Profit and loss account of credit institutions as at 31 December 2020

Press release 21/08

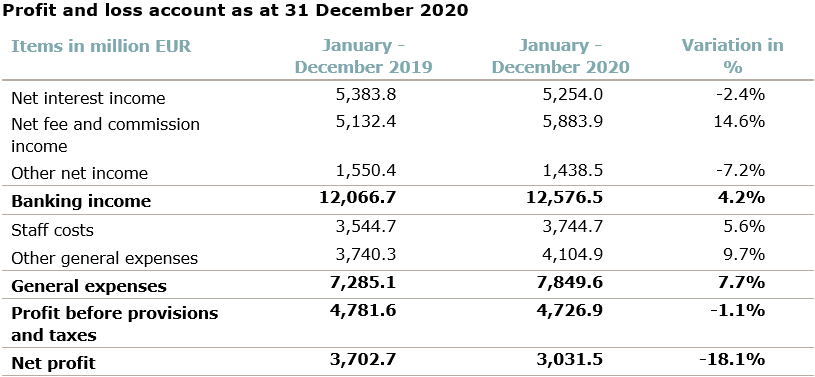

Profit before provisions and taxes of the Luxembourg banking sector1 amounted to EUR 4,726.9 million in 2020, a decrease of 1.1% compared to 2019.

In 2020, net interest income registered a decrease of 2.4% year-on-year. This decrease was mainly due to the decline of interbank lending margins.

Net fee and commission income increased by 14.6% over a year. The extent of this increase resulted from variations in the scope of data collection and aggregation due to intra-group reorganisations, including the integration of new foreign branches. Excluding these effects, the rise in net fee and commission income would amount to 5%. The increase concerned more specifically banks providing wealth management services. Indeed, the increase in the average amount of deposited assets and the high volatility in the markets in 2020 led to a rise in the commissions on custody of assets and on securities transactions of clients.

General expenses (+7.7%) continued their upward trend in most banks. However, this increase was greatly impacted by the above-mentioned intra-group reorganisations.

Accordingly, the above-mentioned developments resulted in a deterioration of the cost-to-income ratio which moved from 60% to 62% at the end of 2020.

The net result for 2020 dropped by 18.1% given the increase in the allocations to provision amounting to EUR 600 million. These provisions mainly related to credit risk in the context of the COVID-19 pandemic and largely affected universal banks and banks specialised in corporate financing. Although this ratio of non-performing loans did not significantly increase in 2020, the application of IFRS 9 led the banks to consider also performing loan provisions.

1 Comprising banks active at the closing date, including their branches.