR-denominated bond UCIs registered a loss in value.

US government bond yields stagnated in the month under review, due, on the one hand, to the impact of the Fed’s decision to raise key interest rates and to start reducing its balance sheet and, on the other hand, to economic indicators less favourable than expected. Within the context of the USD vs. EUR depreciation, USD-denominated bond UCIs ended the month down.

The bond UCI category of emerging countries experienced a bearish month due to geopolitical issues in certain countries of the region, the drop in oil prices and the depreciation of some main currencies.

In June, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of June 2017*

*Variation in % of Net Assets in EUR as compared to the previous month.

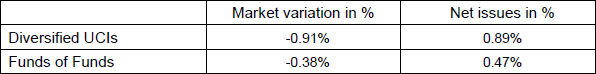

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of June 2017*

*Variation in % of Net Assets in EUR as compared to the previous month.

II. Breakdown of the number and net assets of UCIs

During the month under review, the following fifteen undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- HAIG INTERNATIONAL, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- INVEST EVOLUTION, 3, rue des Labours, L-1912 Luxembourg

- LAMPE SICAV, 80, route d’Esch, L-1470 Luxembourg

- SCOR FUNDS, 60, avenue J-F Kennedy, L-1855 Luxembourg

2) SIFs:

- ALPHABEE ASSET MANAGEMENT FUND, 5, allée Scheffer, L-2520 Luxembourg

- BERLIN LANDBANKING FUND SICAV-SIF, 26, avenue de la Liberté, L-1930 Luxembourg

- CAPE CAPITAL SICAV-SIF II, 5, rue Jean Monnet, L-2180 Luxembourg

- FOREVER FUNDS SICAV-SIF, 12, rue Eugène Ruppert, L-2453 Luxembourg

- HERMES DIRECT LENDING MASTER FUND SCS, SICAV-SIF, 51, avenue J-F Kennedy, L-1855 Luxembourg

- MERCER PRIVATE INVESTMENT PARTNERS IV FEEDER FCP-SIF, 74, rue de Merl, L-2146 Luxembourg

- NOVOSA-LUX FCP-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- TIKEHAU INVESTMENT II S.C.S., SICAV-SIF, 60, avenue J-F Kennedy, L-1855 Luxembourg

- UNIVERSAL POWER S.C.S. SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

3) SICARs:

- BIP FUND (SCA), SICAR

- BTOV GROWTH I SCS, SICAR

The following 27 undertakings for collective investment have been withdrawn from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ALPHA INVESTIMENTI SICAV, 106, route d’Arlon, L-8210 Mamer

- ATTIJARI AFRICA FUNDS, 60, avenue J-F Kennedy, L-1855 Luxembourg

- BREISGAU-FONDS, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- DKO-LUX OPTIMA, 2, place François-Joseph Dargent, L-1413 Luxembourg

- DKO-LUX-AKTIEN DEUTSCHLAND, 2, place François-Joseph Dargent, L-1413 Luxembourg

- DKO-LUX-AKTIEN GLOBAL (DF), 2, place François-Joseph Dargent, L-1413 Luxembourg

- DKO-LUX-AKTIEN NORDAMERIKA, 2, place François-Joseph Dargent, L-1413 Luxembourg

- DKO-LUX-RENTEN EUR, 2, place François-Joseph Dargent, L-1413 Luxembourg

- DKO-LUX-RENTEN USD, 2, place François-Joseph Dargent, L-1413 Luxembourg

- DWS DIVIDENDE DIREKT 2017, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- KATLA MANAGER SELECTION, 9, boulevard Prince Henri, L-1724 Luxembourg

- SUMITOMO MITSUI TRUST EQUITY FUND, 33, rue de Gasperich, L-5826 Howald-Hesperange

2) UCIs Part II Law 2010:

- APRIMA ONE, 534, rue de Neudorf, L-2220 Luxembourg

- ASIAN CAPITAL HOLDINGS FUND, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- ISALPHA, 1, place de Metz, L-1930 Luxembourg

- M.A.R.S. FUND, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- MPC GLOBAL MARITIME OPPORTUNITIES S.A. SICAF, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

3) SIFs:

- 1741 SPECIALISED INVESTMENT FUNDS SICAV, 11-13, boulevard de la Foire, L-1528 Luxembourg

- A CAPITAL CHINA OUTBOUND FUND, 2, avenue Charles de Gaulle, L-1653 Luxembourg

- DIFFERENTIA SICAV-FIS, 14, boulevard Royal, L-2449 Luxembourg

- HP INVESTMENTFUND-FIS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- KAROO INVESTMENT FUND S.C.A. SICAV-SIF, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- KSK-DEKA-FONDS, 5, rue des Labours, L-1912 Luxembourg

- MANASLU, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- MERCURE, 14, boulevard Royal, L-2449 Luxembourg

- SELLIN FUND FCP-FIS, 44, avenue J-F Kennedy, L-1855 Luxembourg

- UBS (LUX) SIF SICAV 1, 33A, avenue J-F Kennedy, L-1855 Luxembourg

1 Since the statistical data of SICARs were published on an annual basis before December 2016, the chart includes the number and net assets of SICARs as at 31 December 2015 for the previous months, resulting in constant figures until November 2016 for these vehicles.

2 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.