Global situation of undertakings for collective investment at the end of November 2019

Press release 20/01

I. Overall situation

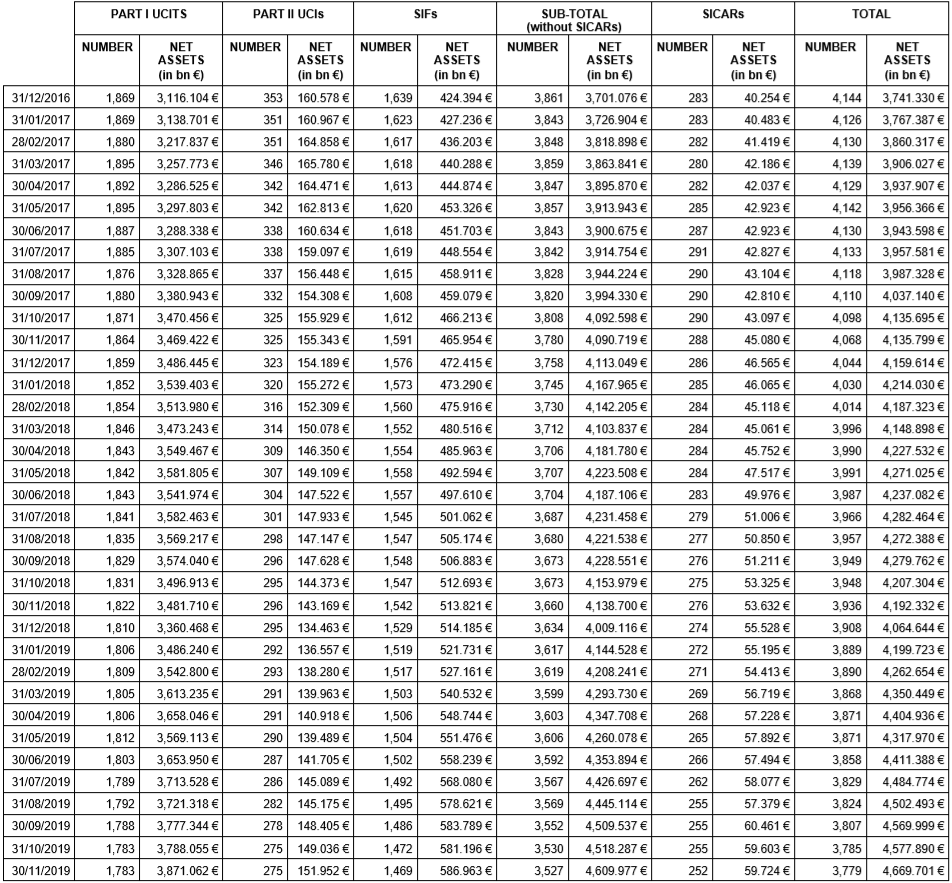

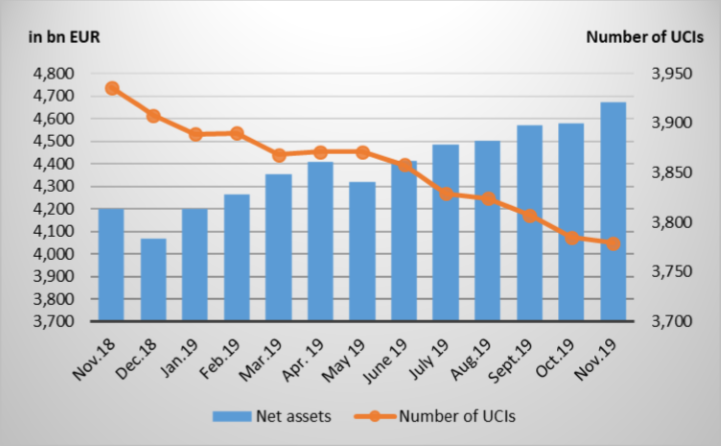

As at 30 November 2019, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,669.701 billion compared to EUR 4,577.890 billion as at 31 October 2019, i.e. a 2.01% increase over one month. Over the last twelve months, the volume of net assets rose by 11.39%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 91.811 billion in November. This increase represents the sum of positive net issues amounting to EUR 20.985 billion (+0.46%) and of a positive development in financial markets amounting to EUR 70.826 billion (+1.55%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,779 as against 3,785 in the previous month. A total of 2,476 entities adopted an umbrella structure, which represented 13,524 sub-funds. When adding the 1,303 entities with a traditional structure to that figure, a total of 14,827 fund units were active in the financial centre.

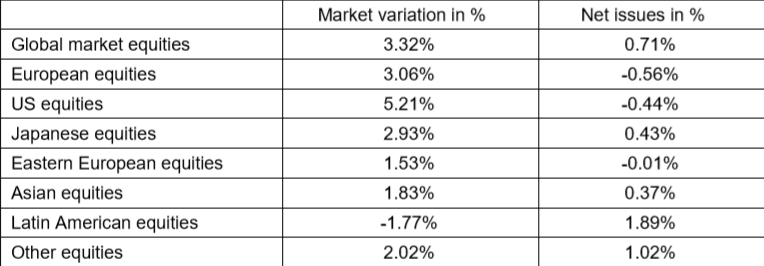

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about November.

Investors’ expectations for a Sino-American trade deal dominated financial markets, contributing to an upward trend in most equity markets.

In developed countries, the European equity UCI category showed a positive performance in a context of stabilising macroeconomic figures in Europe, expectation for an impending agreement in trade negotiations between China and the United States and the perspective of the renunciation of additional customs duties on European cars exported to the US. US equity UCIs also recorded positive figures, mainly due to corporate results exceeding expectations, progress made in the Sino-American trade negotiations and the USD vs. EUR appreciation. Despite mitigated macroeonomic figures in Japan, the Japanese equity UCI category recorded a positive development as trade tensions were appeasing.

As far as emerging countries are concerned, Asian equity UCIs experienced overall price increases, mainly due to the progress made in the trade negotiations between China and the US, despite geopolitical issues in the region. Favorable macroeconomic data in Russia and the RUB vs. EUR appreciation fostered the upward trend of the Eastern European equity UCIs. The negative performance of Latin American equity UCIs can be explained through the political issues that certain Latin American countries are facing, mitigated macroeconomic data and the depreciation of the main South-American currencies.

In November, the category of variable-yield UCIs registered an overall positive net capital investment.

Development of equity UCIs during the month of November 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

* Variation in % of Net Assets in EUR as compared to the previous month

As far as bond markets in developed countries are concerned, government bond yields on both sides of the Atlantic increased mainly as a consequence of a renewed investor appetite for riskier assets in a context marked by appeasing Sino-American trade tensions and continuing accommodating monetary policies. The yields of European corporate bonds followed that upward trend, entailing price losses for EUR-denominated bond UCIs. The overall negative performance of USD-denominated bonds was more than offset by the USD vs. EUR appreciation so that the category of USD-denominated bond UCIs ended the month under review up.

Emerging countries bond UCIs recorded slight changes during the month under review, as a consequence of, on the one hand, the progress made in the trade negotiations between China and the US and, on the other hand, the political issues in certain emerging countries.

In November, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of November 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

* Variation in % of Net Assets in EUR as compared to the previous month

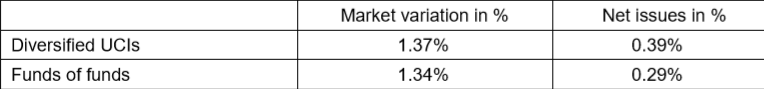

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of November 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following 11 undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- BLUEBALANCE UCITS, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- FAM PRÄMIENSTRATEGIE, 15, rue de Flaxweiler, L-6776 Grevenmacher

- M&G (LUX) INVESTMENT FUNDS FCP, 16, boulevard Royal, L-2449 Luxembourg

2) UCIs Part II 2010 Law:

- LORD ABBETT GLOBAL FUNDS II, 80, route d’Esch, L-1470 Luxembourg

3) SIFs:

- AI-VAESH-FONDS FCP-FIS, 15, rue de Flaxweiler, L-6776 Grevenmacher

- ALLIANZ ALLVEST INVEST SICAV-SIF, 10-12, boulevard F-D Roosevelt, L-2450 Luxembourg

- AXA RESIDENTIAL EUROPE FUND S.C.A., SICAV-SIF, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- GENERALI CORE+ FUND, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- SLIC INFRA EV S.A., SICAF-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

- SLIC INFRA KV S.A., SICAF-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

- TAUNUS TRUST VERMÖGENSFONDS FCP FIS, 4, rue Thomas Edison, L-1445 Strassen

4) SICARs:

- –

The following 17 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- AC, 5, Heienhaff, L-1736 Senningerberg

- SINCRO SICAV, 44, rue de la Vallée, L-2661 Luxembourg

- VB HEILBRONN VERMÖGENSMANDAT, 4, rue Thomas Edison, L-1445 Strassen

2) UCIs Part II 2010 Law:

- GLOBAL FAMILY STRATEGY I, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

3) SIFs

- ACCESSION FUND, 80, route d’Esch, L-1470 Luxembourg

- AIF FOCUS LUX, 2c, rue Albert Borschette, L-1246 Luxembourg

- AIS DIRECT INVESTMENT FUND, 42, rue de la Vallée, L-2661 Luxembourg

- AQUILA FARMS S.A., 5, Heienhaff, L-1736 Senningerberg

- ASYMMETRIC, 11-13, boulevard de la Foire, L-1528 Luxembourg

- ICBC PRIVATE BANKING GLOBAL INVESTMENT FUND SERIES SICAV-SIF, 80, route d’Esch, L-1470 Luxembourg

- MIBL AB US INVESTMENT GRADE CORPORATE BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- MUGC/NE U.S. INVESTMENT GRADE CORPORATE BOND FUND, 287-289, route d’Arlon, L-1150 Luxembourg

- TJ CAPITAL FUND SICAV-SIF, 11, rue Aldringen, L-1118 Luxembourg • VIVACE SICAV SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

4) SICARs:

- C-QUADRAT ALTERNATIVE INVESTMENTS, SICAR, 60, avenue J. F. Kennedy, L-1855 Luxembourg

- FIELD SICAR S.C.A., 24, rue Robert Krieps, L-4702 Pétange

- PRAX CAPITAL CHINA REAL ESTATE FUND III, S.C.A., SICAR, 6A, rue Gabriel Lippmann, L-5365 Munsbach