Profit and loss account of credit institutions as at 31 March 2020

Press release 20/15

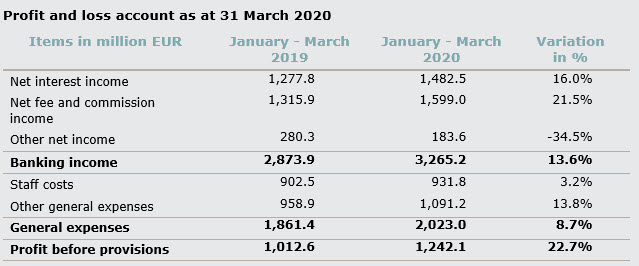

The CSSF estimates profit before provisions of the Luxembourg banking sector at EUR 1,242.1 million for the first quarter of 2020. Compared to the previous year, profit before provisions recorded a significant increase by 22.7%.

The growth of the operating profit before provisions and taxes needs to be put into perspective given the expected increase in value adjustments on credit portfolios for the coming months as a consequence of the health crisis.

In the first quarter of 2020, net interest income recorded an increase by 16% compared to the same period in 2019. This rise was primarily due to the growth of the aggregated balance sheet, part of which was linked to the Brexit. As for net fee and commission income, the increase reached 21.5%. Even though the value of the assets deposited with banks recorded a sharp fall in February and March 2020, it remained – on average, for the first three months of the year – higher than the average amount of assets deposited during the first quarter of 2019. As a result, asset safekeeping fees increased year-on-year. Moreover, market volatility generated more transactions and, consequently, higher fee and commission income. Other net income registered a sharp drop in relative terms (-34.5%) due to the decrease in value of the securities portfolios of some banks.

General expenses continued their steep rise (+8.7%), mainly as a consequence of the increase of other general expenses (+13.8%). Part of this increase was linked to the Brexit and the relocation of operational structures in Luxembourg.