The CSSF’s clarification with regards to an article by the Luxembourg Times on the recent ESMA Peer Review on the supervision of cross-border activities of investment firms

Press release 22/06

In view of the misleading information contained in this article and the medium’s refusal to make changes to it, the CSSF takes the view that it is in the public interest to provide clarification.

On 16 March 2022, the “Luxembourg Times” published a misleading article, under the headline “Failures in CSSF oversight of funds, EU watchdog finds”, on its website. This article refers to publication, on 10 March 2022, by the European Securities and Markets Authority (“ESMA”), the EU’s securities markets regulator, of its peer review report (the “Peer review”) on the supervision of cross-border activities of investment firms. Peer reviews are regularly organised by ESMA on different topics and this Peer review exercise assessed how national competent authorities supervise the investment services that investment firms and credit institutions provide to retail clients on a cross-border basis using a MiFID II passport. This Peer Review did not include investment funds in its scope, contrary to what the title of the article suggests.

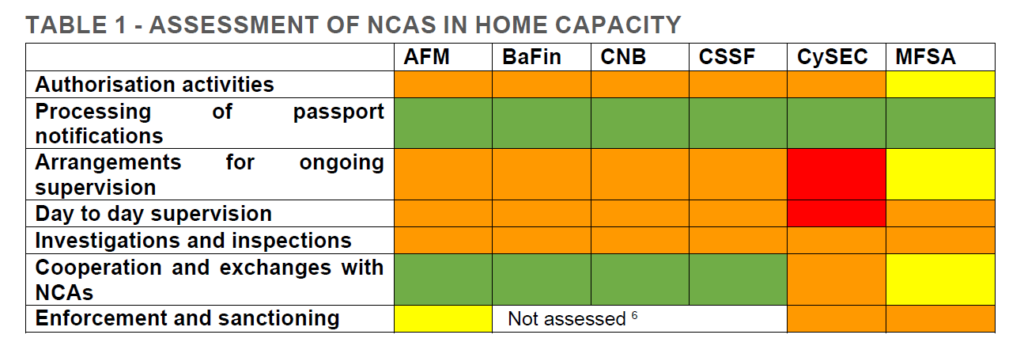

This Peer Review focused on all of the following authorities: AFM (Netherlands), BaFin (Germany), CNB (Czech Republic), CSSF (Luxembourg), CySEC (Cyprus) and MFSA (Malta), in light of the significance of their domestic firms’ cross-border activities. Even though ESMA identified the general need for competent authorities to improve their approach in the authorisation, ongoing supervision and enforcement work, relating to investment firms’ cross border activities, most of the peer review recommendations were addressed to all of the above-mentioned authorities. None of the recommendations were individually addressed to the CSSF. The CSSF has accepted the findings of the peer review.

It is also important to mention that ESMA identified that the CSSF has established adequate processes in relation to the passport notifications and – with some areas for improvements – in the context of cooperation. The CSSF was assessed as fully compliant for these topics.

Finally, it is particularly misleading, as done in the above-mentioned article published by the “Luxembourg Times”, to establish links between this Peer review (which did not cover investment funds) and the preliminary investigation by ESMA into the LFP1 fund. Based on allegations by a private party, ESMA had launched a preliminary investigation on potential breaches of EU law by the CSSF in its supervision of the fund. After a thorough investigation and “in-depth information gathering”, ESMA concluded in December 2021 that the CSSF had not failed to act in its continuous supervision of the fund and abstained from launching an official investigation into these alleged breaches. The fact that case had been dropped, was officially confirmed by ESMA to various media.

The Commission de Surveillance du Secteur Financier

The Commission de Surveillance du Secteur Financier (CSSF) is a public institution which supervises the professionals and products of the Luxembourg financial sector. It supervises, regulates, authorises, informs, and, where appropriate, carries out on-site inspections and issues sanctions. Moreover, it is in charge of promoting transparency, simplicity and fairness in the markets of financial products and services and is responsible for the enforcement of laws relating to financial consumer protection and the fight against money laundering and terrorist financing.

The CSSF carries out its prudential supervision and supervision of the markets in order to contribute to the solidity and stability of the financial sector exclusively in the public interest.

The CSSF is under the authority of the Ministry of Finance but has financial autonomy and autonomy of action as required by the highest international organisations. It has a total workforce of nearly 1,000 highly qualified agents.