Global situation of undertakings for collective investment at the end of December 2019

Press release 20/04

I. Overall situation

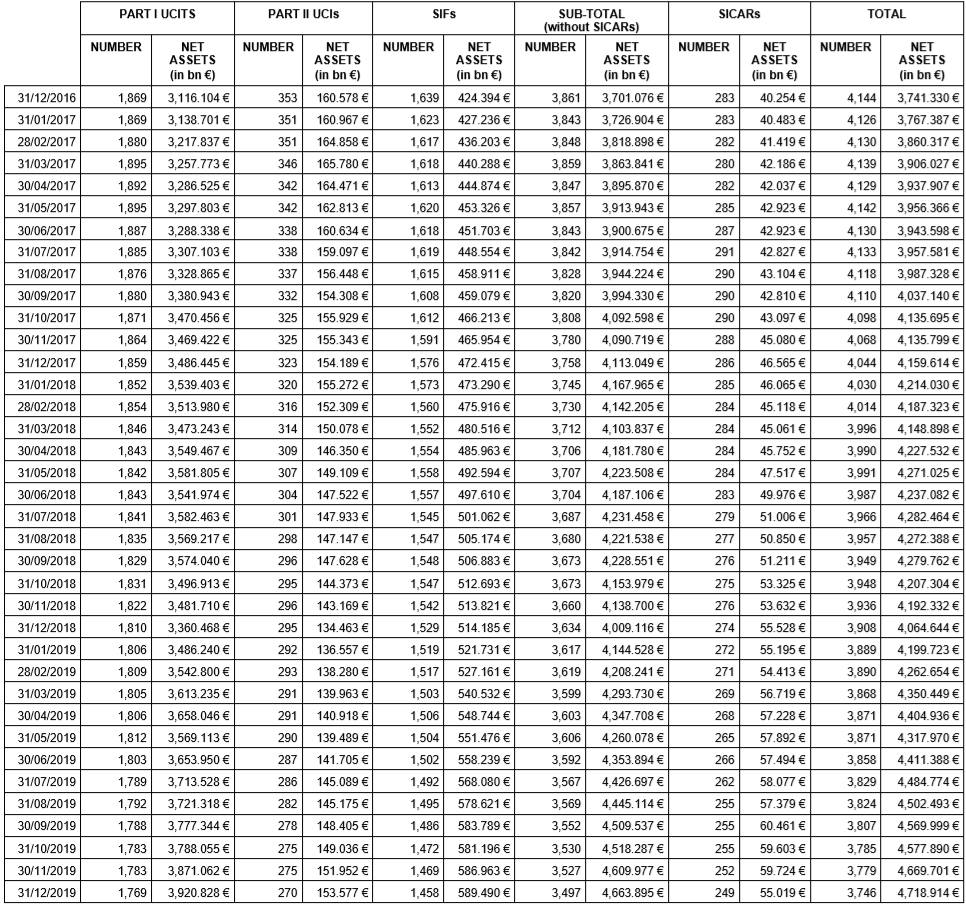

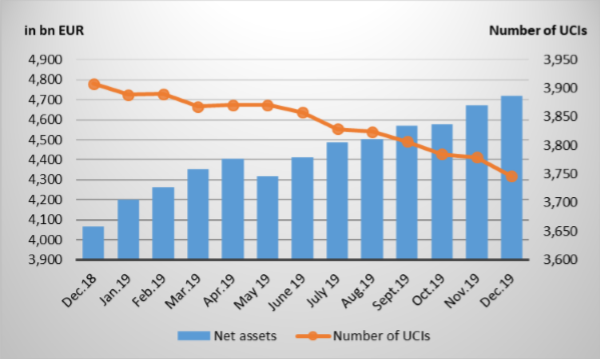

As at 31 December 2019, total net assets of undertakings for collective investment, including UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,718.914 billion compared to EUR 4,669.701 billion as at 30 November 2019, i.e. a 1.05% increase over one month. Over the last twelve months, the volume of net assets rose by 16.10%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 49.213 billion in December. This increase represents the sum of positive net issues amounting to EUR 27.212 billion (+0.58%) and of a positive development in financial markets amounting to EUR 22.001 billion (+0.47%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,746 as against 3,779 in the previous month. A total of 2,452 entities adopted an umbrella structure, which represented 13,514 sub-funds. When adding the 1,294 entities with a traditional structure to that figure, a total of 14,808 fund units were active in the financial centre.

As regards, on the one hand, the impact of financial markets on the main categories of undertakings for collective investment and, on the other hand, the net capital investment in these UCIs, the following can be said about December.

The preliminary trade agreement reached between the United States and China dominated the financial markets in December, driving all equity UCI categories upwards.

As far as developed countries are concerned, this preliminary trade agreement and the strong likelihood of a Brexit with a withdrawal agreement following the elections in the UK have driven the rise in European equity UCIs, despite weak macroeconomic figures in Europe. The agreement in principle resulting from the Sino-American trade negotiations explains the price increases in the US equity UCI category, which were greatly offset by the depreciation of the USD vs. the EUR. Despite mitigated macroeconomic figures in Japan, the Japanese equity UCI category also recorded a positive performance mainly linked to the economic measures announced by the Japanese government and the appeased Sino-American trade tensions. As far as emerging countries are concerned, Asian equity UCIs experienced overall price increases, mainly due to the progress made in the trade negotiations between China and the US and the better-than-expected economic indicators in China. The preliminary trade agreement between China and the US, the oil production reduction announced by OPEC and the appreciation of the RUB against the EUR supported an overall upward trend in the Eastern European equity UCI category, despite heterogeneous developments in the Eastern European stock markets. The sound performance of Latin American equity UCIs can be explained by the positive development of certain South-American stock markets, more accommodating monetary policies and the new free trade agreement between the US, Canada and Mexico (USMCA).

In December, the equity UCI categories registered an overall positive net capital investment.

Development of equity UCIs during the month of December 2019*

* Variation in % of Net Assets in EUR as compared to the previous month

* Variation in % of Net Assets in EUR as compared to the previous month

In Europe, a renewed risk appetite in a context marked by the preliminary trade agreement concluded between the US and China, the lower political risk linked to Brexit following the UK elections and the continuation of an accommodating monetary policy brought along an increase in government bond yields. The yields of high-rated European corporate bonds remained relatively stable during the month under review, implying a price decrease for the EUR-denominated UCI bond category.

In the US, the rising risk appetite that followed the appeasement of trade tensions between China and the US resulted in an increase in long-term government bond yields, whereas US corporate bond yields decreased. However, the depreciation of the USD vs. the EUR negatively impacted the USD-denominated bond UCIs.

Emerging market bond UCIs recorded a positive performance due to a regaining risk appetite, the stabilisation of political issues in certain emerging countries and the risk premium reduction on emerging market bonds.

In December, the category of fixed-income UCIs registered an overall positive net capital investment.

Development of fixed-income UCIs during the month of December 2019*

* Variation in % of Net Assets in EUR as compared to the previous month.

* Variation in % of Net Assets in EUR as compared to the previous month.

The development of net assets of diversified Luxembourg UCIs and of funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of December 2019*

* Variation in % of Net Assets in EUR as compared to the previous month.

* Variation in % of Net Assets in EUR as compared to the previous month.

II. Breakdown of the number and net assets of UCIs

During the month under review, the following nine undertakings for collective investment have been registered on the official list:

1) UCITS Part I 2010 Law:

- WELLINGTON MANAGEMENT FUNDS (LUXEMBOURG) III SICAV, 33, avenue de la Liberté, L-1931 Luxembourg

2) UCIs Part II 2010 Law:

- –

3) SIFs:

- AVIVA INVESTORS GLOBAL, 2, rue du Fort Bourbon, L-1249 Luxembourg

- BLACKROCK EUROZONE CORE PROPERTY FUND S.C.SP. SICAV-SIF, 20, rue de la Poste, L-2346 Luxembourg

- CLEARSIGHT TURNAROUND FUND V (SCA) SICAV-SIF, 412F, route d’Esch, L-2086 Luxembourg

- MIRABAUD PRIVATE CAPITAL S.C.A. SICAV-SIF, 15, avenue J-F Kennedy, L-1855 Luxembourg

- NORDIC SME DEBT ELTIF I, 6B, route de Trèves, L-2633 Senningerberg

- RESIDYS FEEDER SCS SIF, 5, allée Scheffer, L-2520 Luxembourg

- SUSTAINABLE GROWTH FUND II, SCSP, SICAV-SIF, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

4) SICARs:

- ARCANO SPANISH VALUE ADDED REAL ESTATE II S.C.A., SICAR, 11-13, Boulevard de la Foire, L-1528 Luxembourg

The following 42 undertakings for collective investment have been deregistered from the official list during the month under review:

1) UCITS Part I 2010 Law:

- ALLIANZ GLOBAL INVESTORS FUND III, Bockenheimer Landstraße 42-44, D-60232 Frankfurt am Main(1)

- F&C FUND, 49, avenue J-F Kennedy, L-1855 Luxembourg

- IPM UMBRELLA FUND, 6, rue Lou Hemmer, L-1748 Findel

- KB STAR FUNDS, 6B, route de Trèves, L-2633 Senningerberg

- LC (LUX), 1C, rue Gabriel Lippmann, L-5365 Munsbach

- MELLINCKRODT 2 SICAV, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- NORDEA FUND OF FUNDS, 562, rue de Neudorf, L-2220 Luxembourg

- NORDEA MARKETS ETF, 11-13, boulevard de la Foire, L-1528 Luxembourg

- ÖKOWORLD SICAV NEW ENERGY FUND, 44, Esplanade de la Moselle, L-6637 Wasserbillig

- SEB DELUXE, 4, rue Peternelchen, L-2370 Howald

- UNIINSTITUTIONAL EURO CORPORATE BONDS 2019, 308, route d’Esch, L-1471 Luxembourg

- UNIKONZEPT: DIVIDENDEN, 308, route d’Esch, L-1471 Luxembourg

- UNIKONZEPT: PORTFOLIO, 308, route d’Esch, L-1471 Luxembourg

- VAHOCA FOCUS FUND, 12, rue Eugène Ruppert, L-2453 Luxembourg

- WORLDWIDE INVESTORS PORTFOLIO, 1c, rue Gabriel Lippmann, L-5365 Munsbach

2) UCIs Part II 2010 Law:

- ATCM II, 33, rue de Gasperich, L-5826 Hesperange

- BLACKPOINT, 5, allée Scheffer, L-2520 Luxembourg

- NEMROD DIVERSIFIED, 5, allée Scheffer, L-2520 Luxembourg

- SEF SICAV PART II, 65, boulevard Grande-Duchesse Charlotte, L-1331 Luxembourg

- T. ROWE PRICE LIFE PLAN INCOME FUND, 6, route de Trèves, L-2633 Senningerberg

3) SIFs

- AIPP ASIA, 35A, avenue J-F Kennedy, L-1855 Luxembourg

- ALLIANCEBERNSTEIN CHINA INVESTMENTS, 2-4, rue Eugène Ruppert, L-2453 Luxembourg

- BAMBOO FINANCIAL INCLUSION FUND S.C.A., SICAV-FIS, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- CENTENNIAL ARBITRAGE S.A. SICAV-SIF, 11, rue Aldringen, L-1118 Luxembourg

- DMS PLATFORM SICAV-SIF, 2, rue d’Alsace, L-1122 Luxembourg

- EFFICIENCY ALTERNATIVE FUND SICAV-FIS, 5, allée Scheffer, L-2520 Luxembourg

- FALCON CROWN PORTFOLIO UMBRELLA, 2, rue Gabriel Lippmann, L-5365 Munsbach

- GENERALI EUROPEAN REAL ESTATE INVESTMENTS S.A., 4, rue Jean Monnet, L-2180 Luxembourg

- GENERATION IM CREDIT MASTER FUND, 47, avenue J-F Kennedy, L-1855 Luxembourg

- KIRCHBERG SECURITIES FINANCE FUND, SICAV-SIF, 6B, route de Trèves, L-2633 Senningerberg

- LFP PRIME SICAV-SIF S.A., 16, rue Jean-Pierre Brasseur, L-1258 Luxembourg

- LICANCABUR INVESTMENT FUND S.A., SICAV-SIF, 58, rue Charles Martel, L-2134 Luxembourg

- M & T, 6, rue Gabriel Lippmann, L-5365 Munsbach

- MALUBI INVESTMENT FUND S.A., SICAV-SIF, 58, rue Charles Martel, L-2134 Luxembourg

(1) Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.