Situation globale des organismes de placement collectif à la fin du mois d’avril 2021 (uniquement en anglais)

Communiqué de presse 21/10

I. Overall situation

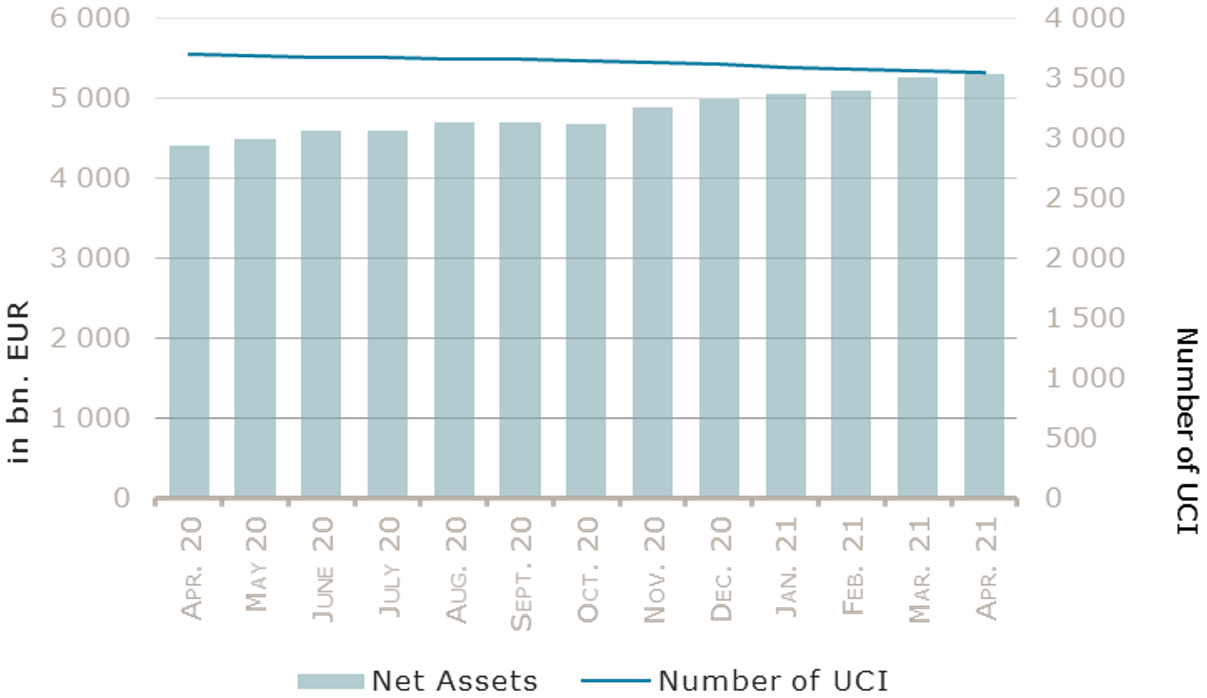

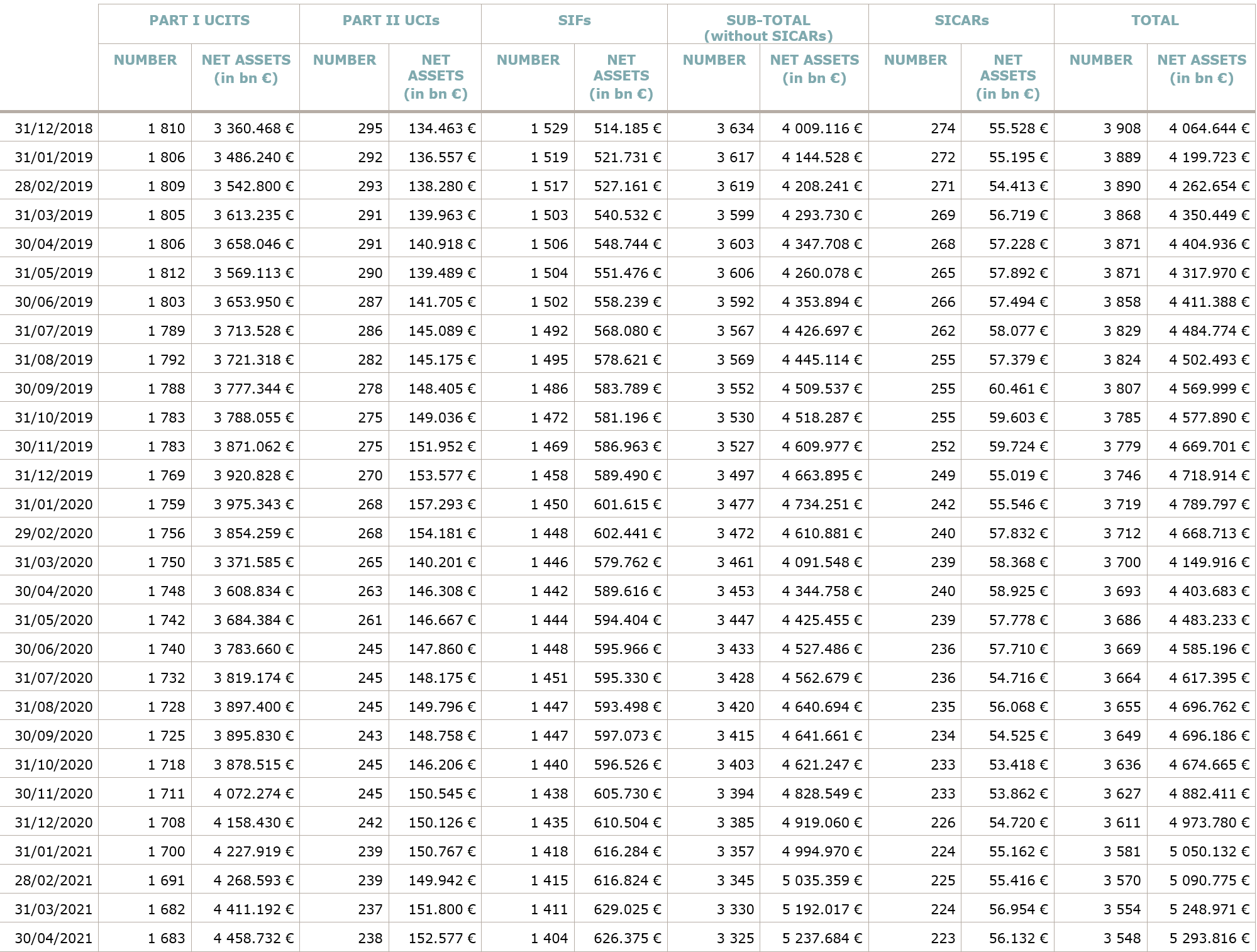

As at 30 April 2021, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,293.816 billion compared to EUR 5,248.971 billion as at 31 March 2021, i.e. an increase of 0.85% over one month. Over the last twelve months, the volume of net assets rose by 20.21%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 44.845 billion in April. This increase represents the sum of positive net capital investments of EUR 29.457 billion (+0.56%) and of the positive development of financial markets amounting to EUR 15.388 billion (+0.29%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,548, against 3,554 the previous month. A total of 2,341 entities adopted an umbrella structure representing 13,310 sub-funds. Adding the 1,207 entities with a traditional UCI structure to that figure, a total of 14,517 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of April:

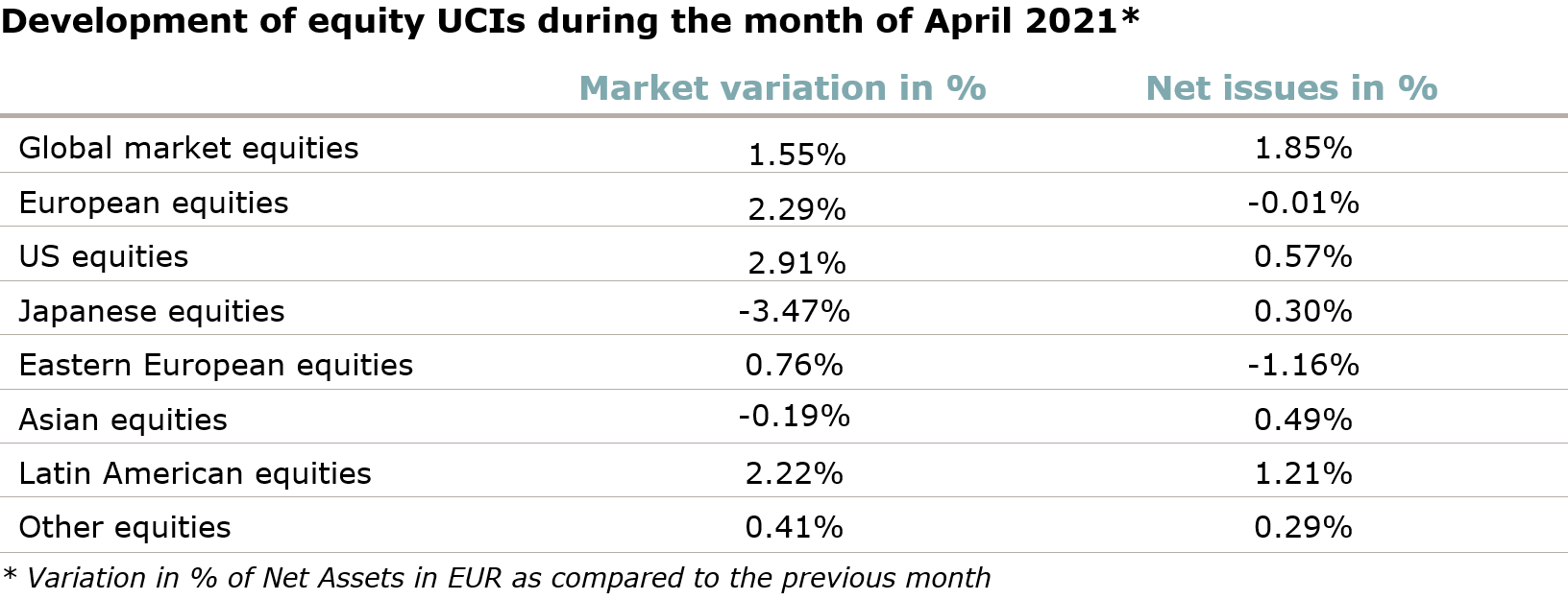

Most equity markets registered a positive development during the month under review in a context marked by improved global macroeconomic data and continuous policy support, while the spreads between US and European government bond yields contracted.

Concerning developed markets, the European equity UCI category performed well, supported by the partial reopening of the economies as the vaccination campaign begins to gain traction, better than anticipated corporate results and improved economic indicators. The US equity UCI category rose as well against a backdrop of good corporate results, positive macroeconomic data, the prospect of extensive fiscal stimulus packages and a rapid vaccination roll-out in the US, albeit a partial compensation of the gains on US equity due to the substantial depreciation of the USD against the EUR. The Japanese equity UCI category finished the month in negative territory amid rising reinfection rates, a mixed start of the corporate earnings season and the depreciation of the JPY against the EUR.

As for emerging countries, the Asian equity UCI category tracked sideways overall, in reaction to the recovery of the world economy and a weaker USD on one hand and the tensions between China and the United States on the other hand. The Eastern European equity UCI category registered a positive performance on the grounds of better global macroeconomic data and the vaccine roll-out in Europe, while the geopolitical tensions in the region continued to weight on these markets. The Latin American equity UCI category rose in April, supported notably by increasing commodity prices.

In April, the equity UCI categories registered an overall positive net capital investment, mainly driven by large inflows in the Global market equity UCI category.

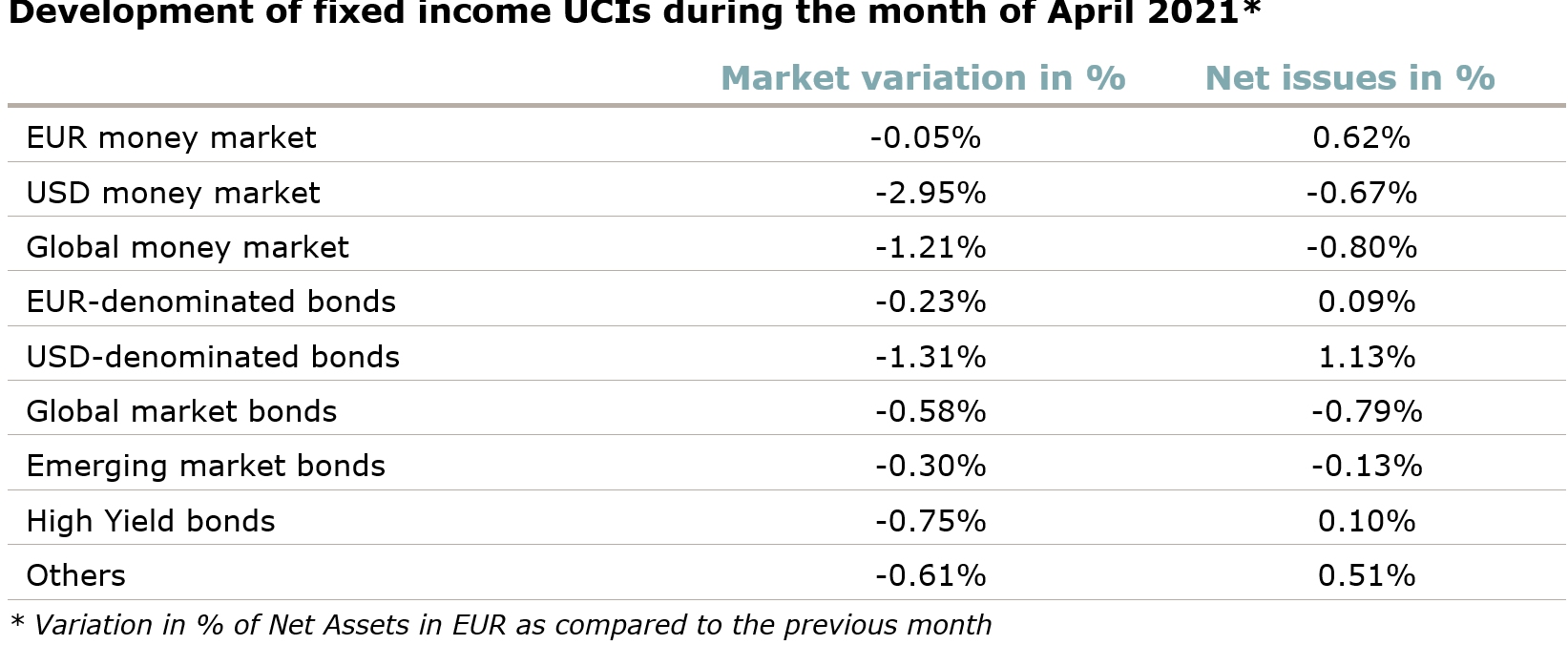

As for EUR-denominated bonds, the yields of government bonds slightly increased (i.e. bond prices fell) on the back of the vaccine roll-out as well as the rising growth and inflation expectations, while the European Central Bank pursued its Pandemic Purchase Emergency Program (PEPP). The yields of investment grade corporate bonds moved sideways, while risk premiums compressed. Overall the EUR-denominated bond UCI category realised a negative performance in April.

Concerning US government bonds, the yields of Treasuries decreased in a context marked by the ongoing strong monetary policy support, despite the good macroeconomic data and expectations of rising inflation which were already priced in the bond prices. US corporate bond yields followed this decreasing trend leading to higher bond prices, but the significant depreciation of the USD against the EUR shifted the USD-denominated bond UCI category in negative territory.

The emerging market bonds UCI category declined in overall during the month amid the divergent evolution of emerging market currencies and regional idiosyncratic risks in some emerging economies, although emerging market bond prices were globally supported by declining US government bond yields, a weaker USD and rising commodity prices.

In April fixed income UCI categories registered an overall negative net capital investment.

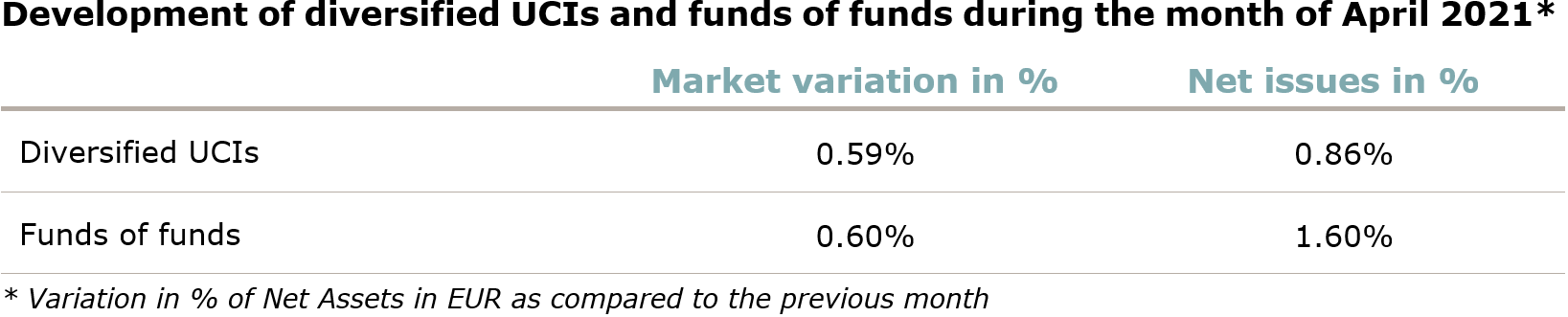

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

II. Breakdown of the number and net assets of UCIs

During the month under review, the following nine undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- ALLSOLUTIONS, 60, avenue J-F Kennedy, L-1855 Luxembourg

- ARFINA FUNDS, 15, avenue J-F Kennedy, L-1855 Luxembourg

- AFIR RAVENSBURG NACHHALTIGKEIT, Mainzer Landstraße 16, D-60325 Frankfurt am Main1

- VM BC PROFESSIONELL AKTIEN, Mainzer Landstraße 16, D-60325 Frankfurt am Main1

- VM BC PROFESSIONELL ANLEIHEN, Mainzer Landstraße 16, D-60325 Frankfurt am Main1

UCIs Part II 2010 Law:

- NB ALTERNATIVE FUNDS SICAV S.A., 80, route d’Esch, L-1470 Luxembourg

SIFs:

- GRAMERCY PROPERTY EUROPE IV SCA, SICAV-SIF, 42-44, avenue de la Gare, L-1610 Luxembourg

- THE BLOSSOM ELTIF, 146, boulevard de la Pétrusse, L-2330 Luxembourg

SICARs:

- TCEE FUND IV SCA SICAR, 8, rue Lou Hemmer, L-1748 Senningerberg

The following fifteen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ABERDEEN STANDARD ISLAMIC SICAV, 35A, avenue J-F Kennedy, L-1855 Luxembourg

- BNP PARIBAS L1, 10, rue Edward Steichen, L-2540 Luxembourg

- NIXDORF UMBRELLA, 1C, rue Gabriel Lippmann, L-5365 Munsbach

- ZENIT MULTISTRATEGY SICAV, 12, rue Eugène Ruppert, L-2453 Luxembourg

SIFs:

- ALPHA FUND, S.C.A., SICAV-SIF, 18, rue de l’Eau, L-1449 Luxembourg

- AXA IM REPRESENTATIVE, 49, avenue J-F Kennedy, L-1855 Luxembourg

- BERLIN-AI FUND SCS, SICAV-FIS, 9, Allée Scheffer, L-2520 Luxembourg

- DEGROOF GREEN FUND, 12, rue Eugène Ruppert, L-2453 Luxembourg

- EUREKA SPECIALIZED FUND SICAV-FIS S.A., 2, avenue du Blues, L-4368 Belvaux

- HAYFIN UMBRELLA FUND SICAV-SIF, 80, route d’Esch, L-1470 Luxembourg

- NORDIC SME DEBT ELTIF I, 6B, route de Trèves, L-2633 Senningerberg

- ODYSSEY (LUX), 46A, avenue J-F Kennedy, L-1855 Luxembourg

- STRONGEAGLE MOZAMBIQUE FUND, 2, boulevard de la Foire, L-1528 Luxembourg

SICARs:

- IFE III SICAR, 42, rue de la Vallée, L-2661 Luxembourg

- TRANSPORT INFRASTRUCTURE INVESTMENT COMPANY (SCA) SICAR, 4, rue Robert Stumper, L-2557 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.