Global situation of undertakings for collective investment at the end of January 2019

Press release 19/13

I. Overall situation

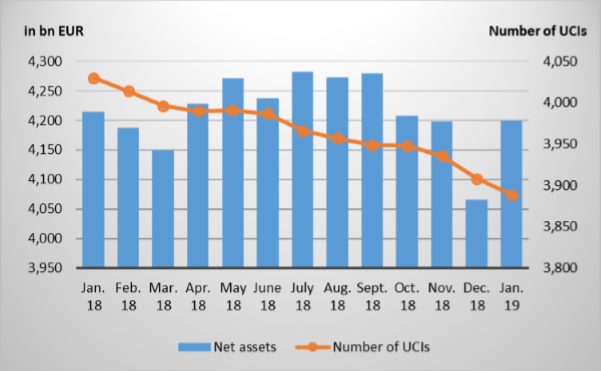

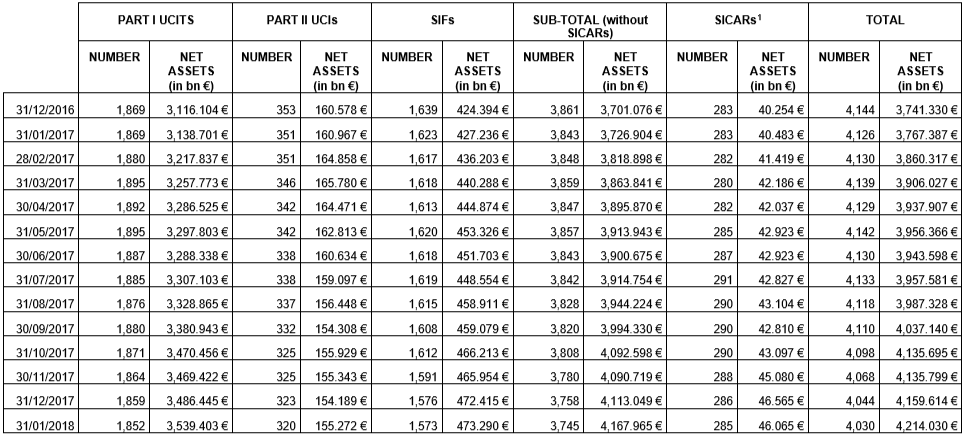

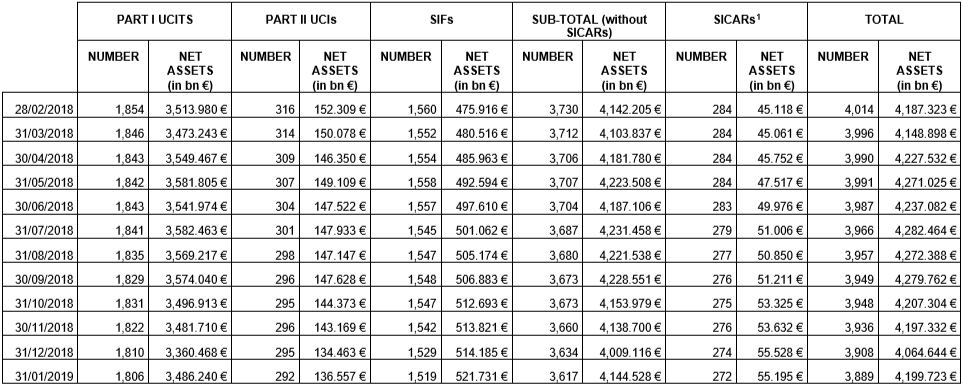

As at 31 January 2019, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs amounted to EUR 4,199.723 billion compared to EUR 4,064.644 billion as at 31 December 2018, i.e. a 3.32% increase over one month. Over the last twelve months, the volume of net assets decreased by 0.34%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 135.079 billion in January. This increase represents the balance of negative net issues of EUR 4.354 billion (-0.11%) and a positive development in the financial markets amounting to EUR 139.433 billion (+3.43%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,889 as against 3,908 in the previous month. A total of 2,524 entities adopted an umbrella structure, which represented 13,527 sub-funds. When adding the 1,365 entities with a traditional structure to that figure, a total of 14,892 fund units were active in the financial centre.

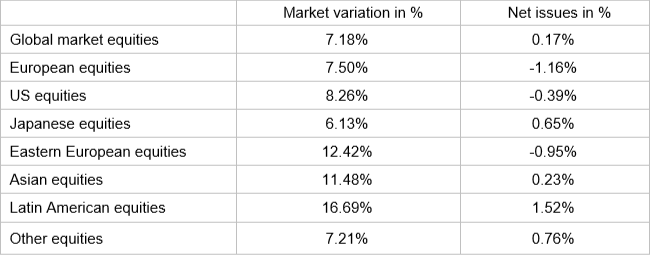

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about January.

Equity markets rebounded in January, with all categories of equity UCIs recording substantial rises.

The European equity UCI category registered price increases due to the progress made in the Sino-American trade negotiations and the accommodating monetary policy, despite weak macroeconomic data in the euro area and political uncertainties related to BREXIT. The rebound of the US equity UCI category was supported by the results of corporates which exceeded expectations and the more accommodating speech of the Federal Reserve. The Japanese equity UCI category followed the upward trend, despite the decrease in Japan’s foreign trade and the slowdown of the overall economic situation.

As regards emerging countries, the Asian equity UCI category substantially improved, mainly as a result of the resumption of trade negotiations between China and the US and the more careful communication by the Fed and despite mitigated economic indicators in China. The category of Eastern European and Latin American equity UCIs registered high price increases following the appreciation of the main currencies in these regions, the more accommodating speech of the Federal Reserve and the rise in oil prices which positively impacted the exporting countries such as Russia and Colombia.

In January, the equity UCI categories registered an overall negative net capital investment.

Development of equity UCIs during the month of January 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

On the bond markets of developed countries, the more accommodating speech on monetary policy from both sides of the Atlantic against the backdrop of uncertainties regarding the strength of the global growth resulted in a decrease in government bond yields. This trend, together with a resurgence of the risk appetite fuelling increases in prices of corporate bonds, led to price gains for EUR-denominated and USD-denominated bond UCIs during the month under review.

As regards emerging bond markets, the progress in the Sino-American trade negotiations, the decrease in yields of US government bonds, the increase in the prices of commodities, the rise of risk appetite and especially the appreciation of the main emerging currencies explain the positive performance of the emerging country bond UCI category.

In January, fixed-income UCI categories registered an overall negative net capital investment.

Development of fixed-income UCIs during the month of January 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of January 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 15 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- FONDACO PREVIDENZA UCITS SICAV, 2, place de Paris, L-2314 Luxembourg

- GLOBAL MASTERS, 16, rue Gabriel Lippmann, L-5365 Munsbach

- MACROEQUITY GLOBAL INVESTMENTS, 17, rue de Flaxweiler, L-6776 Grevenmacher

- SENTAT GLOBAL FUND SICAV, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- SHELTER UCITS, 11-13, boulevard de la Foire, L-1528 Luxembourg

- SULA UCITS SICAV, 2C, rue Albert Borschette, L-1246 Luxembourg

- UNIINSTITUTIONAL EURO CREDIT 2025, 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- DEKA-FLEXGARANT, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

3) SIFs:

- ACCESS OPPORTUNITIES FUND, 11, rue Aldringen, L-1118 Luxembourg

- GRANTIA SICAV-SIF, 28-32, place de la Gare, L-1616 Luxembourg

- INVESCO LUX REAL ESTATE INVESTMENT II S.A. SICAV-SIF, 37A, avenue J-F Kennedy, L-1855 Luxembourg

- PENNANT REEF SICAV-FIS, 4, rue Thomas Edison, L-1445 Strassen

- SCALA ALTERNATIVE INCOME FUND SCSP SIF, 47, avenue J-F Kennedy, L-1855 Luxembourg

- SWISS LIFE ERE CAPITAL PARTNERS FUND S.C.S. SICAV-FIS, 4A, rue Albert Borschette, L-1246 Luxembourg

4) SICARs:

- BREDERODE INTERNATIONAL S.À R.L. SICAR, 32, boulevard Joseph II, L-1840 Luxembourg

The following 34 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- BOLUX, 14, boulevard Royal, L-2449 Luxembourg

- DEKA-OPTIRENT 3Y (II), 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DEUTSCHE AKTIEN TOTAL RETURN, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- FIT FUND, 50, rue Basse, L-7307 Steinsel

- GLOBAL MULTI INVEST, 534, rue de Neudorf, L-2220 Luxembourg

- KÖLNBONN FONDS-PORTFOLIO:, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- MS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- ODDO BHF TRUST FONDS EXKLUSIV, 163, rue du Kiem, L-8030 Strassen

- ROHSTOFF CONTROL FONDS, 8-10, rue Jean Monnet, L-2180 Luxembourg

- UNICORN CAPITAL SICAV, 60, avenue J-F Kennedy, L-1855 Luxembourg

- UNIPROINVEST: STRUKTUR, 308, route d’Esch, L-1471 Luxembourg

2) UCIs Part II 2010 Law:

- BOND SELECT TRUST, 33, rue de Gasperich, L-5826 Howald-Hesperange

- MONEY MARKET FAMILY, 49, avenue J-F Kennedy, L-1855 Luxembourg

- RAM (LUX) FUNDS, 534, rue de Neudorf, L-2220 Luxembourg

3) SIFs:

- ABERDEEN INDIRECT PROPERTY PARTNERS II, 35A, avenue J-F Kennedy, L-1855 Luxembourg

- AHV INTERNATIONAL PORTFOLIO, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- ARBORESCENCE INVESTMENT, 11, avenue Emile Reuter, L-2420 Luxembourg

- ASTELLON FUND SICAV-SIF, 6, rue Lou Hemmer, L-1748 Senningerberg

- ATRIUM INVEST SICAV-SIF, 2, rue Edward Steichen, L-2540 Luxembourg

- CROWN PREMIUM PRIVATE EQUITY BUYOUT, 2, place François-Joseph Dargent, L-1413 Luxembourg

- DUSKA S.A. SICAV – FIS, 12, rue Eugène Ruppert, L-2453 Luxembourg

- EUROPEAN BALANCED PROPERTY FUND, 80, route d’Esch, L-1470 Luxembourg

- FRANKLIN TEMPLETON EUROPEAN REAL ESTATE FUND OF FUNDS, 8A, rue Albert Borschette, L-1246 Luxembourg

- HEITMAN EUROPEAN PROPERTY PARTNERS III, 80, route d’Esch, L-1470 Luxembourg

- HELLEBORE CREDIT SICAV-FIS, 5, allée Scheffer, L-2520 Luxembourg

- INTERNATIONAL PATRIMONIUM FUND SICAV-SIF S.C.A., 56, Grand-rue, L-1660 Luxembourg

- MAGNOLIA SICAV SIF, 204, route de Luxembourg, L-7241 Bereldange

- NORDIC LIGHT FUND, 38, rue Pafebrüch, L-8308 Capellen

- PURE LOAN DEBT FUND S.C.S, SICAV-FIS, 60, avenue J-F Kennedy, L-1855 Luxembourg

- SIREO IMMOBILIENFONDS NO. 5 SICAV – FIS, 4A, rue Albert Borschette, L-1246 Luxembourg

- UNIVERSAL POWER S.C.S. SICAV-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

4) SICARs:

- PARTHENOS S.A. SICAR, 19, rue Eugène Ruppert, L-2453 Luxembourg

- SEE CAR PARK INVESTORS SCA, SICAR, 5, rue Guillaume, L-1882 Luxembourg

- WINVEST INTERNATIONAL S.A. SICAR, 5, rue Pierre d’Aspelt, L-1142 Luxembourg

1 Before 31 December 2016, the statistical data of SICARs were only published on an annual basis.