Global situation of undertakings for collective investment at the end of March 2018

Press release 18/16

I. Overall situation

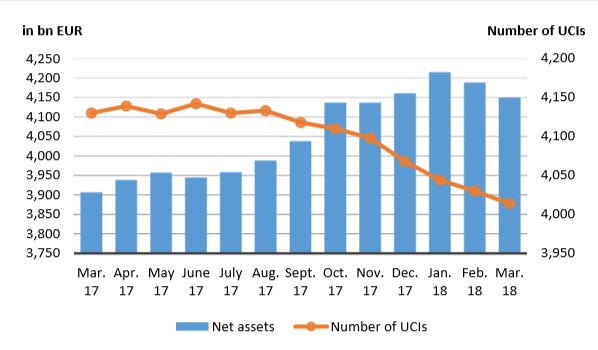

As at 31 March 2018, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 4,148.898 billion compared to EUR 4,187.323 billion as at 28 February 2018, i.e. a 0.92% decrease over one month. Over the last twelve months, the volume of net assets rose by 6.22%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 38.425 billion during the month of March. This decrease results from the balance of positive net issues amounting to EUR 17.900 billion (0.43%) combined with a negative development in financial markets of EUR 56.325 billion (-1.35%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totals 3,996 as against 4,014 in the previous month. 2,578 entities have adopted an umbrella structure, which represents 13,309 sub-funds. When adding the 1,418 entities with a traditional structure to that figure, a total of 14,727 fund units are active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about March.

The financial markets we dominated by the announcement of the US President of protectionist measures which fed the fears of trade tensions, leading to a fall in equity prices and a renewed interest for safe havens.

In this context, the various categories of equity UCIs of developed and emerging countries recorded price losses, despite economic fundamentals remaining overall positive.

In March, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of March 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

The EUR-denominated government bond yields appreciated as the risk aversion of investors seeking safe havens resumed its climb. Within a context of increased uncertainties, corporate bonds globally ended the month down due to the increase of risk premiums. All in all, EUR-denominated bond UCIs registered a slight price increase.

In the United States, government bonds benefited from these market circumstances, resulting in a fall in US long-term yields. However, this trend has been more than offset by the USD vs. EUR depreciation, so that USD-denominated bonds declined overall.

Despite the rise in volatilities and resurgence of investors’ risk aversion, the emerging market bond UCIs realised slight price increases which have been more than offset by the depreciation of the USD and the main emerging currencies against the EUR.

In March, the category of fixed-income UCIs registered an overall negative net capital investment.

Development of fixed-income UCIs during the month of March 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of March 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following three undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- 2XIDEAS UCITS, 2, rue d’Alsace, L-1122 Luxembourg

- H & A INTERNATIONAL FUND, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- SELECT INVESTMENT SERIES III SICAV, 6H, route de Trèves, L-2633 Senningerberg

The following 21 undertakings for collective investment and specialised investment funds were deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- DEKA-EUROGARANT STRATEGIE 1, 5, rue des Labours, L-1912 Luxembourg

- DEKA-OPTIRENT 1+Y, 5, rue des Labours, L-1912 Luxembourg

- DEKA-OPTIRENT 2Y, 5, rue des Labours, L-1912 Luxembourg

- DWS GLOBAL EQUITY FOCUS FUND, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- EURIZON MM COLLECTION FUND, 8, avenue de la Liberté, L-1930 Luxembourg

- HSBC MULTI INDEX FUNDS, 5, allée Scheffer, L-2520 Luxembourg

- LUXGLOBAL, 2, place François-Joseph Dargent, L-1413 Luxembourg

- PROMETHEUS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- SFC GLOBAL MARKETS, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- UNIGARANT: BRIC (2018), 308, route d’Esch, L-1471 Luxembourg

- UNIGARANT: DEUTSCHLAND (2018), 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- OONA SOLUTIONS, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- SAIL MULTI-STRATEGIES FUND, 16, boulevard d’Avranches, L-1160 Luxembourg

3) SIFs:

- ASSAFWA SHARIA, 1B, rue Jean Piret, L-2350 Luxembourg

- BOUWFONDS EUROPEAN STUDENT HOUSING FUND II, 2, place François-Joseph Dargent, L1413 Luxembourg

- MUNICIPAL INFRASTRUCTURE DEVELOPMENT FUND, 14, boulevard Royal, L-2449 Luxembourg

- PM STRATEGIE FONDS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- PRADERA EUROPEAN RETAIL FUND 2, 69, route d’Esch, L-1470 Luxembourg

- SIREO IMMOBILIENFONDS NO. 4 SICAV-FIS, 4A, rue Albert Borschette, L-1246 Luxembourg

- TRIAS INFRASTRUCTURE DEBT FUND S.A., SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- VARIUS RE FUND S.A.-SICAV-SIF, 19, rue Eugène Ruppert, L-2453 Luxembourg

1 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.