Le nouveau règlement LBC/FT, la sixième directive LBC/FT et le futur superviseur LBC/FT de l’UE

Le 19 juin 2024, le règlement du Parlement européen et du Conseil relatif à la prévention de l’utilisation du système financier aux fins du blanchiment de capitaux ou du financement du terrorisme (« règlement LBC/FT ») a été publié dans le Journal officiel de l’Union européenne. Le règlement LBC/FT entrera en vigueur le vingtième jour suivant celui de sa publication et sera applicable à partir du 10 juillet 2027. Le 19 juin 2024 a également été publiée la directive du Parlement européen et du Conseil relative aux mécanismes à mettre en place par les États membres pour prévenir l’utilisation du système financier aux fins du blanchiment de capitaux ou du financement du terrorisme et abrogeant la directive (UE) 2015/849 (« sixième directive LBC/FT »). La sixième directive LBC/FT entrera en vigueur le vingtième jour suivant celui de sa publication au Journal officiel de l’Union européenne. Les États membres disposent de trois ans à compter de son entrée en vigueur pour transposer la sixième directive LBC/FT dans leur législation nationale.

Le cadre juridique européen en matière de lutte contre le blanchiment de capitaux et le financement du terrorisme (« LBC/FT ») existant a permis des réalisations significatives. Cependant, l’expérience a montré qu’il convenait d’introduire des améliorations supplémentaires pour atténuer correctement les risques de blanchiment de capitaux et de financement du terrorisme (« BC/FT ») et détecter efficacement les tentatives d’utiliser abusivement le système financier de l’Union à des fins criminelles.

C’est pour cette raison que le choix législatif s’est porté sur un règlement au lieu d’une directive en vue de parvenir à davantage d’harmonisation. Les directives ne sont pas d’application directe et n’établissent que des règles minimales que les États membres doivent mettre œuvre via leur législation nationale, alors que les règlements sont directement applicables dans les États membres. Concrètement, cela veut dire que les règles établies dans le règlement LBC/FT, le single rule book, énoncent des exigences de fond détaillées qui seront d’application directe de la même manière dans tous les États membres de l’Union européenne.

Le règlement LBC/FT prévoira en particulier des règles européennes en matière de (i) champ d’application des entités assujetties, (ii) politiques, contrôles et procédures internes au niveau des entités assujetties, (iii) obligations de vigilance à l’égard de la clientèle, (iv) transparence des bénéficiaires effectifs, (v) obligations de déclaration, (vi) conservation des informations et (vii) mesures visant à atténuer les risques entrainés par l’utilisation d’instruments anonymes.

Nous nous concentrerons sur les nouvelles règles qui auront une incidence directe sur le secteur financier et/ou le superviseur LBC/FT national.

Élargissement du champ d’application des entités assujetties : Le règlement LBC/FT élargit le champ d’application des entités assujetties aux prestataires de services sur crypto-actifs (« CASP »), aux plates-formes de financement participatif et à d’autres secteurs à haut risque. L’IBAN virtuel défini comme « un identifiant qui a pour effet de rediriger les paiements vers un compte de paiement identifié par un IBAN différent de cet identifiant »1 est pour la première fois compris dans le champ d’application. Par ailleurs, les exigences d’identification des clients et des bénéficiaires effectifs ont été étendues aux IBAN virtuels2.

L’objectif de cet élargissement est de prendre en considération les risques associés aux monnaies virtuelles et d’assurer que les règles LBC/FT s’appliquent aux nouvelles technologies financières.

Des obligations de vigilance renforcées (ou « EDD », enhanced due diligence) pour des transactions spécifiques ont été incluses. Ces obligations EDD devront être exécutées par les CASP pour les relations transfrontières de correspondant. Par ailleurs, les établissements de crédit et financiers devront appliquer des mesures EDD pour les relations d’affaires avec une clientèle fortunée (high net worth individuals, ou HNWI) dont le patrimoine total excède 50.000.000 EUR, impliquant le traitement d’actifs gérés de plus de 5.000.000 EUR. De plus, toutes les entités assujetties devront appliquer des mesures EDD aux transactions conclues à titre occasionnel et aux relations d’affaires impliquant des pays tiers à haut risque, sur la base d’une évaluation à effectuer en tenant compte des listes établies par le Groupe d’action financière (GAFI).

Limites et contrôles applicables aux paiements : Une limite maximale à l’échelle de l’UE de 10.000 EUR est fixée pour les paiements en espèces. Les États membres peuvent adopter une limite maximale inférieure s’ils le jugent nécessaire en raison de risques nationaux spécifiques.

Mesures de vigilance à l’égard de la clientèle

Afin de garantir que les risques d’absence de mise en œuvre ou de contournement de sanctions financières ciblées sont atténués de manière appropriée, les entités assujetties devront vérifier si le client et/ou les bénéficiaires effectifs font l’objet de sanctions financières ciblées. À noter également que, dans le contexte d’entités juridiques, tant les personnes physiques que les personnes morales qui contrôlent l’entité juridique ou détiennent plus de 50% des droits de propriété de cette entité ou une participation majoritaire dans celle-ci, que ce soit individuellement ou collectivement, devront également être vérifiées par rapport aux listes de sanctions financières ciblées3. Tel que c’est actuellement le cas, les obligations dans le contexte des sanctions financières ciblées sont des obligations fondées sur des règles (à la différence d’une approche fondée sur les risques).

Définition des bénéficiaires effectifs

La définition des bénéficiaires effectifs a été affinée afin d’améliorer la transparence et de prévenir des activités financières illicites. La définition mise à jour du bénéficiaire effectif au titre du règlement LBC/FT est plus exhaustive en ce qu’elle vise à établir un cadre plus clair pour identifier les personnes qui, en dernier ressort, possèdent ou contrôlent une entité juridique ou une construction juridique.

Le concept demeure largement inchangé en ce que les bénéficiaires effectifs sont les personnes physiques qui :

- détiennent directement ou indirectement une participation au capital de la société ; ou

- contrôlent directement ou indirectement la société ou toute autre entité juridique, par une participation au capital ou par d’autres moyens.

À noter que le règlement LBC/FT précise que le contrôle par d’autres moyens doit être déterminé indépendamment et en parallèle de l’existence d’une participation au capital ou d’un contrôle par une participation au capital.

Le seuil pour déterminer la participation au capital d’une société a été fixé à hauteur d’au moins 25% des actions ou la détention d’au moins 25% des droits de vote ou de tout autre type de participation au capital de la société, y compris le droit à une quote-part des bénéfices, à d’autres ressources internes ou au boni de liquidation. Il est clairement établi qu’il faut tenir compte de toutes les participations détenues à tous les niveaux de propriété. En adoptant une approche fondée sur les risques, les États membres peuvent identifier des catégories d’entités exposées à des risques de BC/FT plus élevés et proposer un seuil inférieur à la Commission européenne. Cependant, ce seuil ne peut être inférieur à 15%4.

Les informations relatives aux mesures prises pour identifier les bénéficiaires effectifs doivent être conservées. Dans le cas où aucun bénéficiaire effectif n’a pu être déterminé, une déclaration, accompagnée d’une justification des raisons pour lesquelles il n’a pas été possible de déterminer le(s) bénéficiaire(s) effectif(s), doit être jointe.

L’exigence de fournir les informations sur toutes les personnes physiques qui sont des membres d’un niveau élevé de la hiérarchie n’est plus conçue comme une identification du bénéficiaire effectif mais comme une option alternative de repli5.

Par ailleurs, des exigences plus strictes sont établies pour le signalement de divergences par rapport aux informations contenues dans les registres des bénéficiaires effectifs. Les entités assujetties doivent signaler toute divergence qu’elles rencontrent entre les informations disponibles dans le registre des bénéficiaires effectifs et les informations qu’elles doivent recueillir conformément au règlement LBC/FT. Les divergences doivent être signalées sans retard indu, et en tout état de cause dans un délai de quatorze jours calendaires à compter de leur détection. Lorsqu’elles signalent ces divergences, les entités assujetties accompagnent leur rapport des informations qu’elles ont obtenues, indiquant la divergence et les personnes qu’elles considèrent être les bénéficiaires effectifs ainsi que, le cas échéant, les actionnaires mandataires (nominee shareholders) et les dirigeants mandataires (nominee directors).

Règles en matière de registres centraux d’informations sur les bénéficiaires effectifs (« registres centraux »)

La sixième directive LBC/FT prévoit des règles renforcées an matière d’informations sur les bénéficiaires effectifs et leur enregistrement dans les registres centraux. Il est prévu que « les informations sur les bénéficiaires effectifs des entités juridiques et des constructions juridiques, les informations sur les conventions de mandataire (nominee arrangements) ainsi que les informations sur les entités juridiques étrangères ou les constructions juridiques étrangères » soient enregistrées dans ces registres centraux.

Afin de garantir l’exactitude des données contenues dans les registres centraux doivent vérifier, « dans un délai raisonnable suivant la transmission des informations sur les bénéficiaires effectifs, puis de façon régulière, que les informations communiquées sont adéquates, exactes et à jour ». En cas de détection d’incohérences ou d’inexactitudes, les registres centraux doivent « refuser ou suspendre l’enregistrement dans le registre central jusqu’à ce que les défaillances aient été corrigées ». Par ailleurs, les informations doivent être comparées aux personnes ou entités désignées dans le cadre de sanctions financières ciblées.

Mécanismes automatisés centralisés :

Conformément à la sixième directive LBC/FT, les mécanismes automatisés centralisés (au Luxembourg, il s’agit actuellement du registre central de compte bancaires, CRBA) doivent inclure des informations sur les comptes bancaires (y compris les IBAN virtuels), les comptes de paiement, les comptes de titres, les comptes de crypto-actifs et les coffres-forts. Ces mécanismes automatisés centralisés doivent être interconnectés au niveau de l’UE afin de permettre aux Cellules de Renseignement Financier « d’obtenir rapidement des informations transfrontières sur l’identité des titulaires de comptes bancaires et de comptes de paiement, de comptes de titres, de comptes de crypto-actifs et de coffres-forts dans d’autres États membres, ce qui renforcerait leur capacité à effectuer efficacement des analyses financières et à coopérer avec leurs homologues d’autres États membres ».

Le futur superviseur LBC/FT européen

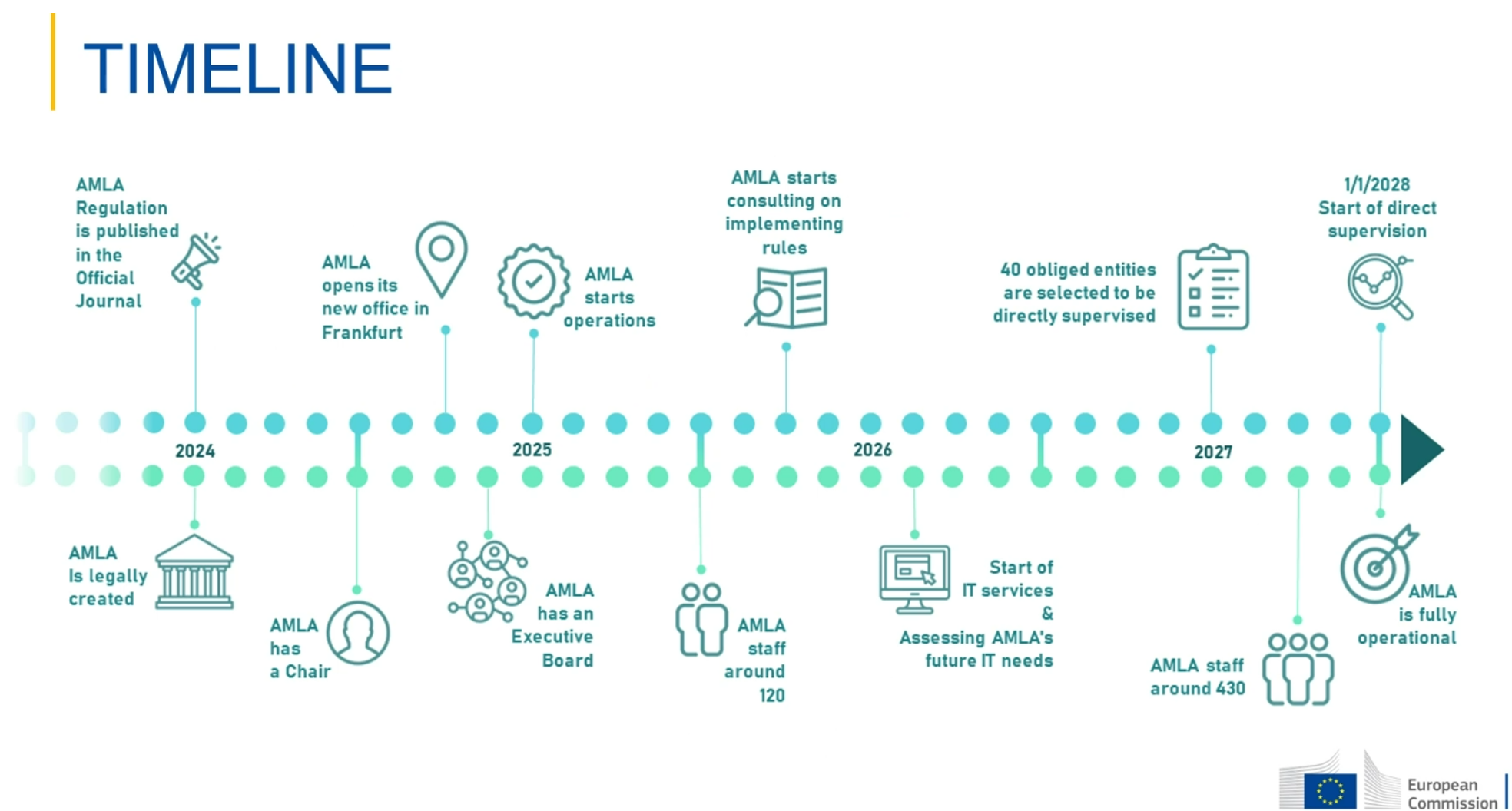

Le règlement du Parlement européen et du Conseil instituant l’Autorité de lutte contre le blanchiment de capitaux et le financement du terrorisme et modifiant les règlements (UE) n° 1093/2010, (UE) n° 1094/2010 et (UE) n° 1095/2010 (« règlement AMLA ») a été publié dans le Journal officiel de l’Union européenne le 19 juin 2024. Le règlement AMLA entrera en vigueur le vingtième jour suivant celui de sa publication et sera applicable à partir du 1er juillet 2025. L’Autorité de lutte contre le blanchiment (« AMLA ») débutera la surveillance directe des entités assujetties sélectionnées en 2028.

Tel qu’annoncé le 22 février 2024, le siège de l’AMLA sera situé à Francfort-sur-le-Main, en Allemagne.

Statut juridique, structure et objectifs généraux de l’AMLA

L’AMLA est un organisme de l’Union doté de la personnalité juridique et « responsable de la mise en œuvre devant le Parlement européen et du Conseil » du règlement AMLA.

La structure de l’AMLA sera composée d’un conseil général (divisé en deux compositions : une composition « surveillance » et une composition « CRF »), d’un conseil exécutif, d’un président et d’une commission administrative de réexamen.

Conformément à l’article 1, paragraphe 3, du règlement AMLA, l’objectif de l’AMLA est « de protéger l’intérêt public, la stabilité et l’intégrité du système financier de l’Union et le bon fonctionnement du marché intérieur ».

À cette fin, l’AMLA doit :

i. prévenir l’utilisation du système financier de l’Union aux fins du BC/FT ;

ii. contribuer à identifier et à évaluer les risques et menaces de BC/FT dans l’ensemble du marché intérieur, ainsi que les risques et les menaces émanant de l’extérieur de l’Union ;

iii. assurer une surveillance de haute qualité dans le domaine de la LBC/FT ;

iv. contribuer à la convergence de la surveillance en matière de LBC/FT dans l’ensemble du marché intérieur ;

v. contribuer à l’harmonisation des pratiques de détection, par les cellules de renseignement financier (« CRF »), des flux financiers suspects ou des activités suspectes ;

vi. soutenir et coordonner les échanges d’informations entre les CRF et entre celles-ci et les autres autorités compétentes.

En ce qui concerne la surveillance, l’AMLA jouera un double rôle : 1) elle surveillera directement un nombre prédéterminé d’entités assujetties sélectionnées, choisies parmi les entités assujetties telles que définies dans le règlement LBC/FT et 2) elle exercera une fonction de surveillance indirecte à l’égard des entités assujetties non-sélectionnées et plus généralement une fonction de surveillance LBC/FT pour le secteur financier dans son ensemble (p.ex. en suivant les évolutions du marché intérieur liées aux activités de BC/FT, en recueillant et analysant des informations fournies par les autorités nationales, etc., tel que prévu à l’article 5 du règlement AMLA).

À noter que l’AMLA exercera également des missions en ce qui concerne les CRF et la surveillance du secteur non financier. Ces missions ne sont pas détaillées ci-dessous.

La surveillance directe des entités assujetties sélectionnées

En ce qui concerne les entités assujetties sélectionnées, l’AMLA, conformément à l’article 5, paragraphe 2, du règlement AMLA, veillera au respect par les entités assujetties sélectionnées des exigences qui leur sont applicables en vertu du règlement LBC/FT et du règlement (UE) 2023/1113 (règlement sur les transferts de fonds ou TFR, veuillez vous référer à la page dédiée), réalisera des contrôles et des évaluations de surveillance au niveau des entités prises individuellement et au niveau du groupe, participera à la surveillance exercée à l’échelle des groupes, développera et tiendra à jour un système d’évaluation des risques et des vulnérabilités des entités assujetties sélectionnées au moyen de questionnaires structurés et d’autres outils. Des équipes communes de surveillance (Joint Supervisory Teams), impliquant des membres du personnel des autorités nationales des pays dans lesquels les entités assujetties sélectionnées opèrent, seront constituées.

En ce qui concerne la sélection des entités assujetties, dans un premier temps, l’AMLA déterminera le nombre d’entités assujetties sélectionnées qu’elle surveillera de manière directe (ce nombre ne pouvant être inférieur à 40), conformément à l’article 13, paragraphe 2, du règlement AMLA.

Ensuite, l’AMLA, en collaboration avec les superviseurs financiers nationaux, effectuera une évaluation pour les entités assujetties opérant dans au moins six États membres et les classifiera en fonction de leur profil de risque comme « faible », « moyen », « important » ou « élevé ».

La méthode de classement du profil de risque inhérent et résiduel sera établie séparément par l’AMLA en fonction des catégories d’entités assujetties (établissements de crédit, organismes de placement collectif, etc.). Pour chaque catégorie d’entités assujetties, la méthode d’évaluation sera fondée sur les catégories de facteurs de risque suivantes : clientèle, produits, services, transactions, canaux de distribution et zones géographiques.

Les entités assujetties qui ont été sélectionnées pour cette évaluation et dont le profil de risque (résiduel) est classé comme élevé sont des entités assujetties éligibles, c’est-à-dire des entités assujetties classées comme ayant un profil de risque élevé présentes dans au moins six États membres.

L’AMLA procèdera ensuite à une sélection, pour les besoins de la surveillance directe, parmi les entités assujetties éligibles, en tenant compte des critères suivants :

- les entités assujetties opérant dans le plus grand nombre d’États membres, et, si ce critère n’est pas suffisant (par exemple, si les entités numéros 39, 40 et 41 opèrent toutes dans le même nombre d’États membres) ;

- les entités assujetties qui présentent le ratio le plus élevé de transactions avec des pays tiers (comparé au volume total des transactions).

À noter que lorsque dans un État membre aucune entité assujettie dont le profil de risque est classé comme élevé ne répond à la définition d’entité assujettie sélectionnée, l’AMLA procèdera à une sélection supplémentaire dans cet État membre, de sorte que dans chaque État membre, au moins une entité soit surveillée directement par l’AMLA.

Surveillance indirecte par l’AMLA

Au-delà de sa compétence de surveillance directe, l’AMLA supervisera également de manière indirecte le secteur financier dans son ensemble pour les besoins de la LBC/FT.

À cette fin, l’AMLA devra, en particulier :

- suivre les évolutions dans l’ensemble du marché intérieur et évaluer les menaces, les vulnérabilités et les risques liés aux activités de BC/FT ;

- recueillir et analyser des informations, à partir de ses propres activités de surveillance et de celles des autorités nationales compétentes en matière de LBC/FT, sur les faiblesses identifiées dans l’application des règles LBC/FT par les entités assujetties, leur exposition au risque, les sanctions infligées et les mesures correctives prises ;

- élaborer, en collaboration avec les autorités nationales compétentes en matière de LBC/FT, une méthode de surveillance LBC/FT harmonisée, détaillant l’approche fondée sur les risques sur laquelle repose la surveillance ;

- coordonner les contrôles thématiques à effectuer par les autorités nationales au niveau européen, le cas échéant ;

- établir et tenir à jour une base de données centrale d’informations LBC/FT, en ce compris p.ex. des informations statistiques, des informations relatives aux mesures administratives et des sanctions pécuniaires, etc. ;

- faciliter le fonctionnement des collèges de surveillance LBC/FT dans le domaine financier ;

- contribuer, en collaboration avec les superviseurs financiers, à la convergence des pratiques de surveillance et à la promotion de normes de surveillance élevées dans le domaine de la LBC/FT.

Redevances perçues pour couvrir le fonctionnement de l’AMLA

Les redevances perçues par l’AMLA auront une incidence sur les entités assujetties sélectionnées de même que sur les entités assujetties non sélectionnées qui « opèrent, que ce soit par le biais d’établissements ou en libre prestation de service, dans au moins six États membres, y compris l’État membre d’origine, autre que l’État membre dans lequel l’entité assujettie est établie, que les activités soient exercées par le biais d’infrastructures sur le territoire concerné ou à distance », conformément à l’article 77, paragraphe 1, du règlement AMLA.

L’article 77, paragraphe 5, du règlement AMLA permet aux autorités nationales de continuer à percevoir des redevances des entités assujetties qui devront payer des redevances à l’AMLA, y compris les entités assujetties sélectionnées, étant donné que les autorités nationales seront impliquées dans les équipes communes de surveillance.

L’AMLA et les autorités nationales se coordonneront cependant en ce qui concerne le niveau des redevances, conformément à l’article 77, paragraphe 4, du règlement AMLA, qui prévoit que l’AMLA « se met en rapport avec le superviseur financier national concerné avant de décider du niveau définitif de la redevance, afin de garantir que la surveillance reste efficace au regard des coûts et raisonnable pour toutes les entités assujetties du secteur financier ».

Pour de plus amples informations relatives à l’AMLA, veuillez vous référer à la page suivante du site Internet de la Commission européenne : AMLA – European Commission (europa.eu).

1 Article 2, paragraphe 26, du règlement LBC/FT.

2 Article 22, paragraphe 3, du règlement LBC/FT.

3 Article 20, paragraphe 1, point d), du règlement LBC/FT.

4 Article 52, paragraphe 2, du règlement LBC/FT.

5 Articles 22 et 63, paragraphe 4, du règlement LBC/FT.