Profit and loss account of credit institutions as at 30 June 2017

Press release 17/33

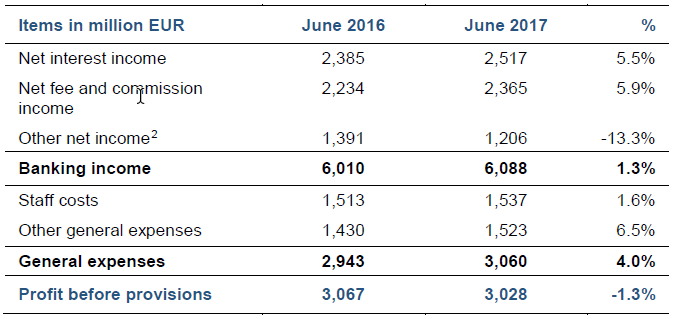

The CSSF estimates profit before provisions of the Luxembourg banking sector at EUR 3,028 million for the first six months of 2017. Compared to the same period in 2016, profit before provisions thus slightly decreased by 1.3%.1

The negative development of profit before provisions of the Luxembourg credit institutions results from the steady increase of general expenses (+4.0%) which was only partially offset by the positive development of banking income (+1.3%) during the same period.

The increase of aggregated banking income is due to a favourable development of net interest income and net fee and commission income, whereas other net income, which is historically very volatile, substantially dropped. Net interest income rose by 5.5% on average. This favourable development, which affects one in every two banks, reflects mainly the increased business volume and the fact that some banks passed on the negative interest rates to their institutional clients. The 5.9% rise of net fee and commission income which is shared by 57% of the Luxembourg banks is chiefly due to asset management activities on behalf of private and institutional clients. However, this item also improved for conventional banking intermediation activities.

General expenses rose by 4.0% over a year. This growth is mainly linked to other general expenses (+6.5%). This increase in other general expenses concerns most of the banks of the financial centre and reflects the investments in new technical infrastructures, charges due to extraordinary events as well as costs to be borne by banks in order to comply with significant new accounting standards and regulations which will enter into force in the next months.

As a result of the above-mentioned developments, profit before provisions decreased by 1.3% year-on-year.

Profit and loss account as at 30 June 2017

1 Due to major changes in the banking prudential reporting in 2016 and 2017 (Circular CSSF 15/621), the aggregation scope has been adapted to better reflect the evolution of the profit and loss accounts of Luxembourg banks. Consequently, the figures for June 2016 have been readjusted to reflect a larger aggregation scope which is similar to the new reporting of June 2017.

2 Including dividends received.