Temps de traitement des agréments de nouveaux fonds d’investissement régulés (uniquement en anglais)

Situation au 30 juin 2024

What is in scope?

- Initial authorisations of investment vehicles completed since 01/01/2020

- Investment vehicles include UCITS funds1 and non-UCITS, i.e. SIF2 and PII L103.

Please consider that a significant number of authorisation requests include cross-border aspects and a wide range of investment strategies that may add a degree of complexity. Consequently, such largely international investment vehicles are not readily comparable to strictly local investment vehicles directed to a more local group of investors.

What is out of scope?

- Subsequent authorisations concerning existing investment vehicles (including addition of sub-funds).

- SICAR4 and outliers5 as non representative.

What is measured?

The processing time between the date of receipt of an application by the CSSF and the date of CSSF authorisation/refusal decision.

It encompasses

- the CSSF assessment period and

- processing time of applicants.

It is expressed in working days (WD).

How to read the charts?

Example for the group « < 3 months (65WD) »:

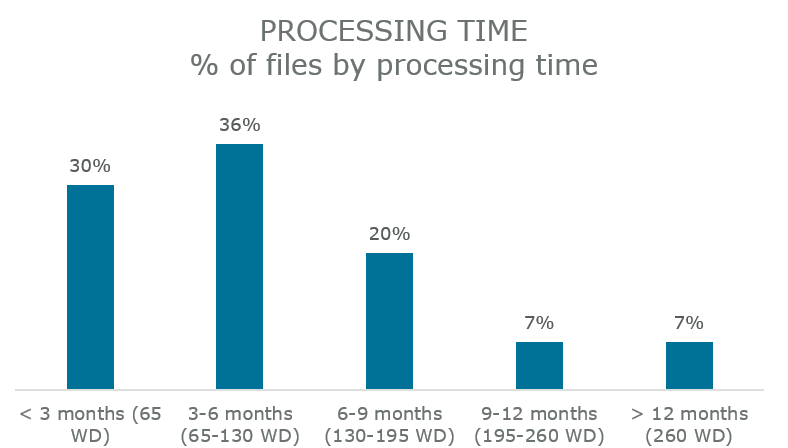

Chart PROCESSING TIME - % of files by processing time

Percent of initial authorisations completed since 1 January 2020 processed within less than 3 months (65 working days).

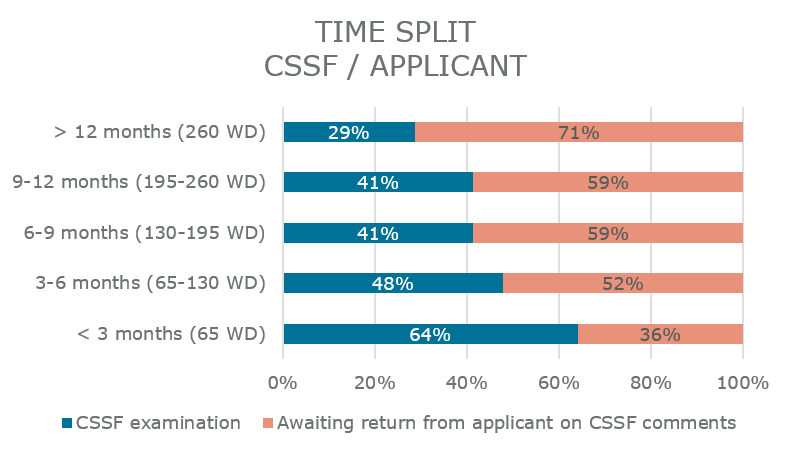

Chart TIME SPLIT CSSF / APPLICANT

For files processed within less than 3 months (65 working days), percent of the processing time corresponding to the CSSF assessment period and percent of processing time by the applicants.

Disclaimer

Processing time does not mean time to market, as the latter includes upfront preparation and post authorisation work.

We further draw your attention to the fact that the charts are consolidated representations that do not represent in detail the level of complexity of applications submitted and cross-border aspects that may impact the processing time.

Key lessons learnt and best practices

The CSSF’s intervention is to be understood as a service rendered in the public interest that goes beyond an administrative exercise, hence implying an in-depth assessment of applications by case officers.

Having due consideration for the importance and expectations attached by applicants to a predictable timespan for granting an authorisation, the CSSF constantly strives to optimise its processes, lastly through digital means aiming at gathering accurate data, information and documents through standardised applications and secured gateways.

The CSSF would further like to share hereafter key lessons learnt and best practices for a smooth application process.

Submission of applications once definitive in scope and complete in content only

When an application is submitted, the underlying project is supposed to be economically viable in the interest of investors and launched shortly after CSSF authorisation. Upon receipt of an application, the case officer checks the file for completeness and assesses its complexity to plan the review accordingly.

Delays in the examination phase may occur for example if

- the upload of forms and supporting documents turn out to be incomplete;

- fragmented application files are returned to the applicant;

changes are done to the initial scope that require the submission of a new application.

Submission of applications according to guidelines disclosed on the CSSF website for a secure and swift submission

All applications must be submitted to the CSSF in accordance with the guidelines.

Provision of transparent and relevant supporting documentation

A good understanding of the application is a prerequisite for a proper planning of its examination by the case officer. The CSSF requires that the mandatory forms are duly supported by underlying documentation, providing additional information in a transparent way.

Depending on nature and complexity of the project, the CSSF recommends that initiators present and describe proactively the project in an explanatory memo.

For complex files, an explanatory memo would outline the characteristics, specificities (in terms of structure, investment policies, strategies and instruments targeted) and compliance with legal and regulatory provisions.

Particular attention should be paid to drafting the prospectus and if applicable the KIID to ensure that investors have adequate, understandable and not misleading information on both the return objectives and associated risks to make up an informed judgement before investment.

The CSSF grants authorisation after a conclusive assessment provided that all legal and regulatory requirements are met.

Timely and exhaustive response to CSSF requests for clarification

In the ordinary course of an assessment, the CSSF takes care to bundle requests for clarifications/confirmations.

Consequently, we expect to be provided with an exhaustive and consolidated answer to such requests enabling a positive momentum in the application assessment.

Assuming that filing is based on a real and short-term project, answers are expected within a short time lapse.

Mark-up of amendments

For ease of review, draft prospectuses and other documents modified during the examination shall be forwarded in marked up version and duly supported by mapping sheets where required.

Avoid substantial changes when examination in progress

An application must be based on a real underlying project, definitive in scope and complete in content.

Hence substantial changes and insertions of new features during the examination phase would be considered as a new project and require the submission of a new application file.

Timely provision of final documents

After notification to the applicant of the end of the examination phase, the CSSF expects a timely submission of

- the final prospectus to be visa-stamped

- the signed final documents and information as requested in the end of examination letter (avis de fin d’examen),

the aforementioned documents being a prerequisite to close the application process and put the new undertaking on the official CSSF list of authorised entities.

A timeframe up to 1 month after the date of the end of examination letter (avis de fin d’examen) is deemed reasonable.

The CSSF reserves the right to consider an application request as abandoned if final documents are not submitted in a timely manner.

Avoid changes to validated draft prospectus

In order to be CSSF visa-stamped, the final prospectus submitted must be strictly identical to the draft version validated by the CSSF for release to investors.

Any change to the version validated by the CSSF without prior notice is strictly prohibited and invalidates the authorisation granted.

1 Undertakings for Collective Investment in Transferable Securities (UCITS) are investment funds falling under the scope of Directive 2009/65/EC of the European Parliament and of the Council of 13 July 2009 on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities. This type of investment fund is subject to Part I of the Law of 17 December 2010 relating to undertakings for collective investment.

2 Specialised Investment Funds (SIFs) are governed by the Law of 13 February 2007 relating to specialised investment funds.

3 Undertakings for Collective Investment (UCIs) are investment funds. They include those subject to Part II of the Law of 17 December 2010 relating to undertakings for collective investment.

4 A société d’investissement en capital à risque (SICAR) is an investment company in risk capital governed by the Law of 15 June 2004 relating to the investment company in risk capital.

5 Outliers include for example withdrawal of applications by applicants.

Toutes les statistiques : lien vers la page « Statistiques »