Situation globale des organismes de placement collectif à la fin du mois de décembre 2020 (uniquement en anglais)

Communiqué de presse 21/02

I. Overall situation

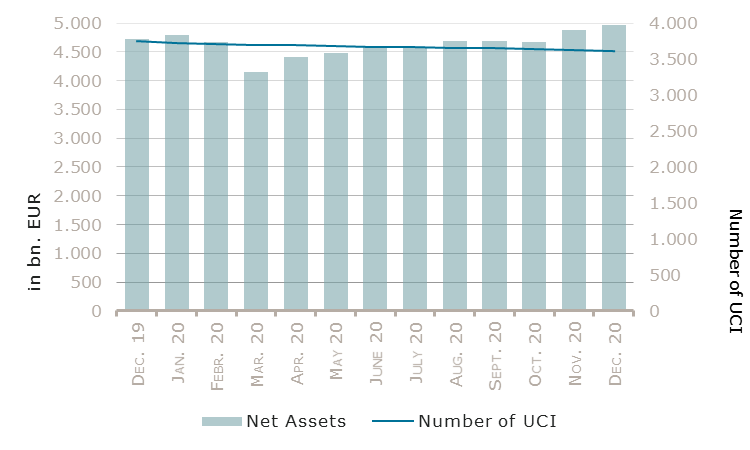

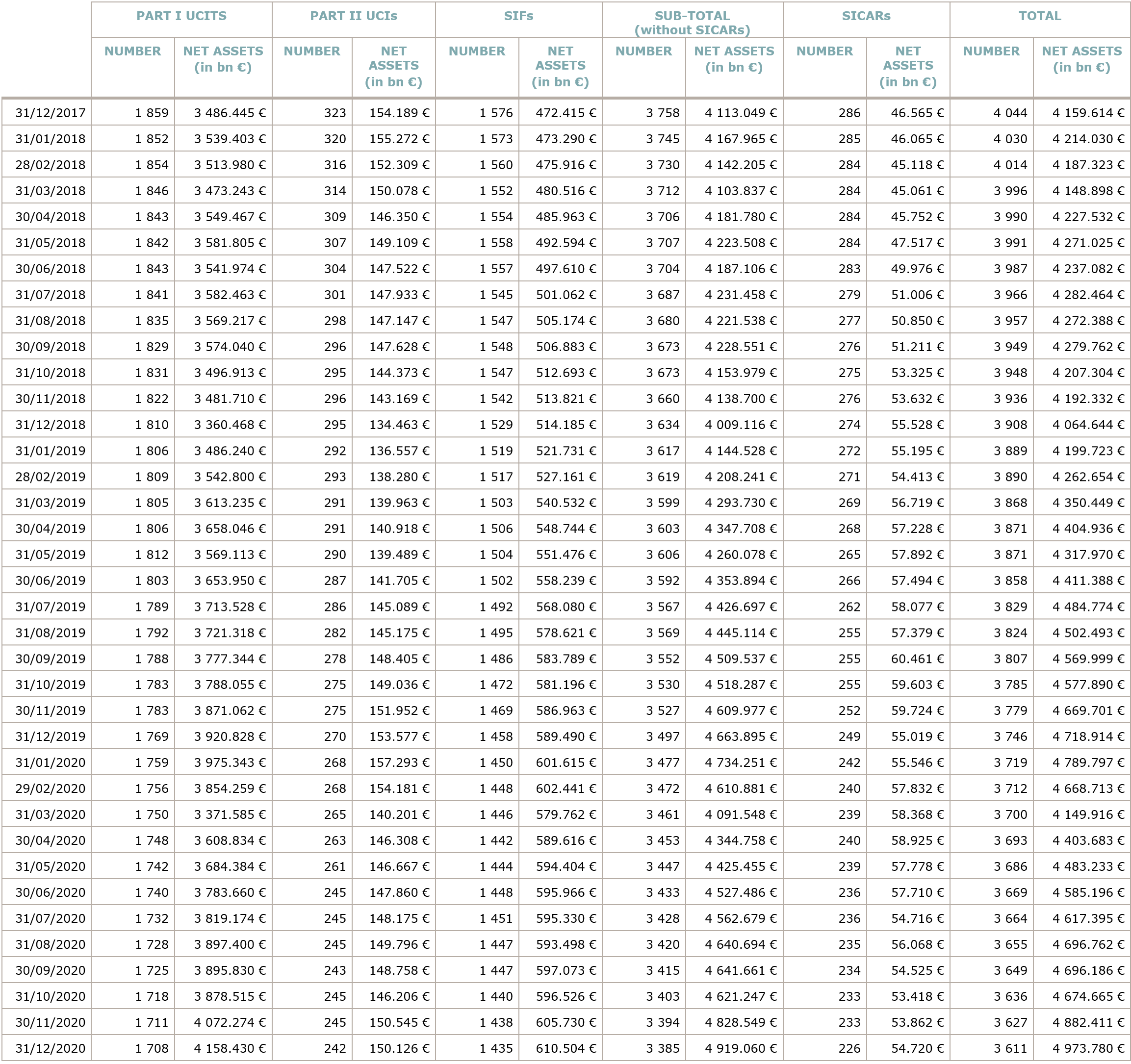

As at 31 December 2020, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 4,973.780 billion compared to EUR 4,882.411 billion as at 30 November 2020, i.e. an increase of 1.87% over one month. Over the last twelve months, the volume of net assets rose by 5.40%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 91.369 billion in December. This increase represents the sum of positive net capital investments of EUR 33.032 billion (+0.68%) and of the positive development of financial markets amounting to EUR 58.337 billion (+1.19%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,611, against 3,627 the previous month. A total of 2,377 entities adopted an umbrella structure representing 13,356 sub-funds. Adding the 1,234 entities with a traditional UCI structure to that figure, a total of 14,590 fund units were active in the financial centre.

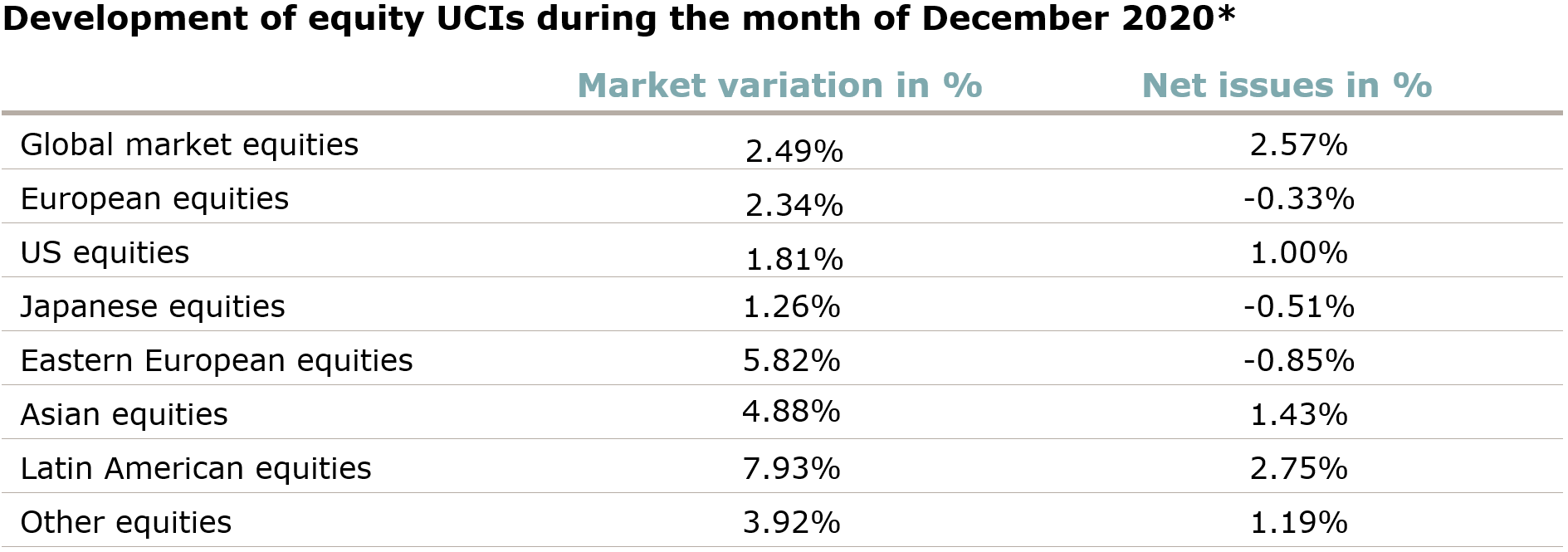

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of December:

Global equity markets pursued their upside movement in the context of the vaccine approvals, stimulus packages in different countries and the continued monetary support from major Central Banks.

Concerning developed markets, the European equity UCI category registered a positive performance supported by the launch of the vaccination campaign by the end of December, the compromise found on the EU budget package and the EU Recovery Fund, the extension of the Pandemic Emergency Purchase Program (PEPP) by the European Central Bank (ECB), better macroeconomic data and the BREXIT deal between the EU and the UK. Amid the prospect of a USD 900 billion fiscal stimulus package in the United States and the start of the rollout of the Covid-19 vaccine, the US equity UCI category generated a robust return compensated in part by the depreciation of the USD against the EUR. The Japanese equity UCI category followed the upward trend on the grounds of the fiscal stimulus program decided by the Japanese government and continued monetary easing measures, despite a depreciation of the Yen against the EUR.

As for emerging countries, the Asian equity UCI category rose against the backdrop of improving economic data, liquidity injections by the Chinese Central Bank and the COVID19 infection rates which remained more contained in comparison to other regions. The Eastern European equity UCI category followed the upward trend in December, driven by the Coronavirus vaccine rollouts in various parts of Europe and rising oil prices due to the agreement reached by the OPEC countries and Russia on oil production. The Latin American equity UCI category rallied on the basis of growing investor confidence, stronger commodity prices and the positive developments of Brazil’s and Mexico’s equity markets.

In December, equity UCI categories registered an overall positive net capital investment.

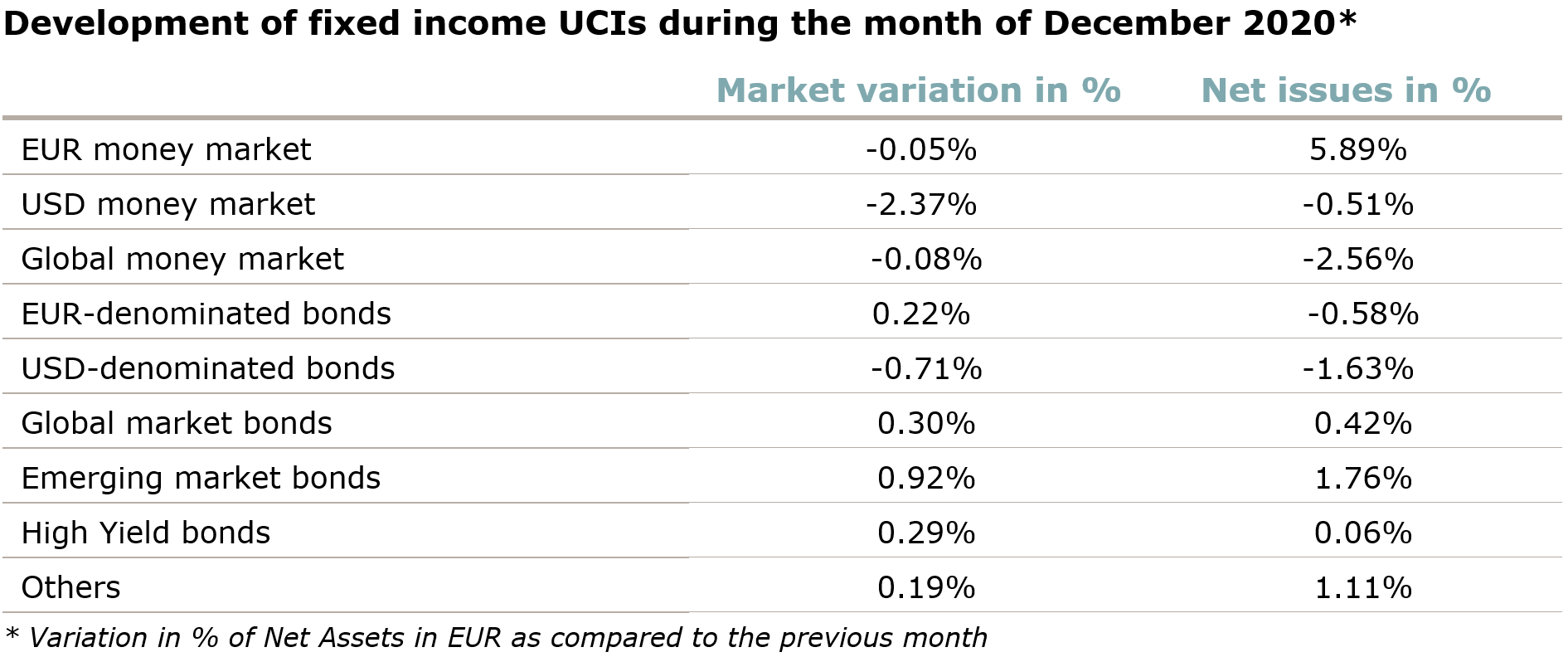

As for the EUR-denominated bonds, highly rated government bonds moved sideways whereas the spreads of lower-rated government bonds of peripheral countries and investment grade corporate bonds decreased slightly (i.e. bond prices increased) mainly due to the continued monetary support and the announcement of the ECB to extent its Pandemic Emergency Purchase Program (PEPP) in 2021, shifting the EUR-denominated bond UCIs category into positive territory.

US government bonds prices declined in December under the impulse of a prospective fiscal stimulus package, leading to an increase of the yield divergence between long-term Euro and US denominated sovereign bonds. US Corporate bonds on the other hand registered gains in December, supported by the announcement of the Federal Reserve Bank to continue its asset purchases as long as its inflation and employment objectives are not fulfilled. In combination with the depreciation of the USD against the EUR, the USD-denominated bonds UCI category finished overall in negative territory.

The Emerging market bonds UCI category generated a robust return amid the growing demand for riskier assets, the reduction of risk premiums as well as the agreement reached by OPEC countries and Russia on oil production. The negative evolution of emerging market currencies compensated partly these gains.

In December fixed income UCI categories registered an overall positive net capital investment. The largest inflows were recorded in the EUR money market UCI category.

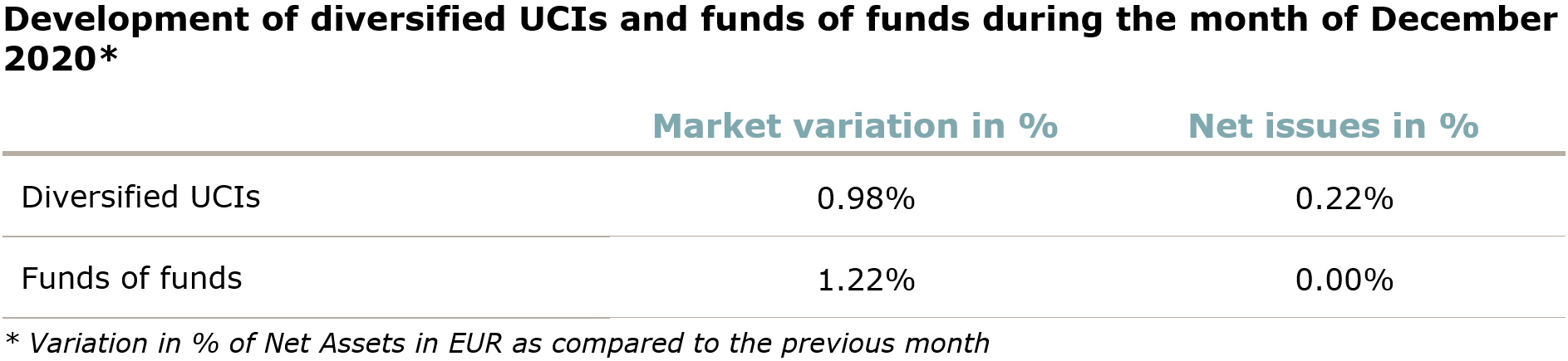

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following fourteen undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- BSK MULTI ASSET, 15, rue de Flaxweiler, L-6776 Grevenmacher

- COLUMBIA THREADNEEDLE (LUX), 31, Z.A. Bourmicht, L-8070 Bertrange

- HERMES LINDER FUND SICAV, 14, Porte de France, L-4360 Esch-sur-Alzette

- LIOR GP, 5, allée Scheffer, L-2520 Luxembourg

- LYRICAL VALUE FUNDS (LUX), 80, route d’Esch, L-1470 Luxembourg

- OPTIMIZE IP SICAV, 4, rue Jean Monnet, L-2180 Luxembourg

- PIQUEMAL HOUGHTON FUNDS, 33A, Avenue J.F. Kennedy, L-1855 Luxembourg

SIFs:

- CORE INFRASTRUCTURE FUND II SCS SICAV-SIF, 5, allée Scheffer, L-2520 LUXEMBOURG

- EO IV LUXEMBOURG SICAV-SIF, 6, route de Trèves, L-2633 Senningerberg

- INVESCO LUX REAL ESTATE INVESTMENT S.À R.L., SICAV-SIF, 37A, avenue J-F Kennedy, L-1855 Luxembourg

- LRC RE-2, 412F, route d’Esch, L-2086 Luxembourg

- SMF EUROPE SICAV-SIF, 6, route de Trèves, L-2633 Senningerberg

- STABLE INCOME EUROPEAN REAL ESTATE FUND S.C.S SICAV-SIF, 20, boulevard Royal, L-2449 Luxembourg

SICARs:

- COSICAR S.C.A. SICAR, 44, avenue J. F. Kennedy, L-1855 Luxembourg

The following thirty undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ASSENAGON DIVERSIFIED INCOME, 1B, Heienhaff, L-1736 Senningerberg

- CROWD, 17, rue de Flaxweiler, L-6776 Grevenmacher

- DWS RENDITE OPTIMA, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- DWS SELECT, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- I. VALOR, 12, rue Eugène Ruppert, L-2453 Luxembourg

- PAM L, 12, rue Eugène Ruppert, L-2453 Luxembourg

- PLF, 17, rue de Flaxweiler, L-6776 Grevenmacher

- ROHSTOFF STRATEGIE, 22, boulevard Royal, L-2449 Luxembourg

- UNIINSTITUTIONAL EM CORPORATE BONDS 2020, 308, route d’Esch, L-1471 Luxembourg

- VIETNAM EMERGING MARKET FUND SICAV, 4, rue Thomas Edison, L-1445 Strassen

UCIs Part II 2010 Law:

- BBVA NOVA SICAV, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- NEVAFUNDS, 88, Grand-Rue, L-1660 Luxembourg

- SPECTRUM 360, 15, avenue J-F Kennedy, L-1855 Luxembourg

SIFs:

- BLADO INVESTMENTS S.C.A., SICAV-SIF, 6, rue Eugène Ruppert, L-2453 Luxembourg

- FERONIA SICAV SIF, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- GLL RETAIL CENTER I, 20, boulevard Royal, L-2449 Luxembourg

- MANDATUM LIFE SICAV-SIF, 26-28, rue Edward Steichen, L-2540 Luxembourg

- PATRIMONIUM PROPERTY FUND, 5, allée Scheffer, L-2520 Luxembourg

- PHAROS REAL ESTATE FUND, S.C.A., SICAV-FIS, 1, rue Peternelchen, L-2370 Howald

- PRIVATE CO-INVESTMENT EUROPE SICAV-FIS, 5, allée Scheffer, L-2520 Luxembourg

- THIBAULT S.A., SICAV-SIF, 58, rue Charles Martel, L-2134 Luxembourg

- VALKENDORF FUND I, 2, rue d’Alsace, L-1122 Luxembourg

SICARs:

- CFSH SECONDARY OPPORTUNITIES S.A. SICAR, 2, place de Metz, L-1930 Luxembourg

- EDR REAL ESTATE (EASTERN EUROPE) S.C.A., SICAR, 20, boulevard Emmanuel Servais, L-2535 Luxembourg

- EUROPEAN CAPITAL S.A. SICAR, 2, Boulevard de la Foire, L-1528 Luxembourg

- FIVE ARROWS NAUTILUS CO-INVEST FEEDER SCA SICAR, 33, rue Sainte Zithe, L-2763 Luxembourg

- FOUGERA S.C.A., SICAR, 412F, route d’Esch, L-1030 Luxembourg

- GLOBAL SOLAR FUND, S.C.A., SICAR, 20, rue de la Poste, L-2346 Luxembourg

- PRAX CAPITAL CHINA GROWTH FUND III, S.C.A., SICAR, 6A, rue Gabriel Lippmann, L-5365 Munsbach

- WAGNER CAPITAL S.A. SICAR, 2-4, avenue Marie-Thérèse, L-2132 Luxembourg