Situation globale des organismes de placement collectif à la fin du mois de février 2024 (uniquement en anglais)

Communiqué de presse 24/09

I. Overall situation

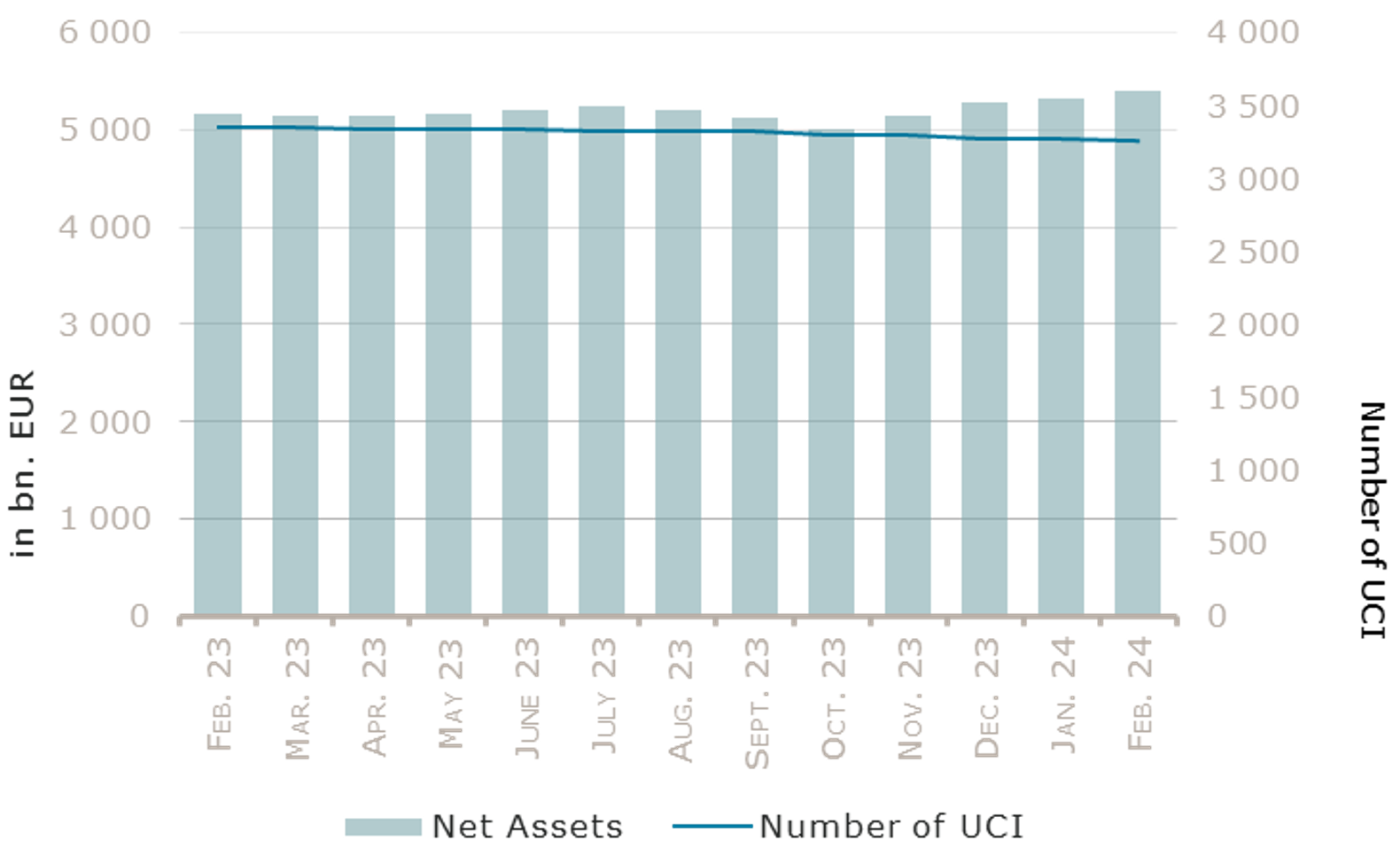

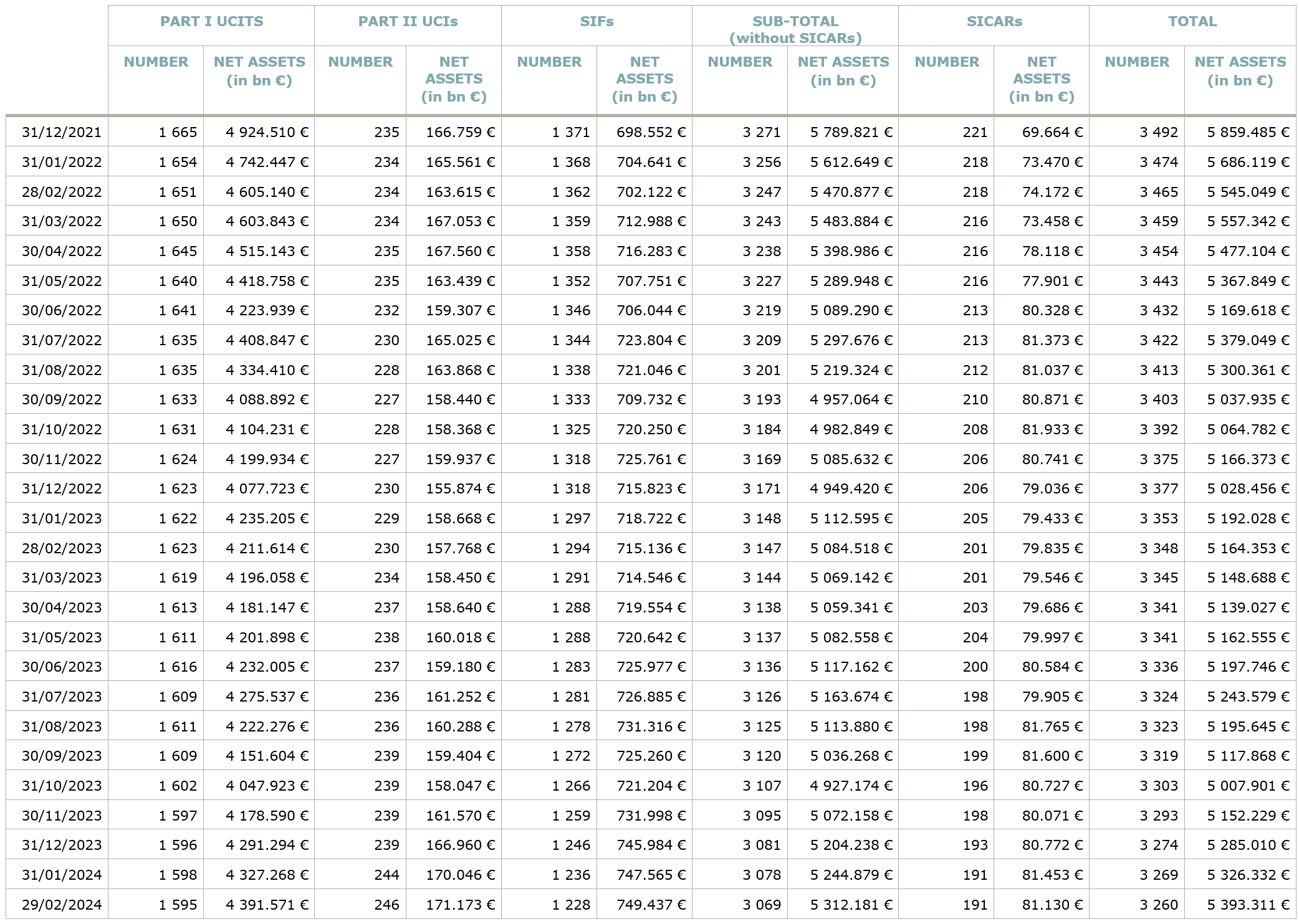

As at 29 February 2024, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,393.311 billion compared to EUR 5,326.332 billion as at 31 January 2024, i.e. an increase of 1.26% over one month. Over the last twelve months, the volume of net assets increased by 4.43%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 66.979 billion in February. This increase represents the sum of negative net capital investments of EUR 2.442 billion (-0.04%) and of the positive development of financial markets amounting to EUR 69.401 billion (+1.30%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment (UCIs) taken into consideration totalled 3,260, against 3,269 the previous month. A total of 2,132 entities adopted an umbrella structure representing 12,795 sub-funds. Adding the 1,128 entities with a traditional UCI structure to that figure, a total of 13,923 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of February.

Equity markets continued to rally, for the fourth consecutive month, mostly due to positive economic data, showing notably that the US economy is still resilient and that it is improving slightly in Europe. Equity markets also benefitted from the publication of quarterly results, which mostly met or exceeded expectations. In that context, the US and European equities UCI categories posted positive monthly performances. The Asian equities UCI category registered the best monthly performance, mainly due to China, which rebounded from multi-years lows, after the government announced several interventions to support the economy and the markets, notably with a view to reduce mortgage rates. All the other equities UCI categories also performed well, including Japanese equities while the Yen weakened, but with the exception of Latin American equities, which posted a slightly negative performance.

In February, the equity UCI categories registered an overall slightly positive capital investment with inflows, mostly in the European equities UCI category, being partially offset by outflows in the UCI categories Global market equities, Asian equities and Latin American equities.

Development of equity UCIs during the month of February 2024*

|

Market variation in % |

Net issues in % |

|

| Global market equities |

3.17% |

-0.70% |

| European equities |

2.01% |

2.27% |

| US equities |

5.30% |

-0.01% |

| Japanese equities |

3.19% |

0.27% |

| Eastern European equities |

3.04% |

0.39% |

| Asian equities |

5.52% |

-1.57% |

| Latin American equities |

-0.19% |

-3.15% |

| Other equities |

3.63% |

0.17% |

* Variation in % of Net Assets in EUR as compared to the previous month

The publication of stronger than expected inflation data for January, both in the US and in Europe, reduced expectations for imminent interest rate cuts, leading to a rise in yields and to negative performances for most fixed income UCIs categories. High yield and Emerging bonds posted barely positive performances.

In February, fixed income UCIs registered an overall positive net capital investment due to significant inflows in all bond UCI categories whereas the money market UCI categories registered outflows except for USD money market.

Development of fixed income UCIs during the month of February 2024*

|

Market variation in % |

Net issues in % |

|

| EUR money market |

0.23% |

-2.01% |

| USD money market |

0.17% |

0.64% |

| Global money market |

0.09% |

-1.22% |

| EUR-denominated bonds |

-0.77% |

1.11% |

| USD-denominated bonds |

-1.07% |

3.43% |

| Global market bonds |

-0.63% |

0.91% |

| Emerging market bonds |

0.07% |

0.84% |

| High Yield bonds |

0.05% |

0.68% |

| Others |

-0.53% |

1.15% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of February 2024*

|

Market variation in % |

Net issues in % |

|

| Diversified UCIs |

0.90% |

-0.80% |

| Funds of funds |

0.85% |

-0.17% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following eight undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- PREMIUM INVEST CHANCE AUSSCHÜTTUNGSFOKUS, Lyoner Strasse 13, 60528 Frankfurt am Main1

- PREMIUM INVEST ERTRAG AUSSCHÜTTUNGSFOKUS, Lyoner Strasse 13, 60528 Frankfurt am Main1

- VER CAPITAL CREDIT VALUE, 4, rue Robert Stumper, L-2557 Luxembourg

UCIs Part II 2010 Law:

- INCOFIN CLIMATE-SMART MICROFINANCE FUND S.A., SICAV, 2, rue d’Alsace, L-1122 Luxembourg

- ODDO BHF PRIVATE ASSETS SICAV LUX, 11-13, boulevard de la foire, L-2520 Luxembourg

- P & R SICAV, 15, rue de Flaxweiler, L-6776 Grevenmacher

SICARs:

- EQT FC SICAR SCA, 51A, boulevard Royal, L-2449 Luxembourg

- ARCANO SPANISH VALUE ADDED REAL ESTATE III S.C.A. SICAR ELTIF, 46A, avenue J.F. Kennedy, L-1855 Luxembourg

The following seventeen undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- DEKA-DEUTSCHLANDPROTECT STRATEGIE 90 III, 6, rue Lou Hemmer, L-1748 Luxembourg-Findel

- DEKA-NACHHALTIGKEIT AKTIEN NORDAMERIKA, 6, rue Lou Hemmer, L-1748 Findel

- DWS MULTI THEMATIC, 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- DZPB CONCEPT, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- PVV SICAV, 4, rue Thomas Edison, L-1445 Luxembourg-Strassen

- VTB CAPITAL IM RUSSIA EQUITY UCITS FUND, 106, route d’Arlon, L-8210 Mamer

UCIs Part II 2010 Law:

- FINECTIVE SICAV, 49, boulevard Prince Henri, L-1724 Luxembourg

SIFs:

- 3J FUND FCP-SIF, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- BTM PREMIER FUND V, 287-289, route d’Arlon, L-1150 Luxembourg

- GOLDING MEZZANINE SICAV-FIS V, 6, avenue Marie-Thérèse, L-2132 Luxembourg

- GREEN UTILITY SICAV-SIF, 2, rue Edward Steichen, L-2540 Wasserbillig

- MIM SICAV, 15, avenue J-F Kennedy, L-1855 Luxembourg

- MIRABAUD OPPORTUNITIES SICAV-FIS, 15, avenue J-F Kennedy, L-1855 Luxembourg

- NIAM CREDIT SENIOR FUND I, FCP-SIF, 5, allée Scheffer, L-2520 Luxembourg

- TYRUS CAPITAL EUROPEAN REAL ESTATE FINANCE S.A., 20, rue de la poste, L-2346 Luxembourg

SICARs:

- E-CAPITAL III (S.C.A.) SICAR, 7, avenue Gaston Diderich, L-1420 Luxembourg

- NEUFLIZE OBC CINEMA S.C.A. SICAR, 46A, avenue J-F Kennedy, L-1855 Luxembourg

1 Undertaking for collective investment for which the designated management company was authorised by the competent authorities of another Member State in accordance with Directive 2009/65/EC.