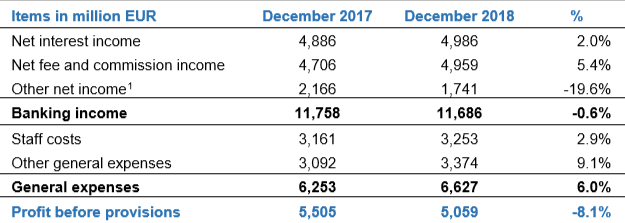

Profit and loss account of credit institutions as at 31 December 2018

Press release 19/15

The CSSF estimates profit before provisions of the Luxembourg banking sector at EUR 5,059 million at the end of 2018. Compared to the previous year, profit before provisions dropped thus by 8.1%.

Net interest income grew by 2.0%. The two main factors explaining this rise were the growth in business volume as measured by the balance sheet total and a better average return on assets. For a limited number of banks, the application of negative interest rates on deposits collected from their institutional customers also contributed to an improvement of their net interest income. However, only 56% of banks of the financial centre recorded an upward trend of net interest income. Overall, the persistently low levels of interest rates continue to be a real challenge for the banking sector.

The increase in net fee and commission income (+5.4%) was observed for 56% of the banks. It is largely attributable to the positive development of the activities related to asset management on behalf of private and institutional customers.

Other net income declined (-19.6%) as compared to the same period last year. Due to its composition, this item exhibits high volatility and its development is often only linked to non-recurring factors affecting a limited number of banks. Compared to the previous year, the decrease results, among others, from accounting reclassifications of commissions to the item “other net income” as well as from the negative development of gains in the different securities portfolios.

General expenses continued to grow (+6.0%) throughout 2018. This rise is linked to other general expenses (+9.1%) as well as to staff costs (+2.9%). The sustained increase of general expenses was the main reason for the negative development of profit before provisions. Consequently, the banks’ profitability deteriorated as evidenced by the costto-income ratio which rose from 53% in 2017 to 57% at the end of 2018.

Profit and loss account as at 31 December 2018

1 Including dividends received.