Investment fund managers

Situation as at 30 September 2024

Introduction

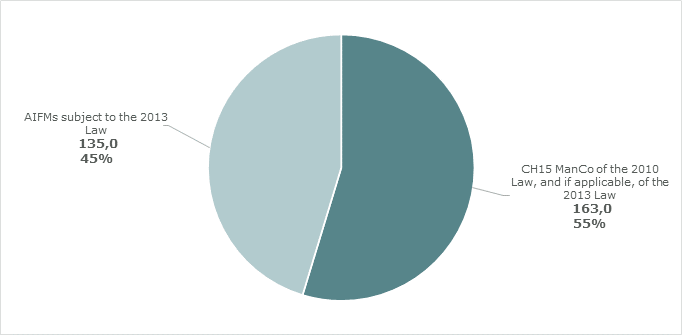

For all the charts presented in this document, authorised investment fund managers (authorised IFMs) comprise the following types of fund managers:

- management companies subject to Chapter 15 (CH15 ManCo) of the Law of 17 December 2010 relating to undertakings for collective investment (hereinafter 2010 Law);

- authorised alternative investment fund managers (AIFMs) subject to the Law of 12 July 2013 on alternative investment fund managers (hereinafter 2013 Law).

The caption other investment fund managers (other IFMs) are composed of:

- registered investment fund managers (registered IFMs);

- management companies subject to Article 125-1 of Chapter 16 of the 2010 Law;

- self-managed UCITS investment companies (SIAGs);

- internally-managed alternative investment fund managers;

- the sole management company set up under Chapter 18 of the 2010 Law.

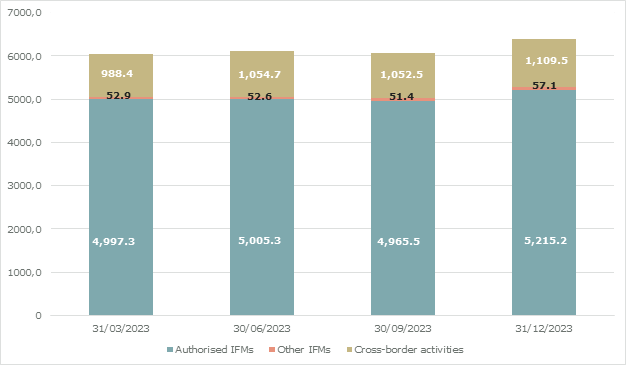

Evolution of the assets managed (in € billions) by IFM type

The cross-border activities presented in the above chart correspond to IFMs established in another EU Member State and managing Luxembourg-based UCITS or AIFs under Article 119 of the 2010 Law and/or Article 33 of the 2013 Law.

1. Authorised investment fund managers

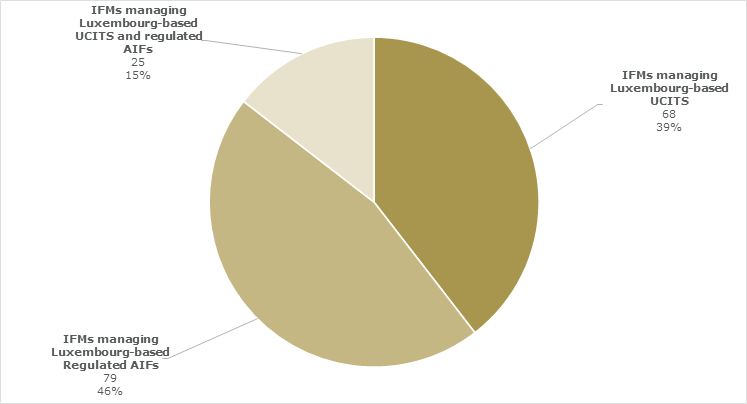

Breakdown of authorised IFMs by category

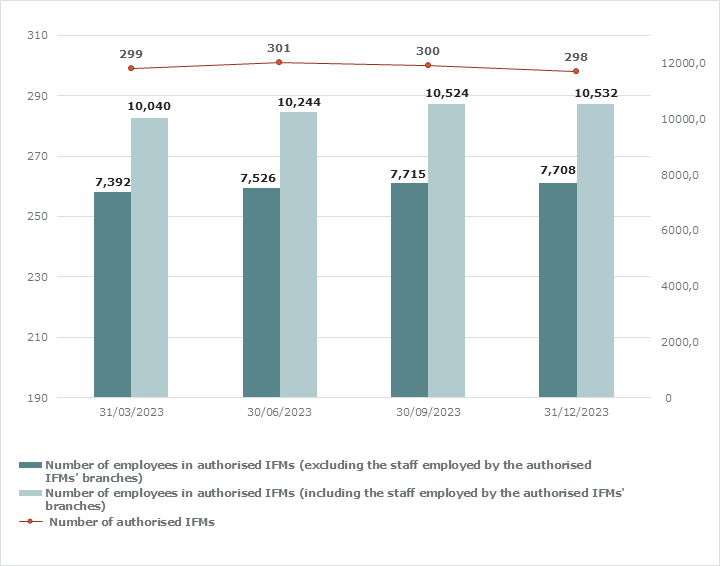

1.1. Development in numbers / Development in employment

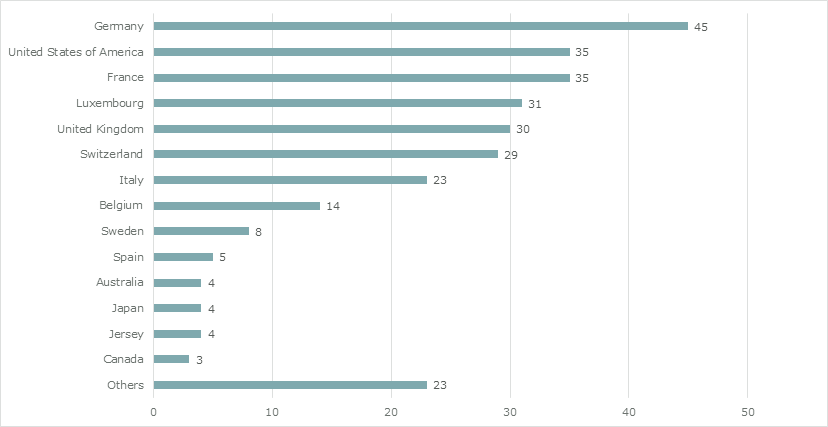

1.2. Geographical origin

Geographical origin of authorised IFMs

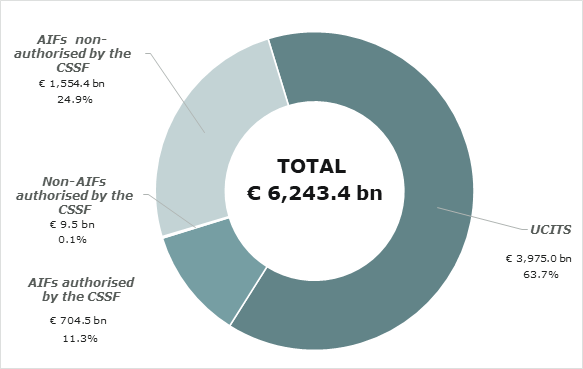

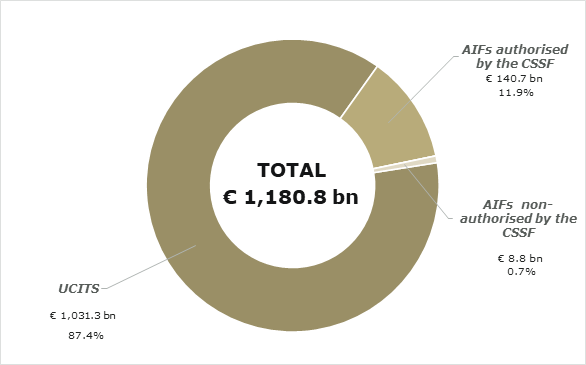

1.3. Assets under management

Breakdown of assets managed by product type

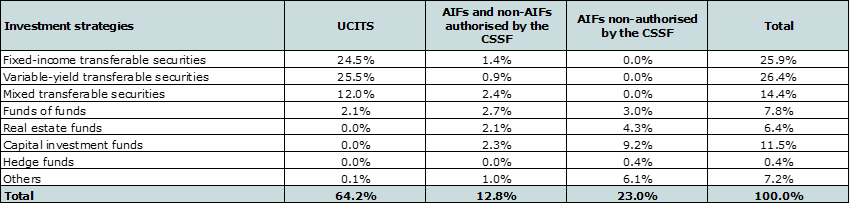

1.4. Investment strategies

Breakdown by investment strategy

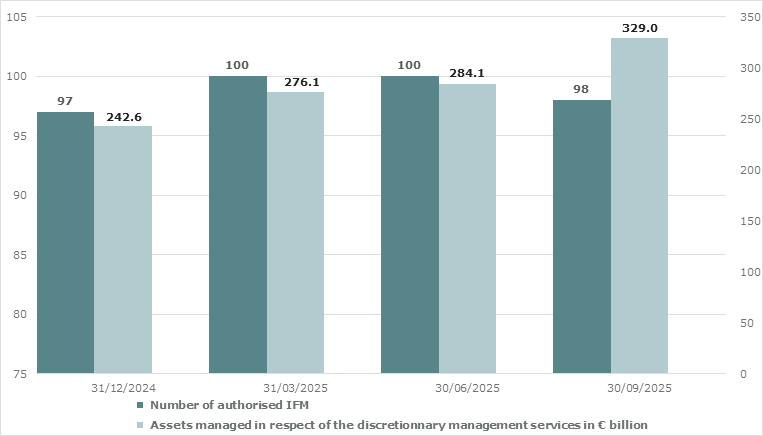

1.5. Discretionary management

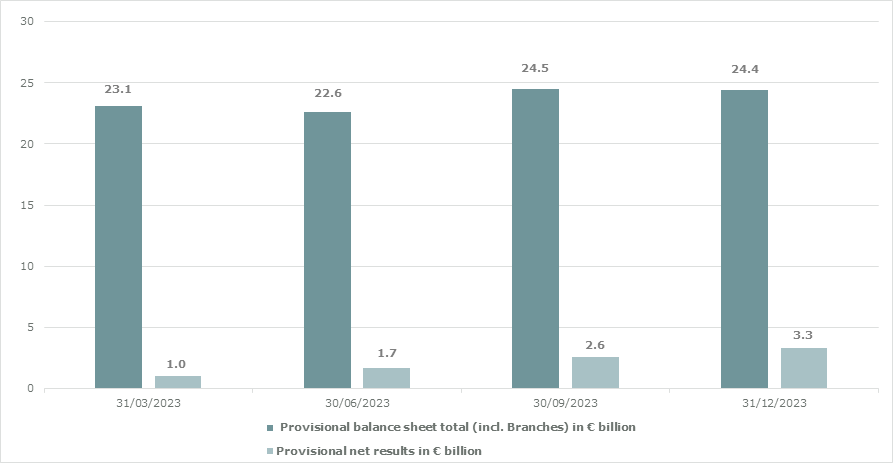

1.6. Financial situation

2. Other investment fund managers

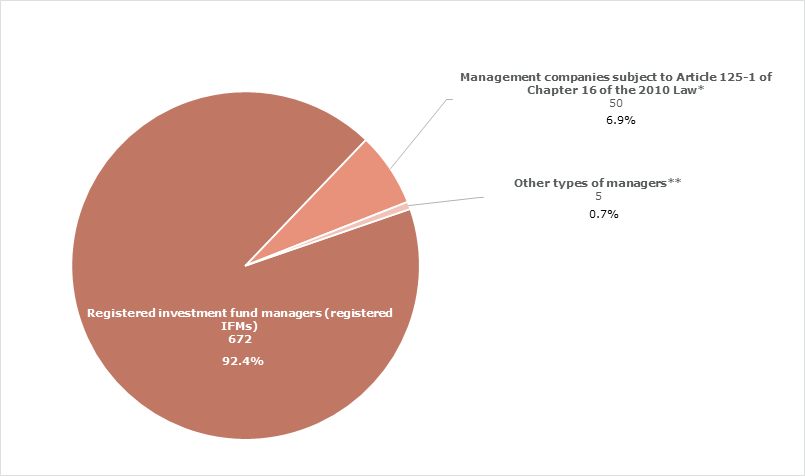

Breakdown of other IFMs numbers by category

* these management companies manage UCIs which do not qualify as AIFs or UCITS or which fall within the scope of the exemption or transitional provisions of the 2013 Law

** Other types of managers:

- 1 self-managed UCITS investment companies (SIAGs) – 0.10%

- 3 internally-managed alternative investment fund managers – 0.50%

- 1 management company set up under Chapter 18 of the 2010 Law- 0.10%

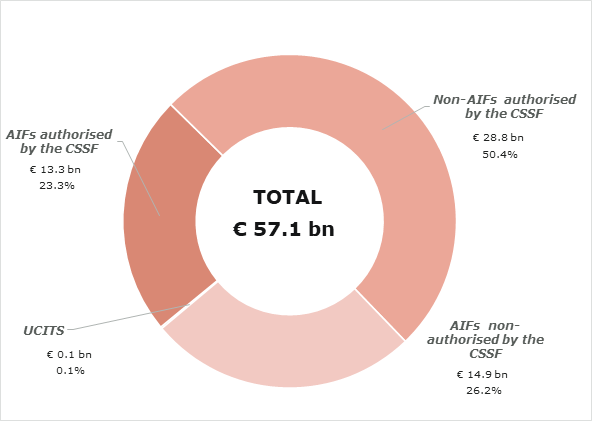

It should also be noted that an additional € 118.2 billion are held in AIFs and non-AIFs authorised by the CSSF which fall within the scope of the transitional provisions as defined in Article 58 of the 2013 Law and which are consequently not linked to an authorised or registered IFM set up under the 2013 Law.

2.1. Assets under management

Breakdown of assets managed through other IFMs by product type

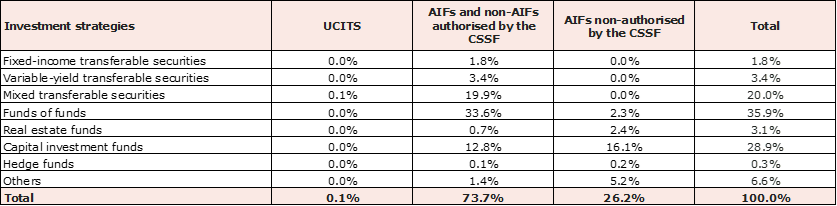

2.2. Investment strategies

Breakdown by investment strategy

3. Cross-border activities*

3.1. IFMs established in another EU Member State

Breakdown of products managed on a cross-border basis**

Breakdown of IFMs with cross-border activities numbers by category

* The IFMs established in third countries, carrying out the management of Luxembourg AIFS authorised and non-authorised by the CSSF according to Article 44 of the 2013 Law and managing € 11.9 billion of assets of funds authorised by the CSSF, are excluded.

** Data not available for AIFs non-authorised by the CSSF.

3.2. IFMs established in Luxembourg

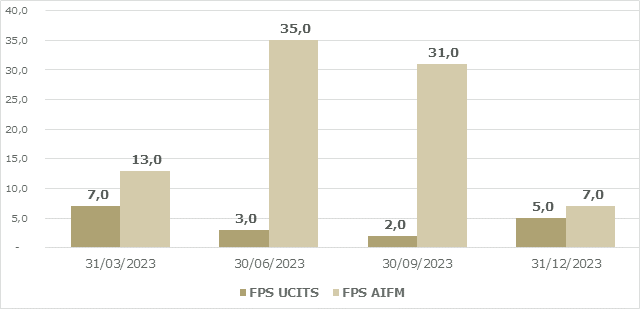

3.2.1. Freedom to provide services under the UCITS Directive and the AIFMD

Number of authorised IFMs having notified their intention to carry out the functions included in the collective management activities in another EU/EEA Member State in the framework of freedom to provide services (“LPS”)

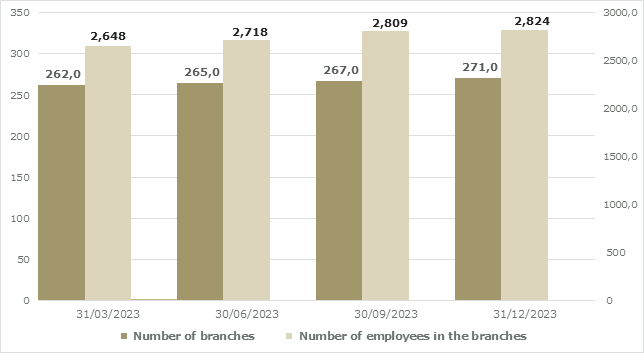

3.2.2. Free establishment of branches under the UCITS Directive and the AIFMD

As at 30 September 2024, 108 authorised IFMs (compared to 107 as at 30 June 2024) were represented by a branch in one or several EU Member States under the UCITS Directive or the AIFMD.

All statistics: link to the “Statistics” page