Profit and loss account of credit institutions as at 30 June 2020

Press release 20/20

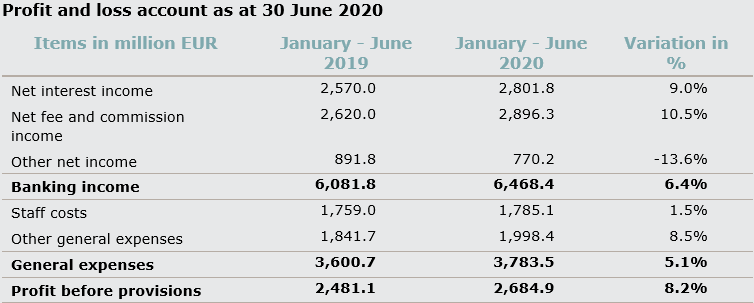

Profit before provisions of the Luxembourg banking sector amounts to EUR 2,684.9 million for the first half of 2020, i.e. an increase of 8.2% compared to the same period of the previous year.

The net result for 2020 will depend on the extent of the provisions for credit risk made as a result of the COVID-19 pandemic.

In the first half of 2020, net interest income recorded an increase by 9.0% compared to the same period of 2019. This increase is the result of, on the one hand, the growth of the aggregated balance sheet and, on the other hand, the reduction of refinancing costs. As for net fee and commission income, the increase reached 10.5%. The average amount of assets deposited in the first half year rose compared to the same period of 2019. As a result, asset safekeeping fees increased year-on-year. Moreover, market volatility generated more transactions and, consequently, higher fee and commission income. The development of other net income continued to be marked by a strong volatility dominated by non-recurring results for a limited number of banks.

General expenses continued to rise (+5.1%), mainly as a consequence of the increase of other general expenses (+8.5%). Part of this increase was linked to the Brexit and the relocation of operational structures in Luxembourg.