Profit and loss account of credit institutions as at 30 June 2019

Press release 19/46

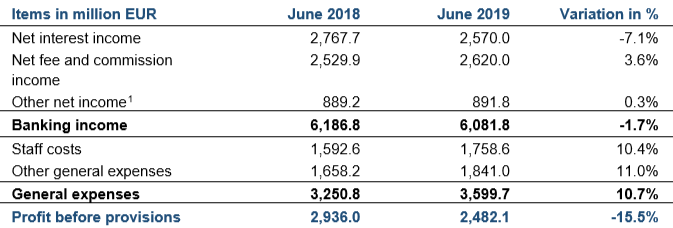

Profit before provisions of the Luxembourg banking sector amounts to EUR 2,482.1 million for the first half of 2019, a decrease of 15.5% compared to the same period of the previous year.

As regards income, net interest income fell by 7.1%. This fall is mainly due to the credit portfolio restructuring of one bank of the financial centre. Half of the credit institutions recorded a growing net interest income resulting from an increased business volume and an improved average return on assets. Net fee and commission income rose by 3.6%, reflecting the positive development of asset management and asset keeping activities. Only one third of the banks recorded an increase in their net fee and commission income, in particular institutions whose activity substantially grew due to Brexit.

General expenses continued their steep rise (+10.7%). This rise concerns other general expenses (+11.0%) as well as staff costs (+10.4%). The extent of the increase of general expenses is linked to the mobilisation of human and technical means necessary to manage, in Luxembourg, the banking activities transferred in view of the Brexit. The above-mentioned developments result in a deterioration of the cost-to-income ratio which moved from 53% to 59% at the end of the first half of 2019. This negative trend shows the difficulty of banks to maintain their profitability.

Profit and loss account as at 30 June 2019

1 Including dividends received.