Global situation of undertakings for collective investment at the end of July 2018

Press release 18/30

I. Overall situation

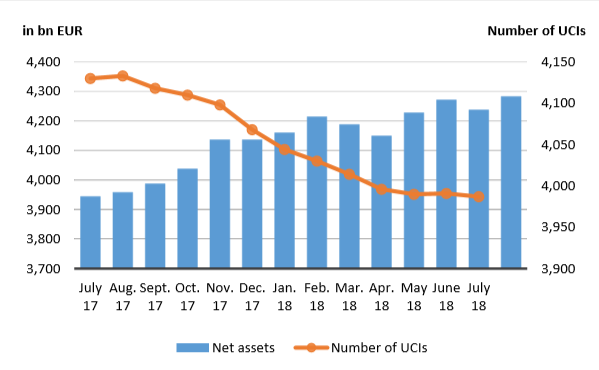

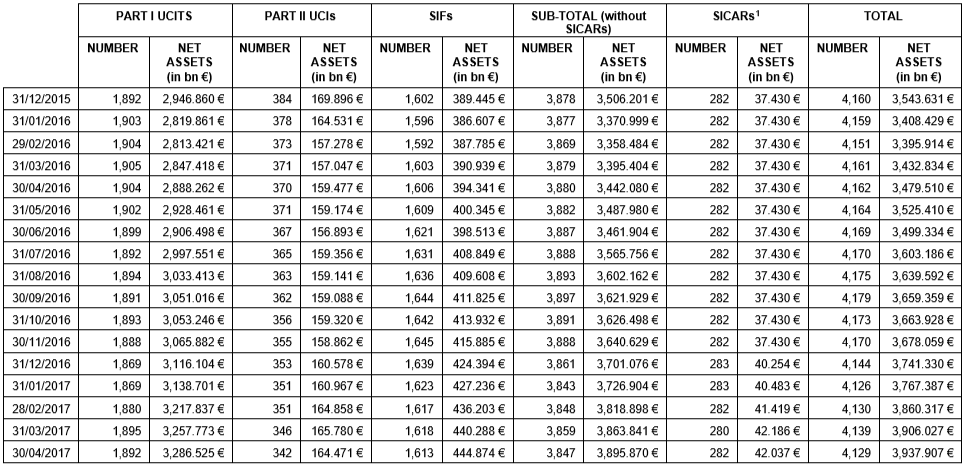

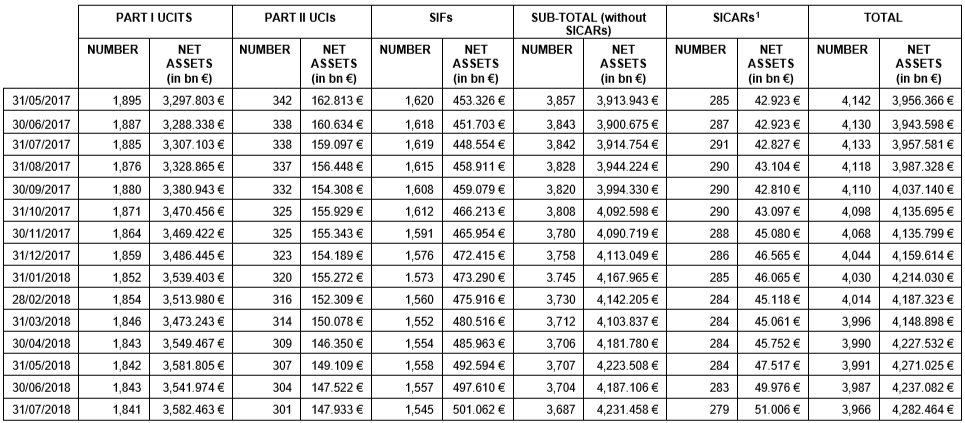

As at 31 July 2018, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 4,282.464 billion compared to EUR 4,237.082 billion as at 30 June 2018, i.e. a 1.07% increase over one month. Over the last twelve months, the volume of net assets rose by 8.21%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 45.382 billion in July. This increase represents the sum of positive net issues of EUR 10.523 billion (0.25%) and of the positive development in the financial markets amounting to EUR 34.859 billion (0.82%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,966 as against 3,987 in the previous month. A total of 2,573 entities adopted an umbrella structure, which represented 13,364 sub-funds. When adding the 1,393 entities with a traditional structure to that figure, a total of 14,757 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about July.

As regards developed countries, the European equity UCIs realised a positive performance following the easing of the trade tensions between Europe and the United States, the stabilisation of the economic indicators and the sound results of the companies in Europe. The robust growth in the Unites States as well as corporate earnings exceeding anticipations resulted in the US equity UCIs ending the month up. While the Japanese equity prices were sustained by an overall favourable economic environment, despite somewhat lower economic indicators for Japan, the depreciation of the YEN as compared to the EUR has offset these gains. As a result, there was little change in the Japanese equity UCIs.

As regards emerging countries, the trade tensions between the United States and China, the slight slower growth of the Asian countries, divergent developments of the equity markets in several countries of this region as well as the depreciation of the main Asian currencies against the EUR have weighted on the prices of Asian equity UCIs which performed poorly. Despite the political problems of certain Eastern European countries, the lull in the trade tensions between Europe and the United States resulted in the price increases of the Eastern European equity UCIs. This sharp rise in the prices of Latin American equity UCIs is the result of the strong market performance, mainly in Brazil and Mexico as well as a significant appreciation of the main South American currencies as compared to the EUR.

In July, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of July 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

In Europe and in the United States, the government bond yields slightly increased in relation, notably, to the easing of trade tensions between Europe and the United States and the positive economic figures in these two regions. In this context, the investors turned increasingly to corporate bonds with, as a consequence, a slight decrease in risk premiums in favour of these values.

On this basis, EUR-denominated bond UCIs changed little during the month under review whereas the USDdenominated bond UCIs, in particular, in the context of the USD depreciation against the EUR ended the month down.

The relaxation of the trade tensions between Europe and the United States, the economic and political measures started by China as well as the reduction of the risk premiums bolstered the increase of the prices of the emerging countries’ bond UCIs.

In July, fixed-income UCIs showed an overall positive net capital investment, mainly due to net subscriptions in money market UCIs.

Development of fixed-income UCIs during the month of July 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of July 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 14 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- BELGRAVIA LUX UCITS, 15, avenue J-F Kennedy, L-1855 Luxembourg

- BLUEORCHARD UCITS, 28-32, place de la Gare, L-1616 Luxembourg

- BOS INTERNATIONAL FUND, 33A, avenue J-F Kennedy, L-1855 Luxembourg

- CONVICTION PATRIMOINE, 12, rue Eugène Ruppert, L-2453 Luxembourg

- KEEL CAPITAL SICAV-UCITS, 11-13, boulevard de la Foire, L-1528 Luxembourg

- MANDATUM LIFE SICAV-UCITS, 26-28, rue Edward Steichen, L-2540 Luxembourg

- UNIINSTITUTIONAL STRUCTURED CREDIT, 308, route d’Esch, L-1471 Luxembourg

- VM BC AKTIEN GLOBAL, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- VM BC ANLEIHEN GLOBAL, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- VM BC BASISSTRATEGIE GLOBAL, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

2) SIFs:

- PROXYP SICAV-SIF, 15, rue Bender, L-1229 Luxembourg

- RASMALA ALTERNATIVE INVESTMENT FUNDS, 11, rue Aldringen, L-1118 Luxembourg

- REDWING S.A. SICAV-SIF, 11, rue Aldringen, L-1118 Luxembourg

- THREE HILLS CAPITAL SOLUTIONS III, 2, boulevard de la Foire, L-1528 Luxembourg

The following 35 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- DB FIXED COUPON FUND 2018, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- ECM CREDIT FUND SICAV, 80, route d’Esch, L-1470 Luxembourg

- FAVORIT-INVEST GARANT 1, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- FAVORIT-INVEST GARANT 2, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- GFG FUND SICAV, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- HERBEUS SICAV, 2, place François-Joseph Dargent, L-1413 Luxembourg

- ONEWORLD TACTICS, 5, Heienhaff, L-1736 Senningerberg

- PAM INTERNATIONAL FUND SELECTION PORTFOLIO, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- ROCHE-BRUNE FUNDS, 60, avenue J-F Kennedy, L-1855 Luxembourg

- W&W STRATEGIE FONDS, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- WERTE & SICHERHEIT NR. 1, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- WERTE & SICHERHEIT NR. 2 – GLOBALE STABILITÄT, 4, rue Thomas Edison, L-1445 Strassen

2) UCIs Part II 2010 Law:

- BLAKENEY INVESTORS, 15, avenue J-F Kennedy, L-1855 Luxembourg

- EOS INVESTMENT SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- MAN-AHL LANDMARK, 287-289, route d’Arlon, L-1150 Luxembourg

3) SIFs:

- AGALUX ALTERNATIVE FUND, 60, avenue J-F Kennedy, L-1855 Luxembourg

- AMBOLT S.A., 121, avenue de la Faïencerie, L-1511 Luxembourg

- AXA-SPDB CHINA DOMESTIC GROWTH A-SHARES, 49, avenue J-F Kennedy, L-1855 Luxembourg

- CEE MULTISECTOR FUND S.A. – SICAV – SIF, 19, rue Eugène Ruppert, L-2453 Luxembourg

- FOS FORTUNE, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- FOS SURPRISE, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- HIGH LIQUIDITY INVESTMENT FUND, 19-21, route d’Arlon, L-8009 Strassen

- IPC – FORTUNA FUND 1, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC – STELLA CAPITAL FUND, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- IPC-PORTFOLIO INVEST I, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- PRIMATUM FCP SPECIALIZED INVESTMENT FUND, 5, rue Guillaume Kroll, L-1882 Luxembourg

- QUEENSGATE INVESTMENTS FUND I, 42-44, avenue de la Gare, L-1610 Luxembourg

- RESA FONDS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- SESFIKILE GLOBAL PROPERTY FUND, 58, rue Charles Martel, L-2134 Luxembourg

- VAH PRIVATE EQUITY SICAV, 6, avenue Marie-Thérèse, L-2132 Luxembourg

- VALLIS CONSTRUCTION SECTOR CONSOLIDATION FUND SICAV-SIF, 5, rue Guillaume Kroll, L-1882 Luxembourg

4) SICARs:

- EURAZEO PARTNERS B S.C.A., SICAR, 25C, Boulevard Royal, L-2449 Luxembourg

- EURAZEO PARTNERS S.C.A., SICAR, 25C, Boulevard Royal, L-2449 Luxembourg

- EURO INDUSTRIAL S.A R.L. SICAR, 20, rue de la Poste, L-2346 Luxembourg

- SLB BRAZIL ECONOLOGY FUND S.A. SICAR, 5, rue Guillaume Kroll, L-1882 Luxembourg

1 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.