Global situation of undertakings for collective investment at the end of September 2021

Press release 21/27

I. Overall situation

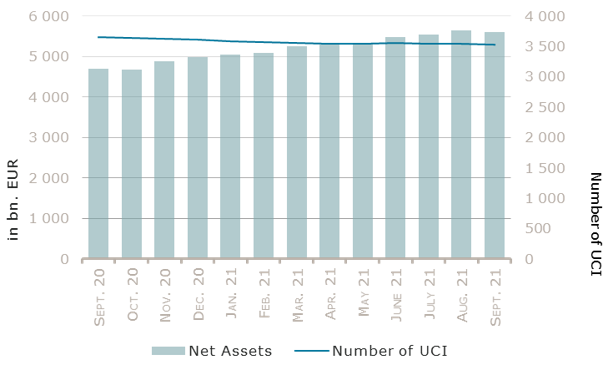

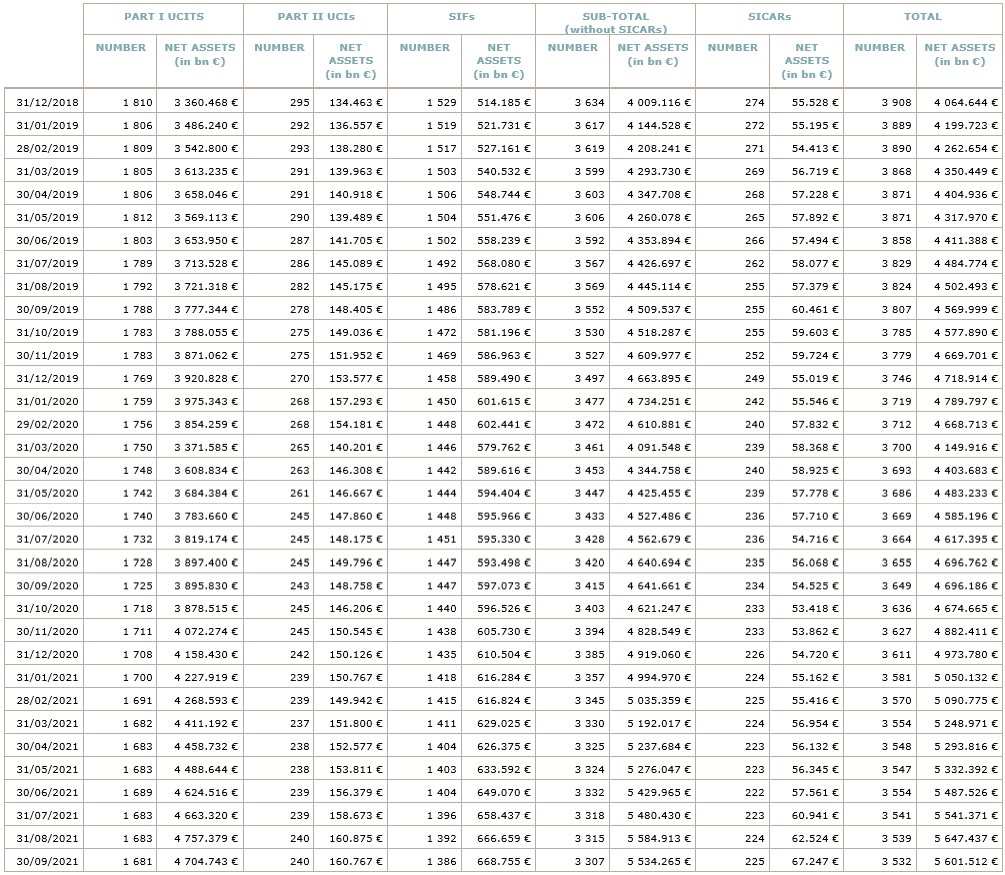

As at 30 September 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,601.512 billion compared to EUR 5,647.437 billion as at 31 August 2021, i.e. a decrease of 0.81% over one month. Over the last twelve months, the volume of net assets rose by 19.28%.

The Luxembourg UCI industry thus registered a negative variation amounting to EUR 45.925 billion in September. This decrease represents the sum of positive net capital investments of EUR 11.262 billion (+0.20%) and of the negative development of financial markets amounting to EUR 57.187 billion (-1.01%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,532, against 3,539 the previous month. A total of 2,321 entities adopted an umbrella structure representing 13,263 sub-funds. Adding the 1,211 entities with a traditional UCI structure to that figure, a total of 14,474 fund units were active in the financial centre.

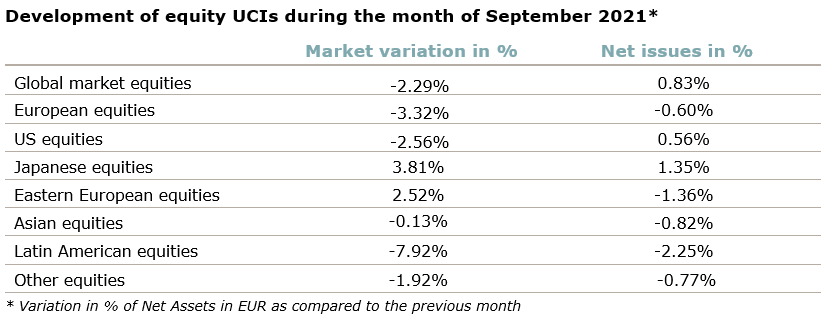

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of September:

With regard to developed markets, the European equity UCI category registered a negative performance amid declining leading economic indicators, continuing supply chain bottlenecks and a higher inflation, this despite the beginning of the NGEU (Next Generation EU) transfers and the continuation of the accommodative monetary policy by the European Central Bank (ECB). The deceleration of the US growth, supply chain problems, a persistent sharp increase of inflation and the announcement of a possible tapering by the Federal Reserve (FED) weighted on US equity markets, causing the US equity UCI category, notwithstanding a strong appreciation of the USD against the EUR, to end the month with a loss. Expectations of a political change in Japan in the near future supported the Japanese equity UCI category.

In the emerging countries, the Asian equity UCI category, despite divergent developments across the region, registered an overall negative performance, mainly driven by a weaker growth in China, policy tightening and more stringent regulation in some economic sectors in China as well as the debt problems faced by the property developer Evergrande. For the Eastern European equity UCI category, the overall positive performance is mainly driven by the Russian equity market benefiting from higher energy prices. Political uncertainties in some countries such as Brazil and falling metal prices mainly explain the negative performance of the Latin American equity UCI category.

In September, the equity UCI categories registered an overall positive net capital investment, mainly driven by inflows in the Global market equity UCI category.

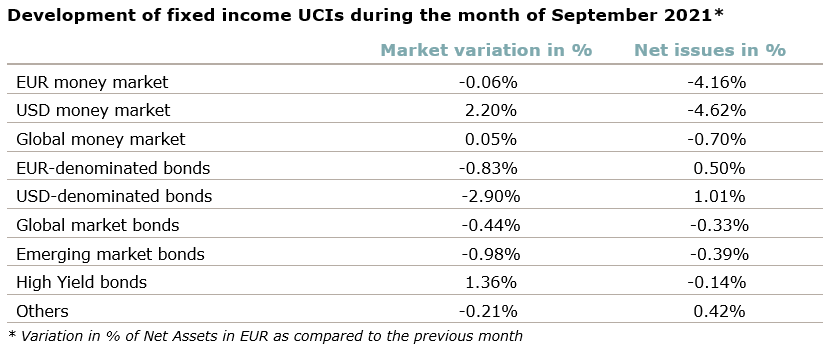

On both sides of the Atlantic, concerns around higher inflation caused long-term government bond yields to increase in September (i.e. bond prices increased).

The EUR denominated bond UCI category closed in negative territory amid rising yields on highly rated EUR denominated bonds. Considering the increase in inflation in Europe as a temporary movement, the ECB announced continuing its accommodative monetary policy for avoiding a tightening of financial conditions.

Highly rated USD denominated bonds, against the background of the sharp rise in inflation in the United States, also registered rising yields. As a result, the FED signaled a possible beginning of its tapering program in a short-term future. On the budgetary side, the Congress is still looking for a solution to avoid a shutdown. Spreads of investment grade corporate bonds were not significantly impacted by economic developments in September. Overall, despite a significant appreciation of the USD against the EUR, the USD denominated bond UCI category realised a negative performance.

The Emerging market bond UCI category ended the month with a negative performance in a context of rising US yields, interest rate hikes decided by several emerging market central banks and divergent developments of emerging market currencies.

In September, fixed income UCI categories registered an overall negative net capital investment, the USD money market UCI category recording the highest outflows.

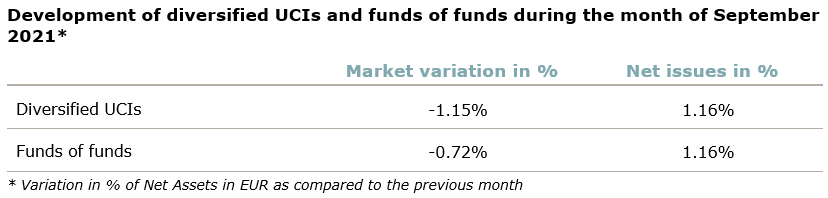

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following thirteen undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- CS GESTIÓN INTERNATIONAL FUND, 5, rue Jean Monnet, L-2180 Luxembourg

- FLOSSBACH VON STORCH IV, 2, rue Jean Monnet, L-2180 Luxembourg

- FUND CHANNEL INVESTMENT PARTNERS, 5, allée Scheffer, L-2520 Luxembourg

- MONEY MATE DEFENSIV, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- MONEY MATE ENTSCHLOSSEN, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- MONEY MATE MODERAT, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- MONEY MATE MUTIG, Bockenheimer Landstraße 42-44, 60323 Frankfurt am Main1

- UNITHEMEN DEFENSIV, 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- PICTET REAL ESTATE CAPITAL ELEVATION CORE PLUS ELTIF SICAV, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

SIFs:

- MK VENTURE DECENNIUM OPPORTUNITIES FUND SCA, SICAV-FIS, 1c, rue Gabriel Lippmann, L-5365 Munsbach

- SPF EUROPE SICAV-SIF, 12E, rue Guillaume Kroll, L-1882 Luxembourg

- SWISS LIFE ESG HEALTH CARE GERMANY V FEEDER S.C.A., SICAV-SIF, 4A, rue Albert Borschette, L-1246 Luxembourg

SICARs:

- CRSEF PARTICIPATIONS S.À R.L., SICAR, 2, avenue Charles de Gaulle, 4th floor, L-1653 Luxembourg

The following twenty undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- CIKK FUND, 6C, route de Trèves, L-2633 Senningerberg

- DEKA-EUROSTOCKS, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- FULCRUM FUNDS, 4, rue Robert Stumper, L-2557 Luxembourg

- GOODHART PARTNERS HORIZON FUND, 106, route d’Arlon, L-8210 Mamer

- H & A LUX RIAITO, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- KEEL CAPITAL SICAV-UCITS, 3, rue Gabriel Lippmann, L-5365 Munsbach

- SEB TRENDSYSTEM RENTEN, 4, rue Peternelchen, L-2370 Howald

- SOTHA, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- TRA UCITS FUND, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- WALLBERG STRATEGIE, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

UCIs Part II 2010 Law:

- AMBD SICAV, 287, route d’Arlon, L-1150 Luxembourg

SIFs:

- CATELLA WINNING REGIONS EUROPE SCA SICAV-SIF, 17, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- G.A.-FUND-L, 60, avenue J-F Kennedy, L-1855 Luxembourg

- JUBELADE S.C.A., SICAV-FIS, 1B, rue Jean Piret, L-2350 Luxembourg

- LIAM RENTEN PROTECT 80, 22, boulevard Royal, L-2449 Luxembourg

- M GLOBAL SOLUTIONS, 5, rue Jean Monnet, L-2180 Luxembourg

- NIAM NORDIC CORE-PLUS, 80, route d’Esch, L-1470 Luxembourg

- PFA INVESTMENT FUND, 2, rue Jean Monnet, L-2180 Luxembourg

- THREE HILLS, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- UFG GLOBAL COMMERCIAL & HOSPITALITY REAL ESTATE FUND I S.A., SICAV-SIF, 1B, rue Jean Piret, L-2350 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.