Global situation of undertakings for collective investment at the end of July 2022

Press release 22/21

I. Overall situation

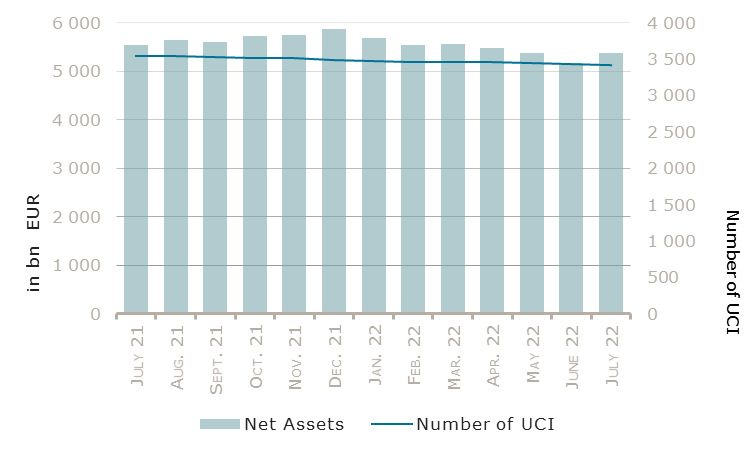

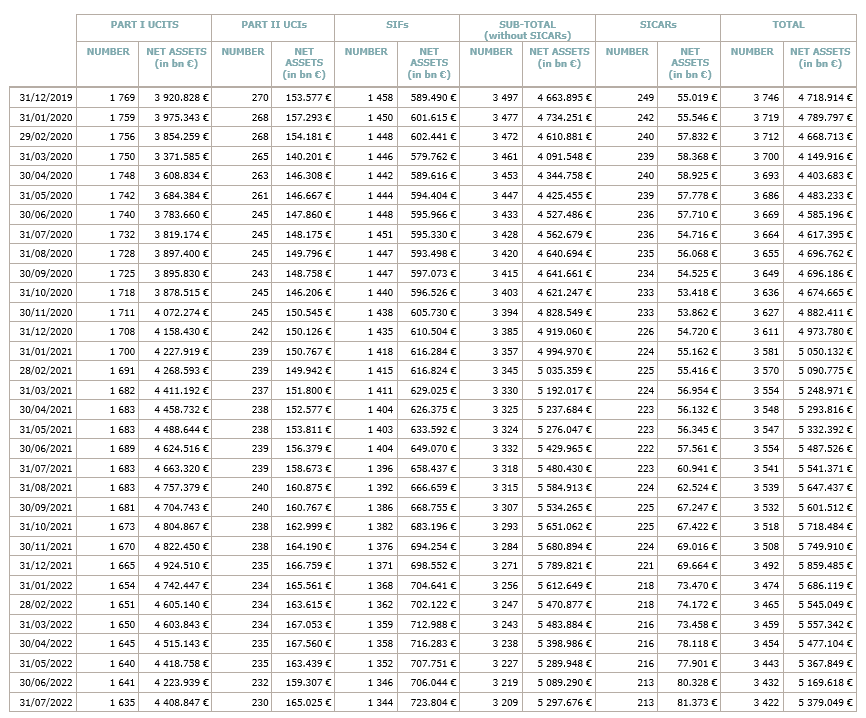

As at 31 July 2022, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,379.049 billion compared to EUR 5,169.618 billion as at 30 June 2022, i.e. an increase of 4.05% over one month. Over the last twelve months, the volume of net assets decreased by 2.93%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 209.431 billion in July. This increase represents the sum of negative net capital investments of EUR 21.009 billion (-0.41%) and of the positive development of financial markets amounting to EUR 230.440 billion (+4.46%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,422, against 3,432 the previous month. A total of 2,238 entities adopted an umbrella structure representing 13,170 sub-funds. Adding the 1,184 entities with a traditional UCI structure to that figure, a total of 14,354 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of July.

At a global level, the global macroeconomic context remained challenging, given inflation, monetary policy tightening, the Ukraine war, the recessionary fears and the strong dollar.

Concerning developed markets, the European equity UCI category gained in July despite the deterioration of market confidence indicators, the Ukraine crisis and the rise of recessionary fears in Europe. The US equity UCI category similarly registered a positive performance in July, despite a technical recession (two consecutive quarters of GDP decline) and the fall of confidence indicators. The good performance of European and US markets in July is partially related to the decreasing yields, with tech stocks and consumer cyclicals as best performers. The Japanese equity market also registered positive developments, due, among others, to the relative weakness of the yen.

As for emerging countries, the Asian equity UCI category is the only category with negative performance. While India, South Korea and Taiwan performed well, China was one of the worst performers due to economic activity slowdown, persistent weakness of real estate markets and ongoing COVID-19 lockdown measures. The Eastern European equity UCI category remained subdued due to persisting geopolitical tensions resulting from the Ukraine crisis as well as to high inflation. The Latin American equity UCI category registered a positive performance, mainly driven by Brazil, Chile and Peru.

In July, the equity UCI categories overall registered a negative net capital investment.

Development of equity UCIs during the month of July 2022*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

8.24% |

-0.90% |

| European equities |

7.74% |

-0.99% |

| US equities |

11.06% |

-0.13% |

| Japanese equities |

7.70% |

-0.09% |

| Eastern European equities |

0.81% |

-2.94% |

| Asian equities |

-1.44% |

0.05% |

| Latin American equities |

5.63% |

-2.74% |

| Other equities |

3.55% |

-0.64% |

* Variation in % of Net Assets in EUR as compared to the previous month

In context of high and still rising inflation and of relatively high uncertainty on future price developments, the ECB raised its interest rates by 50 basis points (its first rate hike in 11 years), shifted from forward guidance to a meeting-by-meeting approach to interest rate decisions and finally approved an anti-fragmentation tool, the Transmission Protection Instrument (TPI), which enables the ECB to purchase securities in case of unwarranted disorderly market dynamics. Despite this monetary policy tightening, the yields of the EUR denominated bond UCI category globally declined (i.e. bond prices rose) due to the Ukraine crisis, the related uncertainty surrounding the gas supply to Europe and more generally the rise of the recessionary risks.

Similarly to the EUR denominated bond category, the yields of the USD bond category declined (i.e. bond prices rose) given the economic activity slowdown and this despite the second consecutive 75 basis points increase of the interest rates by the Fed. An inversion of the yield curve, generally associated to recessionary dynamics, occurred in July.

The yields for the Emerging Market bond UCI category declined as well (i.e. bond prices rose) in line with EUR and USD bond categories, due to global economic slowdown. The credit spreads tightened, especially for high yield bonds and less so for investment grade ones.

In July, fixed income UCI categories registered an overall negative net capital investment.

Development of fixed income UCIs during the month of July 2022*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.03% |

3.67% |

| USD money market |

1.88% |

-2.90% |

| Global money market |

1.49% |

0.81% |

| EUR-denominated bonds |

3.86% |

0.41% |

| USD-denominated bonds |

3.26% |

1.04% |

| Global market bonds |

2.56% |

-0.26% |

| Emerging market bonds |

2.20% |

-1.93% |

| High Yield bonds |

5.02% |

-1.68% |

| Others |

5.01% |

-0.79% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of July 2022*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

4.10% |

-0.30% |

| Funds of funds |

3.14% |

1.42% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following four undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- BOERSE.DE-TECHNOLOGIEFONDS, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- DEVON EQUITY FUNDS SICAV, 6H, route de Trèves, L-2633 Senningerberg

SIFs:

- AEW EUROCORE SCS SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- PGIM REAL ESTATE PAN EUROPEAN REAL ESTATE FUND II, 20, rue de la Poste, L-2346 Luxembourg

The following fourteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- AKZENT INVEST FONDS 1 (LUX), 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- AXA IM CASH, 49, avenue J-F Kennedy, L-1855 Luxembourg

- DEGROOF INST., 12, rue Eugène Ruppert, L-2453 Luxembourg

- DEGROOF PETERCAM FRANCE SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

- DPAM BONDS L, 12, rue Eugène Ruppert, L-2453 Luxembourg

- DPAM EQUITIES L, 12, rue Eugène Ruppert, L-2453 Luxembourg

- GALLOWAY MASTER FUND, 106, route d’Arlon, L-8210 Mamer

- HAIG TREND, 1C, rue Gabriel Lippmann, L-5365 Munsbach

UCIs Part II 2010 Law:

- GLOBAL ARBITRAGE STRATEGIE, 15, rue de Flaxweiler, L-6776 Grevenmacher

- UNIALTERNATIV: PRIVATMARKT ELTIF A, 3, Heienhaff, L-1736 Senningerberg

SIFs:

- ALPHA PATRIMOINE FLAGSHIP FUND SICAV SIF, 25A, boulevard Royal, L-2449 Luxembourg

- CMB EVERGREEN SA, SICAV-SIF, 20, boulevard Royal, L-2449 Luxembourg

- EXOR FINANCIAL INVESTMENTS SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- GBF SICAV-SIF, 14, Porte de France, L-4360 Esch-sur-Alzette