Global situation of undertakings for collective investment at the end of November 2018

Press release 19/01

I. Overall situation

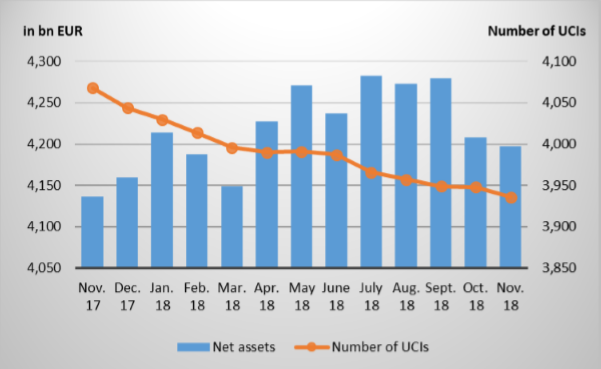

As at 30 November 2018, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,192.332 billion compared to EUR 4,207.304 billion as at 31 October 2018, i.e. a 0.36% decrease over one month. Over the last twelve months, the volume of net assets rose by 1.37%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 14.972 billion during the month of November. This decrease represents the balance of the negative net issues of EUR 22.211 billion (-0.53%) and the positive development in financial markets amounting to EUR 7.239 billion (+0.17%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,936 as against 3,948 in the previous month. A total of 2,553 entities adopted an umbrella structure, which represented 13,569 sub-funds. When adding the 1,383 entities with a traditional structure to that figure, a total of 14,952 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about November.

The various categories of equity UCIs developed differently during the month under review.

As regards the developed countries, the European equity UCI category registered a negative performance in a context of economic figures which were not as good in Europe and uncertainties related to Brexit and the Italian budget. With better growth figures in the United States and a more accommodating speech by the Fed, the US equity UCI category developed positively. Despite mixed economic indicators in Japan and persistent trade tensions, the category of Japanese equity UCIs recorded a slightly positive performance during the month under review.

As regards emerging countries, despite the gradually slowing growth in China and the Sino-American trade tensions, the category of Asian equity UCIs registered sharp gains in view of the prospect of possible growth stabilisation measures in China and the appreciation of several Asian currencies. All in all, the category of Eastern European equity UCIs ended the month up, mainly as a result of the more accommodating statements of the Fed concerning the increase of the key interest rates. Latin American UCIs ended the month in negative territory, chiefly in a context of economic and political uncertainties in Mexico and the profit-taking in the Brazilian equity markets.

In November, equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of November 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

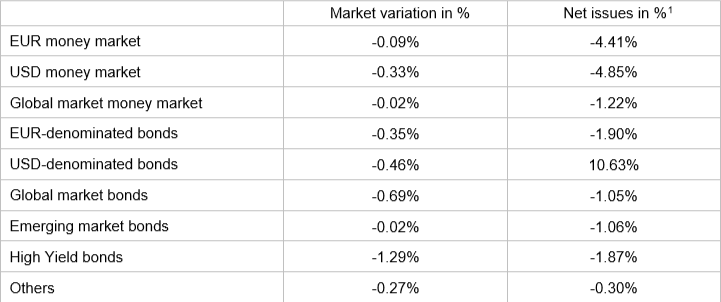

In Europe, worries about the global economic environment, trade tensions and political uncertainties led to the rise in prices of high-rated government bonds which were sought by investors as ‘safe haven’, whereas risk premiums increased overall for private sector bonds. All in all, EUR-denominated bond UCIs recorded slight price losses.

In the United States, in a context of mid-term election results and the anticipation of a more accommodating monetary policy, the prices of USD-denominated bond UCIs increased, while the prices of corporate bonds recorded small changes during the month under review. Against the backdrop of the depreciation of the USD against the EUR, USDdenominated bond UCIs ended the month in negative territory.

Overall, the emerging market bond UCIs changed little due to, on the one hand, the decrease in oil prices and the growth decline in China and, on the other hand, the more accommodating statements of the Fed.

In November, the category of USD-denominated bond UCIs recorded a positive net capital investment, whereas most other categories of fixed-income UCIs recorded a negative net capital investment.

Development of fixed-income UCIs during the month of November 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of November 2018*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following nine undertakings for collective investment have been registered on the official list:

1) UCIs Part II 2010 Law:

- SYNCHRONY PRIVATE EQUITY FUND OF FUNDS WORLD, 43, boulevard du Prince Henri, L-1724 Luxembourg

2) SIFs:

- ARDIAN REAL ESTATE EUROPEAN FUND II S.C.S., SICAV-SIF, 24, avenue Emile Reuter, L-2420 Luxembourg

- BLACKROCK EUROPE PROPERTY FUND V SCSP SIF, 20, rue de la Poste, L-2346 Luxembourg

- COLMASTER REAL ESTATE SCA SICAV-SIF, 5, rue Guillaume Kroll, L-1882 Luxembourg

- CROWN PREMIUM PRIVATE EQUITY VIII MASTER S.C.S., SICAV-FIS, 2, place François-Joseph Dargent, L-1413 Luxembourg

- CROWN PREMIUM PRIVATE EQUITY VIII S.A., SICAV-FIS, 2, place François-Joseph Dargent, L-1413 Luxembourg

- NN (L) ALTERNATIVE CREDIT, 3, rue Jean Piret, L-2350 Luxembourg

- SWISS LIFE REF (LUX) EUROPEAN HOTEL FUND S.A., SICAV-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

3) SICARs:

ARDIAN INFRASTRUCTURE FUND V S.C.A., SICAR, 24, avenue Emile Reuter, L-2420 Luxembourg

The following 21 undertakings for collective investment and specialised investment funds were deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- AB SICAV II, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- ASTELLON UCITS FUND, 6, rue Lou Hemmer, L-1748 Senningerberg

- FELS TOP 35+ AKTIEN EUROPA, 15, rue de Flaxweiler, L-6776 Grevenmacher

- FIDELITY FUNDS II, 2A, rue Albert Borschette, L-1246 Luxembourg

- MIZUHO ALPINE FUND, 1B, rue Gabriel Lippmann, L-5365 Munsbach

- PREMIUM SAVINGS SOLUTIONS, 8-10, rue Jean Monnet, L-2180 Luxembourg

- TRINITY STREET FUNDS, 106, route d’Arlon, L-8210 Mamer

- TUNDRA CAPITAL MANAGEMENT FUND, 12, rue Eugène Ruppert, L-2453 Luxembourg

- UNIEURORENTA CORPORATES 2018, 308, route d’Esch, L-1471 Luxembourg

2) SIFs:

- AQUILA CAPITAL RENEWABLES AND INFRASTRUCTURE FUND IV S.A., SICAV-SIF, 5, Heienhaff, L-1736 Senningerberg

- BEYLA SCA SICAV-FIS, 44, boulevard Grande-Duchesse Charlotte, L-1330 Luxembourg

- CENTRE LANE CREDIT PARTNERS, SLP – SIF, 40, avenue Monterey, L-2163 Luxembourg

- CHASSELAS FUND, 15, avenue J-F Kennedy, L-1855 Luxembourg

- CLERVILLE FUND S.C.A. SICAV-SIF, 14, boulevard Royal, L-2449 Luxembourg

- IPC-CAPITAL STRATEGY XX, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- PRELIOS GERMAN RETAIL PROPERTY FUND, 11, rue Beaumont, L-1219 Luxembourg

- SANCTUARY SICAV-SIF, 2, place de Metz, L-1930 Luxembourg

- SWISS REAL ESTATE PERFORMANCE S.C.A. SICAV-SIF, 42, rue de la Vallée, L-2661 Luxembourg

- TUNGSTEN AYCON, 2, place François-Joseph Dargent, L-1413 Luxembourg

- VOLKSBANK FORCHHEIM EG SPEZIALFONDS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- WINTON ALTERNATIVE INVESTMENT FUND COMPANY S.A., SICAV-SIF, 20, rue de la Poste, L-2346 Luxembourg

1 The positive net issues of the money market UCI categories are in part the result of cross-border mergers of foreign funds into Luxembourg funds.

2 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.