Profit and loss account of credit institutions as at 31 December 2019

Press release 20/11

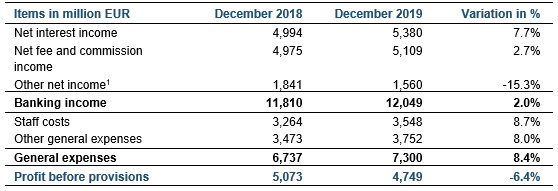

Profit before provisions of the Luxembourg banking sector amounted to EUR 4,748.6 million as at 31 December 2019, a decrease of 6.4% compared to the previous year.

As regards income, net interest income increased by 7.7% compared to 2018. A majority of the credit institutions recorded a growing net interest income resulting from an increased business volume and an improved average return rate on assets. More than half of the banks now apply negative interest rates on the deposits collected from financial institutional clients.

Net fee and commission income rose by 2.7% over a year, mainly reflecting the positive development of depositary banks of investment funds as well as, for a limited number of banks, the transfer of business to Luxembourg due to Brexit.

The development of other net income continued to be marked by a strong volatility dominated by non-recurring results for a very limited number of banks. The main reasons for the decline recorded by this item in 2019 were, in order of importance, the decrease of realised gains in securities portfolios and the decrease of dividends received.

As for expenses, two thirds of the banks saw an increase in their general expenses over a year. However, the extent of this increase (+8.4%) is mostly related to the mobilisation of human and technical means necessary to manage the banking activities transferred to some credit institutions in Luxembourg in view of Brexit. This rise concerns other general expenses (+8.0%) as well as staff costs (+8.7%). Excluding the Brexit effect, the total amount of general expenses would show a slight decrease, considering the decline in the number of banks to 125 entities as at 31 December 2019.

The above-mentioned developments resulted in a deterioration of the cost-to-income ratio which moved from 57% to 61% at the end of 2019.

Profit and loss account as at 31 December 2019

1 Including dividends received.